Gold royalty and streaming company Franco-Nevada (TSX: FNV; NYSE: FNV) is buying an additional 1.5% net smelter returns royalty (NSR) on Marathon Gold‘s (TSX: MOZ) Valentine project for US$45 million ($60 million).

The acquisition increases Franco-Nevada’s aggregate NSR on the gold project, located in Newfoundland and Labrador, to 3%.

The Toronto-based firm has also has offered to purchase Marathon’s common shares comprising the entire back-end of a non-brokered charity flow-through offering of about US$5.2 million ($6.9 million).

“Franco-Nevada has been a royalty holder since 2019, and we welcome their continuing strong support for the project,” Marathon Gold president and CEO, Matt Manson, said in the Thursday news release. “The associated offering of flow-through shares, by which Franco-Nevada also increases its share ownership in the corporation, will be used to fund our discovery-oriented exploration programs in 2023 and 2024, including exploration at the encouraging and underexplored Eastern Arm Prospect.”

A feasibility study on the Valentine project in December outlined a three-pit mining and conventional milling operation with an annual production of 195,000 oz. of gold for 12 years within a 14.3-year mine life. The study estimated gold reserves of 2.7 million ounces.

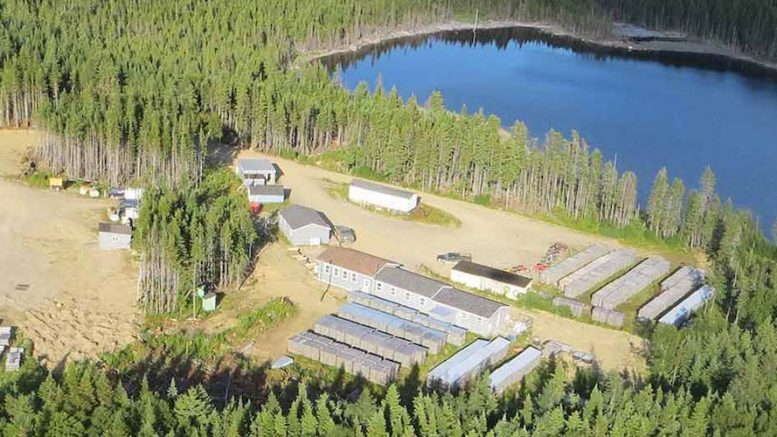

Construction at the project, which comprises a series of five mineralized deposits along a 32-km system, began in October 2022.

Valentine is considered the largest undeveloped gold project in Atlantic Canada and is scheduled to begin production by the first quarter of 2025.

Be the first to comment on "Franco-Nevada grows royalty on Marathon Gold’s Valentine project"