With two low-cost gold mines under construction in Mexico and Guatemala,

“We’re not moving to marginal growth at higher gold prices, but we’re building better, lower-cost mines with plus ten-year mine lives and substantial growth upside,” says Glamis President Kevin McArthur in a recent quarterly report. “This production profile is second to none in our sector and backed by proven and probable reserves.”

The upside is not restricted to new projects: exploration success at the company’s 66.7%-owned Marigold operation in Nevada has led to an expansion of the mine and reserves.

Glamis is an intermediate level gold producer that has been mining continuously in the southwestern U.S. for more than 20 years. The San Martin mine in Honduras, which entered commercial production in January 2001, was the company’s first commercial venture outside of the U.S., and its success has provided a springboard into Latin America.

For calendar 2003, Glamis earned 14 per share based on its three mines: San Martin, Marigold, and the depleted Rand in California. These produced a total of 230,294 oz. at a cash cost of US$184 per oz. and a total production cost of US$262 per oz. By comparison, 251,919 oz. were produced in 2002 at a cash cost of US$160 per oz. and a total cost of US$236 per oz. The company expects to produce 265,000 oz. in 2004.

Gold production for the first quarter of 2004 was 50,919 oz. at a cash cost of US$205 per oz. and a total cost of US$289 per oz., compared with 56,712 oz. at a cash cost of US$194 per oz. in the previous quarter and 61,292 oz. at US$170 per oz. in the corresponding period of 2003. The lower production was expected, and is attributed to lower output from both the Marigold and Rand heap-leach operations. Rand was mined out in January 2003, but leaching is continuing through to the end of 2004 in conjunction with final reclamation activities. First-quarter production at Rand was 4,787 oz. at a cash cost of US$234 per oz., versus 12,519 oz. at US$227 per oz. for the first three months of 2003. The Rand mine is expected to produce 15,000 oz. for the year.

At the San Martin mine in Honduras, gold production in the recent quarter was 28,926 oz. at a cash cost of US$174 per oz. and a total cost of US$270 per oz. San Martin is a simple, open-pit, heap-leach oxide operation situated 90 km by road north of the capital city of Tegucigalpa. Glamis acquired the San Martin prospect through a $40-million share-and-cash takeover of Mar-West Resources in 1998. It cost Glamis a further US$32 million to put San Martin into production, based on a 1.1-million-oz. reserve. Gold production peaked in 2002, its second year, when the mine cranked out a record 129,435 oz. at a cash cost of US$106 per oz.

During 2003, 6.5 million tonnes of ore containing 196,400 oz. were placed on the leach pad. The mine produced 101,835 oz. at a cash cost of US$175 per oz. and a total cost of US$269 per oz. Gold production for much of the year was below expectations as the mine experienced delays in gold recoveries, owing to temporary leach pad chemistry problems encountered early in the year. The pH (hydrogen ion concentration) imbalance of the heap was exacerbated by continuing drought conditions in Honduras that persisted until late in the year.

During the latter half of the year, mining moved from the depleted Rosa pit to the Palo Alto pit, where ore grades and recoveries are projected to be somewhat lower. San Martin is forecast to produce 102,000 oz. in 2004 and gradually decline to 80,000 oz. annually over the remaining six years of its life, with higher cash costs.

“We will see excellent free cash flows from San Martin, and these are the dividends that we are now pouring back into our gold programs in Latin America,” says McArthur.

At the end of 2003, proven and probable reserves amounted to 654,500 oz. in 27.7 million tonnes grading 0.72 gram gold per tonne. All of Glamis’s ore reserves are based on a gold price of US$325 per oz. and a silver price of US$5 per oz.

Roughly 47,200 contained ounces were added to the reserve base by infill and extensional drilling and by pit-modeling work.

Marigold

Glamis is the operator of the Marigold mine, near Winnemucca, Nev., with a two-thirds interest. The remainder is held by

In 2003, Marigold mined and placed 7.4 million tonnes of ore containing 195,915 oz. on the leach pad. Production came primarily from the Terry Zone 1 and 2 pits.

“Our Marigold mine continues to exceed expectations,” says McArthur. Based on new discoveries of oxide mineralization in and around the mine area, such as the Terry Zone North (TZN) deposit, Glamis is proceeding with an accelerated second-phase expansion, which is expected to last five years. Plans call for a larger, 320-ton truck mining fleet for the start of stripping in the southern end of the Millennium area. The second phase will expand production to well over 240,000 oz. per year in the last three years of the 5-year plan.

“This commitment to big equipment and simplified processing has led to low operating costs and high productivity,” McArthur told delegates at BMO Nesbitt Burns’s recent Global Resources conference in Tampa, Fla. “This mine is a model of efficiency as we continue to find more ore that feeds the next phase of the expansion.”

Exploration in 2003 added 372,000 ounces to proven and probable reserves, which now stand at 84.6 million tonnes grading 0.82 gram gold, equivalent to 2.2 million contained ounces. The TZN discovery is still classified as a resource, Glamis has an immediate source of future reserves, says McArthur. The company is continuing to drill in the Millennium area, in and around the Terry zone, and going north from TZN remains a major objective for the coming years.

The Marigold property covers 75 sq. km along the Battle Mountain trend in a neighbourhood that includes Newmont Mining’s Lone Tree mine.

This year, production at Marigold will rise slowly to about 170,000 oz. as expansion activities in the Millennium area begin to ramp-up. Mine output in the first quarter of 2004 was down 22% from last year’s comparable period at 25,808 oz. (17,206 oz. to Glamis’s account), with cash costs of US$248 per oz. and total costs of US$324 per oz. The decline was expected, as stripping activities ate into production.

El Sauzal

El Sauzal, in Mexico’s Chihuahua state, is the next major gold project for Glamis. Construction activities are on schedule and budget for mill startup in the fourth quarter of 2004. The company expects to recover around 35,000 oz. by year-end.

El Sauzal has been designed as an open-pit oxide milling project, with a mill capacity of 5,500 tonnes per day. Capital costs work out to US$101 million, including US$10 million in contingency, and annual production is expected to average 190,000 oz. over a 10-year life at cash costs of US$110 per oz. The project generates a 25% internal rate of return, based on a gold price of US$300 per oz.

Proven and probable reserves are estimated at 18.3 million tonnes grading 3.36 grams gold and 3.77 grams silver, equivalent to almost 2 million oz. gold and 2.2 million oz. silver.

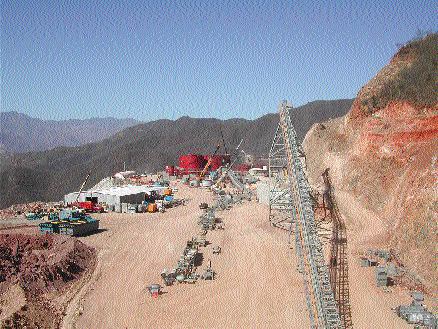

“It’s a big project in terms of land position,” says McArthur. “Our main job over the past several months has been to establish year-round access into this remote site.” A 97-km road connecting the port city of Los Mochis to the mine site has been completed, with the exception of the bridge over the El Fuerte River, where construction is well under way. The bridge will be in use before the onset of the rainy season in late June. The ball mill, semi-autogenous grinding (SAG) mill and haul trucks are now on site. Construction of the 125-km-long power line is about 60% complete.

“El Sauzal is on track, and we’ve got no stoppers in sight,” asserts McArthur.

In the meantime, exploration is uncovering some interesting targets at El Sauzal. “There is good potential beyond what we could have conceivably seen during the acquisition phase.”

Mine development activity has exposed favourable alteration leading to the identification of four targets. A high silver anomaly was discovered in the West Lip area while constructing a haulage road from the shop area. It is similar to the silver anomaly that sits over the main West pit but without any drill holes.

Says McArthur: “Obviously our priority is one of mine construction for the present. It’s a busy project site right now. We have an exploration team on site, and they’re preparing for their shot at reserve expansion. But that’s going to happen in the latter half of this year.

Marlin

The Marlin gold project in Guatemala will be the company’s next show piece. It is expected to be even bigger and more profitable than El Sauzal.

Glamis acquired both El Sauzal and Marlin as a result of the merger with Francisco Gold in 2002. Marlin is already permitted, and engineering, site preparation and construction began in the first quarter of 2004.

Marlin is in the western highlands of Guatemala, 48 km southwest of Huehuetenango. It is being developed as a combination open-pit/underground mine, based on proven and probable reserves of 14.1 million tonnes grading 4.77 grams gold and 73.7 grams silver, equivalent to 2.2 million oz. gold and 34 million oz. silver. The deposit is still open to depth and along strike. Annual production is expected to average 217,000 oz. gold and 3.3 million oz. silver over a 10-year life, with cash costs of US$93 per oz. gold, net of silver byproduct credits. About three-quarters of the 4,100-tonne-per-day milling capacity will be fed by the open pit, with the remainder coming from higher-grade underground ore.

Recoveries are estimated at greater than 90% for gold and 80% for silver. The underground mining method will be underhand cut-and-fill with back-filling. The portal has been collared and the underground spiral decline is being advanced. Mill foundations will be poured later this summer.

The capital cost for Marlin is estimated at US$120.3 million, including a contingency of US$11 million. Glamis has completed the purchase of key milling components from an existing plant that will have an excess capacity of 900 tonnes per day. The feasibility study assumed the purchase of new equipment, but the higher processing rates are expected to increase capital costs to about US$130 million. This may lead to an earlier startup date in the fourth quarter of 2005, instead of early 2006 as originally planned.

The project yields an internal rate of return of 25%, based on prices of US$325 per oz. for gold and US$5 per oz. for silver.

“It’s all about growth in the Americas,” says Kevin McArthur. “These are solid operations with significant land holdings and excellent exploration potential.” The company has budgeted US$9.5 million for exploration this year, with US$6 million earmarked for Guatemala.

Glamis’s geological team has outlined several targets within 5 km of Marlin. Says MacArthur: “We’ve got alteration, we’ve got geology, and we’ve got gold on the surface in quartz veins — everything you need.”

One of the promising targets, La Hamaca, is a Marlin lookalike 3 km north of the main zone. There, drilling has discovered bonanza-grade quartz-adularia veins below nearly barren quartz outcrop.

The first hole intersected 5.2 metres (true width) grading 23.3 grams gold and 735 grams silver. “This means La Hamaca has great potential for adding reserves,” says Charles Ronkos, Glamis’s exploration manager. “The results highlight the potential for the other half-dozen targets in the district for discovery of similar high-grade mineralization.”

MacArthur says his company intends to develop the Marlin region into a “new gold mining district totally controlled by Glamis.” Glamis controls about 1,000 sq. km of a highly prospective land package in western Guatemala in an area that has seen no historic gold mining.

The company has 130 million shares outstanding, no debt and is entirely unhedged. Net earnings for the first quarter of 2004 totalled US$9.1 million (or 7 per share), compared with US$2.4 million (2 per share) in the corresponding period of 2003. Results for the latest quarter included an aftertax gain of US$7 million from the sale of the company’s half-stake in the Cerro San Pedro project to

Cash flow generated from operations in the first three months of the year was US$7.6 million. The company ended the March quarter with US$114 million cash in hand.

Be the first to comment on "Glamis looks to Americas for growth"