The much-anticipated consolidation that’s shaking up the gold industry is capturing the attention of investors and mining executives alike. Although most of the attention is focused on activities at the corporate level, to see which industry players will survive, it’s conceivable that dramatic changes will also occur in mining camps, as ownership of individual mines could change hands. The consolidation of a mining camp becomes even more likely in situations where only a few rival companies, sharing interests in mines, may wish to bargain for better deals.

Consolidation is designed to improve the bottom lines of the companies involved: efficiencies can be improved and costs can be lowered, making the surviving companies stronger financially. This same principle is also applicable at the operations level. By combining mines within a district, costs can be lowered and productivity increased, resulting in a more profitable operation.

According to Donald MacLean, managing director of Beacon Group Advisors, consolidation is a common stage of development in any mining camp. “There are historical precedents and economic reasons why this type of activity takes place,” he says.

MacLean, a long-time gold analyst, has written a report titled Global Gold Production Outlook: 2001 to 2010, in which supply and demand fundamentals for gold are examined. The report also discusses the consolidation occurring in the gold industry. MacLean believes consolidation of mining districts becomes an issue when the mines have reached a certain maturity and profits become jeopardized. “The need to find additional synergies, to lower costs, increases as mining activities mature and become less profitable. The upside of consolidation can be the extension of a mining district’s life. We’ve seen examples of this in Kalgoorlie and, more recently, in South Africa’s Witwatersrand.”

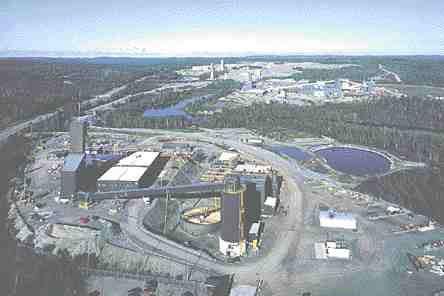

The maturing mines of the Hemlo gold district could well present a situation in which consolidating operations makes sense. Hemlo, situated 250 kilometres east of Thunder Bay, Ont., is a prolific camp that produces almost 1 million oz. gold annually. Only a few senior companies hold interests in the mines that comprise the Hemlo district.

MacLean believes consolidation at Hemlo could occur in the not-too-distant future. “We haven’t seen much of this here [in the Hemlo camp], but I suspect there will be some consolidation at some point. It should take place.”

The Hemlo mines already have a colourful history of ownership changes as a result of mergers and acquisitions. Two of the three owners of the Hemlo mines have, in fact, only recently acquired their interests there.

Ownership changes

Homestake Mining had owned Barrick’s 50% share of the Williams and David Bell mines; Barrick acquired its interest in late 2001 with the acquisition of Homestake. Newmont’s interest in Golden Giant earlier belonged to Hemlo Gold, which was acquired by Battle Mountain Gold in the late 1990s and subsequently purchased by Newmont in 2001. Newmont has since acquired Franco-Nevada Mining, which holds a working interest in certain properties of the Hemlo district. The only company to have retained its interest in any Hemlo operation since production began is Teck, now known as Teck Cominco.

Barrick spokesman Vincent Borg declines to comment on the possibility of consolidating specific assets, though he concedes that consolidation, whether by asset swap, acquisition or other means, generally makes the industry healthier and more efficient. “If larger companies had been involved in the development of Hemlo earlier on, it’s unlikely you would see three head frames there now,” he says.

For Teck Cominco and Barrick, the combined operations of the David Bell underground mine and the Williams underground and open-pit mines generated more than 610,000 oz. gold at a cash cost of US$195 per oz. in 2001. Since these two mines started up, in 1985, more than 10 million oz. have been pulled from the ground. In 2002, production at Williams and David Bell is anticipated to be 608,000 oz. at a cash cost of US$192 per oz. Proven and probable reserves at these mines total 34.9 million tonnes averaging 4 oz. grams gold per tonne, or about 5 million oz. Additional resources are pegged at 2.5 million oz.

According to Stuart Brown, underground mine manager at the Williams mine, cost savings have already been generated by consolidating milling operations. “We have realized some economies of scale,” he says. “We recently shut down the David Bell mill and we now process all ore at the Williams mill. As a result, we generated a savings on milling costs of $7 per tonne.”

Milling costs are $14 per tonne at David Bell and $7 million at Williams. Also, production from the Williams pit has increased; as a result, cash costs at Williams fell to US$190 per oz. in 2001 from US$230 in 1997. Over the same period, production increased to 430,000 from 400,000 oz.

Williams and David Bell also hold significant exploration potential. At the former, exploration is focused on the existing open pit and underground mines, in particular the western downdip extension of the ore zones. At David Bell, other targets are being investigated east of the shaft.

The neighbouring Golden Giant mine was developed around the same time as both the Williams and David Bell underground operations. In 2000, Golden Giant produced 334,000 oz. gold at a cash cost of US$151 per oz. for Newmont. At the end of 2000, Golden Giant had reserves of 4.4 million tonnes averaging 9.8 grams gold per tonne, or 1.3 million oz.

Newmont’s holdings also have significant exploration potential. With the acquisition of Franco-Nevada, Newmont acquired a 100% working interest in the western downdip extension of the Williams mine.

For now, the companies involved are keeping their options open and have declined to comment on consolidation.

Be the first to comment on "FPO Hemlo seen as ripe for consolidation"