Having raised US$27 million in a debt financing, partners

Under the financing deal, the partners hedged 300,000 oz., or 49%, of the project’s recoverable gold reserves. Half the ounces are hedged at US$360 per oz.; the other half, at a minimum price of US$360 per oz. The upside potential is said to be US$390 per oz., and contracts will be delivered over six years.

Construction of the mine, including a 6,000-tonne-per-day carbon-in-leach plant, is expected to last a year. The site has already been fitted with roads, a landing strip, a surface water dam, a storage reservoir, a water pipeline, and an electrical power station.

The project comprises the Samira Hill and Libiri deposits, which, combined, host a measured and indicated resource of 15 million tonnes grading 1.6 grams gold per tonne. Minable reserves stand at 10.1 million tonnes grading 2.21 grams gold. Both deposits are open at depth.

Initially, the plant will process oxide ore, followed by transition ore from open pits on the two deposits. Beginning in the second year of operation, the plant will treat ore from the upper portions of the Libiri pit.

First-year production is pegged at 135,000 oz. at a cash cost of US$177 per oz. Over the mine’s life, which should exceed six years, annual output is expected to average 100,000 oz. at US$203 per oz.

ONA/Managem, Morocco’s largest mining company, controls Semafo and will act as operator. The project is actually held by La Socit des Mines du Liptako, which is itself 80%-held by African GeoMin Mining Development (AGMD), with the government of Niger holding the remaining 20%. Semafo and Etruscan each have a 50% participating interest in AGMD.

Tirisano

Meanwhile in South Africa, Etruscan and another partner,

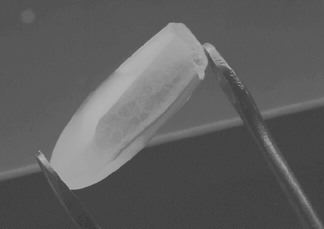

The stone, known as the Tirisano Easter Diamond, is vivid pink (a rare colour) when exposed to ultraviolet light and it retains the colour for an extended period after exposure. The stone is on its way to the Swiss Gemological Institute for further studies.

In all, a 100,000-tonne controlled mining block at Tirisano yielded 1,510 carats, including a yellow fancy and a 27-carat stone that fetched an average of US$440 per carat — US$40 per carat more than the life-of-mine projection.

At last report, Tirisano had an in situ indicated resource of 10.4 million cubic metres grading 2.9 carats per 100 cubic metres.

Etruscan operates and owns 51% of Tirisano. The remaining interest is divided among Mountain Lake, with 25%, and minority shareholders of an Etruscan subsidiary.

The British Columbia Securities Commission is currently reviewing Mountain Lake’s disclosure practices in relation to an early 2001 prefeasibility study at Tirisano.

The partners say that since the mine is already producing, they don’t plan to update the study.

Also failing to meet standards is an updated resource estimate at Tirisano. An amended report by RSG Global is due by the end of July.

Be the first to comment on "Etruscan, Semafo break ground in Niger"