Rising gold prices and better operational and financial discipline are motivating companies more than ever to seek new ounces to fill their production pipelines. Below is a look at eight companies exploring worldwide.

Aurania Resources

Stones from a road found in the Lost Cities–Cutucu Project in southeastern Ecuador. Credit: Aurania Resources/Twitter.

Aurania Resources (TSXV: ARU) is exploring its flagship Lost Cities–Cutucu gold-copper project in southeastern Ecuador under the direction of seasoned mining executives CEO Keith Barron and Richard Spencer, president.

The company is hunting for two gold-mining centres that Spanish manuscripts and maps from the 16th and 17th centuries refer to as Sevilla del Oro and Logrono de los Caballeros. In late November, field teams found remnants of what the company believes is an old road in the central part of the project that once linked the two mining centres. The remnants of the road, 50 km from where Aurania is drilling its Yawi gold target, were found in heavy vegetation over 2.5 km, and run north-south along Aurania’s concession block in the eastern foothills of the Andes mountain range of southeastern Ecuador. The next steps include a LIDAR survey over the area.

In addition to its gold targets, Aurania has come across two types of copper at surface — porphyry-related copper and sedimentary copper, where the copper exists in specific sedimentary horizons — and reported an average grade from 18 outcrop samples of 4.4% copper and 51 grams silver per tonne at its Tsenken, Kirus and Jempe targets. Highlights included 9% copper with 185 grams silver per tonne and 7.1% copper with 19 grams silver per tonne.

Late last year, Aurania hired Gregor Borg, a professor and independent specialist and expert on sedimentary-hosted copper deposits, to assess the project. Borg reported in December that he had never before come across spatially coincident porphyry copper and sedimentary-hosted copper as seen across the project area. He thought that the intrusion of porphyries into the red beds augmented the volume of copper available for precipitation in the overlying black shales — the typical host-rock of sedimentary-hosted copper.

The company has identified multiple targets on the property by employing a variety of exploration tools, including a heliborne geophysical (magnetics and radiometrics) survey, stream sediment sampling and 5,000 metres of scout drilling.

In mid-February Aurania announced a private placement that will raise $8 million to fund work on corporate social responsibility to obtain access to concession areas, basic exploration including field work and stream sediment sampling, the completion and interpretation of geophysics surveys to refine 64 targets, and scout drilling for gold, silver and copper targets.

Aurania has only explored 55–60% of its Ecuador concessions so far.

In January, Aurania applied for mineral concessions in northern Peru that it believes may sit on the same geological trend as its Lost Cities – Cutucu project.

The company has a $121-million market cap.

Bear Creek Mining

Bear Creek Mining’s Corani silver property in southern Peru. Credit: Bear Creek Mining.

Bear Creek Mining (TSXV: BCM; US-OTC: BCEKF) is a Peru-focused silver exploration company and owns the Corani silver-lead-zinc project, one of the largest fully permitted silver deposits in the world.

The Vancouver based company completed a feasibility study on Corani in late 2019, which outlined a three-pit mining scenario operating at 27,000 tonnes per day that would produce 9.6 million oz. silver per annum over a mine life of 15 years at all-in sustaining costs of US$4.55 per oz. silver. In addition, the mine would annually produce an average of 98 million lb. lead and 69 million lb. zinc over the mine’s life.

The study, which used a base case of US$18 per oz. silver, US$0.95 per lb. lead and US$1.10 per lb. zinc, forecast an after-tax net present value at a 5% discount rate of US$531 million and internal rate of return of 22.9%. Initial capex of US$579 million could be paid back in 2.4 years.

Production will be from three pits — Este, Minas and Main. The Este pit contains the highest silver grade and will make up the majority of mineralized material produced in the first three years of the mine life. The Main pit contains relatively higher lead grades, while the Minas pit has relatively higher zinc grades. Under the current mine plan, the mining fleet would be provided by a mining contractor. Lead and zinc concentrates would be trucked to the container port of Matarani, about 632 km from the mine.

Reserves stand at 139.1 million tonnes grading 50.3 grams silver per tonne, 0.90% lead and 0.59% zinc, for total contained metal of 225 million oz. silver, 2.75 billion lb. lead and 1.81 billion lb. zinc.

Corani is about 160 km southeast of Cusco in the high mountain desert of the Andes and the project consists of 13 mineral concessions covering about 5,700 hectares.

Bear Creek originally acquired a 70% stake in Corani from Rio Tinto Mining and Exploration in March 2007 and increased its interest to 100% in February 2011.

Elsewhere in Peru, Bear Creek owns 100% of the 3,500-hectare Maria Jose project, about 140 km northwest of Lima.

Bear Creek has a $244.34-million market cap.

Cardinal Resources

Workers in the core shack at the Namdini gold project. Credit: Cardinal Resources.

Cardinal Resources (TSX: CDV) is focused on its Namdini orogenic gold project in Ghana, 60 km south of Ghana’s border with Burkina Faso in West Africa. Namdini lies within the Nangodi greenstone belt, one of a series of southwest-northeast trending granite-greenstone belts that host mineralization in Ghana and Burkina Faso.

The company completed a feasibility study on Namdini in October 2019 that envisioned a single, large open-pit mine and conventional carbon-in-leach processing. The mine would produce 4.2 million oz. gold over a mine life of 15 years at all-in sustaining costs of US$895 per oz. gold (average annual gold production of 287,000 oz.).

The study estimated initial capex of US$348 million could be paid back in 21 months at a gold price of US$1,350 per oz. driven by early higher grades and recoveries, low strip ratio and low costs within the starter pit. The study forecast a post-tax net present value at a 5% discount rate of US$590 million and internal rate of return of 33.2%.

Discovered in 2015 about 50 km southeast of Bolgatanga, reserves now stand at 138.6 million tonnes grading 1.13 grams gold per tonne for 5.1 million oz. gold, at a 0.5 gram cut-off grade.

The company is targeting first production in the second half of 2022.

In January management reported that it has received a number of term sheets from banks and financiers for the project.

In addition to Namdini, Cardinal Resources is exploring its Bolgatanga project in northern Ghana near the town of Bolgatanga, and its Subranum project in southern Ghana, 240 km northwest of the capital city of Accra and 45 km west of the township of Kumasi.

Cardinal Resources has a $110.3-million market cap.

Condor Gold

A drill site on the America vein at Condor Gold’s La India gold project in Nicaragua. Credit: Condor Gold.

Condor Gold (TSX: COG; LSE: CNR) is an exploration company focused on developing its 100%-owned La India project in Nicaragua.

The project hosts the historic La India mine, which operated between 1938 and 1956, and processed an estimated 1.7 million tonnes grading 13.4 grams gold per tonne for 576,000 oz. gold, some of it when the mine was under the ownership of Noranda. Mine records from 1953 show annual production of 41,861 oz. gold at a grade of 11.8 grams gold per tonne.

The mine worked a dozen narrow high-grade, low-sulphidation epithermal veins using traditional back-stoping techniques, but the activity was concentrated on two veins: the La India vein, where a 1,200-metre strike length was mined up to 200 metres below surface, and the America–Constancia vein, where a 2,200-metre strike length was mined to 250 metres below surface.

In addition to the La India and America sets of veins, Condor is also exploring the Mestiza vein set, and all three are situated within a 6 km by 3 km area. In 2011, Condor geologists found another mineralization style on the edge of a major late-stage, northeast-striking fault that it calls its Central Breccia prospect.

The project’s indicated resources stand at 9.85 million tonnes grading 3.6 grams gold per tonne for 1.14 million contained oz. gold. Inferred resources measure 8.48 million tonnes grading 4.3 grams gold per tonne for 1.18 million oz. gold. Of the total, the vast majority (8.58 million tonnes of indicated and 3.01 million tonnes of inferred) are defined as open-pit resources, while the rest is classified as underground.

In addition to the main La India pit, the project has four satellite pits that could act as feeder pits for the mill.

The government awarded the company permits for the main La India pit and for a 2,800-tonne-per-day processing plant in August 2018. Condor is permitting the America and Mestiza pits, 2 km and 4 km away from the proposed site of a central mill.

A prefeasibility study was completed in 2014. The study considered three scenarios: an open-pit mine at La India only; an expansion scenario with open-pit mining at La India, America and Central Breccia; and an expansion scenario contemplating open-pit mining at La India, America and Central Breccia, and underground mining at La India and America.

In August 2018, the company received an environmental permit for the development, construction, and operation of a processing plant with a capacity of up to 2,800 tonnes per day and associated mine infrastructure.

Condor has two exploration projects, Estrella and Rio Luna. The 18 sq. km Estrella concession includes the historic Estrella gold mine, and is about 20 km southwest of Siuna, a mining town in northeastern Nicaragua. Rio Luna is an advanced project covering a 43 sq. km. area in Nicaragua’s central highlands.

Condor Gold has a $40.71-million market cap.

Cora Gold

West Africa-focused Cora Gold’s (LSE: CORA)’s flagship project is Sanankoro in southern Mali, about 110 km southwest of Bamako, and consists of five exploration permits over a 342-sq.-km area. There has been extensive artisanal gold mining activity in the area with shallow workings extending over about 10 km.

Before Cora Gold acquired the project from Hummingbird Resources in 2017, there had been two main phases of work on the project. The first by Randgold Resources in the mid-2000s, and the second by Gold Fields from 2008 until 2012. Combined drilling by Randgold, Gold Fields and Cora Gold totalled 78,500 metres of reverse circulation, air core, rotary air blast and diamond drilling. Sanankoro’s inferred resources stand at 5 million tonnes grading 1.6 grams gold per tonne for 265,000 oz. contained gold. The current resource has a range of pit depths from about 40-100 metres, and the company believes there is scope to increase the resource with further drilling.

The company released the latest set of assays on Feb. 11, with highlights of 2.61 grams gold per tonne over 29 metres from 82 metres, including 3.89 grams gold over 12 metres in drill hole 241; 4.2 grams gold per tonne over 7 metres from 101 metres, including 8.38 grams gold per tonne over 3 metres in drill hole 246; and 2.05 grams gold per tonne over 14 metres, including 3.31 grams gold over 7 metres, starting from 61 metres.

An initial scoping study on Sanankoro, released in January, envisioned an open-pit heap leach mine with an initial mine life of three years producing 45,632 oz. per year at all-in sustaining costs of US$942 per oz. The study estimated total capex of US$22.7 million. At a gold price of US$1,400 per oz., the project would generate a post-tax net present value of US$24.2 million at an 8% discount rate and after-tax internal rate of return of 73%.

The company also is exploring permits at its Yanfolila project, about 25 km from Hummingbird Resources’ Yafolila gold mine, and permits at Diangounte in western Mali and eastern Senegal.

Cora Gold has a £7.94 million market cap.

Lumina Gold

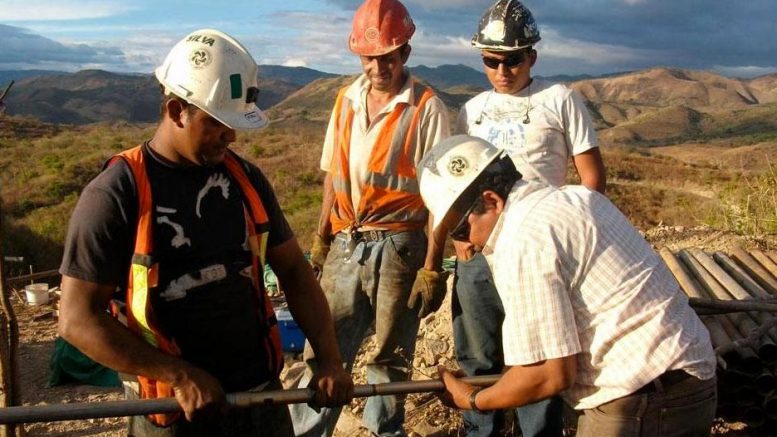

Workers handle core at a drill site at Lumina Gold’s Cangrejos gold-copper project in Ecuador. Credit: Lumina Gold.

Lumina Gold (TSXV: LUM) is a precious and base metals exploration and development company focused on its Cangrejos gold-copper project in southwest Ecuador. The project is 30 km southeast of the provincial capital of Machala and the Pan American Highway and 40 km from the deep water commercial port of Puerto Bolivar

The Cangrejos project is located in the Andean foothills of El Oro province, which has a long established history of mining. Lumina Gold, formerly Odin Mining, identified the Cangrejos area in 1994 as the source of the Biron alluvial gold deposit, which yielded 69,000 oz. gold. A joint venture was formed with Newmont Mining (NYSE: NEM) and from 1994 to 2001 geophysical and geochemical surveys were completed and anomalies were tested by diamond drilling. The Cangrejos zone was discovered by hole CC-99-14, which intersected 1.57 grams gold per tonne over 192 metres.

Today Lumina Gold owns 100% of the project, which currently consists of two deposits – Cangrejos and Gran Bestia. In November 2019, the company significantly updated its resource estimate for Cangrejos and unveiled a maiden resource estimate for Gran Bestia.

The Cangrejos deposit now contains 469 million tonnes of indicated resources grading 0.59 gram gold per tonne and 0.12% copper for 8.9 million oz. contained gold and 1.2 billion lb. copper.

Inferred resources stand at 255 million tonnes grading 0.43 gram gold per tonne and 0.08% copper for 3.5 million oz. gold and 466 million lb copper. The Cangrejos deposit remains open to expansion with further exploration to the west and at depth.

Gran Bestia has indicated resources of 99 million tonnes grading 0.46 gram gold per tonne and 0.08% copper for 1.5 million oz. contained gold and 178 million lb. copper, and inferred resources of 221 million tonnes grading 0.39 gram gold per tonne and 0.07% copper for 2.7 million oz. contained gold and 322 million lb. copper. The Gran Bestia deposit remains open to the north, west and at depth.

In the latest set of drill results from Cangrejos, released in Sept. 2019, drill hole G2B returned one of the best mineralized intervals ever intercepted at Cangrejos with 444 metres averaging 1.18 grams gold per tonne and 0.09% copper from a depth of 4 metres.

The company plans to complete an updated preliminary economic assessment on the project in the second quarter of 2020 that will update the 2018 PEA and integrate the addition of a carbon-in-leach circuit and a high-pressure grinding rolls (HPGR).

Mining entrepreneur and financier Ross Beaty owns 19.9% of the company’s outstanding common shares.

Lumina Gold has a $255-million market cap.

Roxgold

The processing plant at the Yaramoko gold mine in Burkina Faso, which Roxgold expanded to a 1,100-tonne-per-day capacity in 2018. Credit: Roxgold.

Roxgold (TSX: ROXG; US-OTC: ROGFF) is a gold mining company with assets in West Africa. The company owns and operates the high-grade Yaramoko gold mine located on the Houndé greenstone belt in southwestern Burkina Faso and is also advancing the development and exploration of the Séguéla gold project in Côte d’Ivoire.

The Yaramoko gold mine consists of two high-grade underground gold mines: the 55 Zone and Bagassi South. The gold mine, 200 km southwest of the capital city of Ouagadougou, is a 1,100-tonne per day operation using longhole stoping with cemented rock fill as its primary mining method. Yaramoko produced 142,204 oz. gold in 2019, generating US$47 million in free cash-flow before growth expenditures in the second half of the year. The company ended 2019 with US$41.8 million in cash and debt of US$25.6 million. It expects 2020 production of 120,000-130,000 oz. gold.

The 55 Zone was discovered in 2011 and commercial production began in October 2016. The 55 Zone has proven and probable reserves to a depth of 980 metres and the company is developing a dedicated drilling platform about 650 metres below surface to target extensions to the orebody at depth. Bagassi South, consists of two gold deposits, QV1 Zone and QV, and is situated about 1.8 km south of the 55 Zone. The QV1 Zone is the Bagassi South’s main deposit, and is geologically similar to the 55 Zone.

Roxgold acquired the Séguéla project in April 2019 as part of a portfolio comprised of 11 regional exploration permits. The 3,298 sq. km land package, about 240 km northwest of the country’s political capital of Yamoussoukro, includes the near-surface Antenna gold deposit, which was discovered in 2016.

The Antenna deposit consists of potentially open-pittable mineralization and is located near existing infrastructure including grid power, transport and water resources. In January, Roxgold updated its resource estimate for the Antenna deposit to 7.1 million tonnes grading 2.3 grams gold per tonne for 529,000 oz. contained gold, and inferred resources stand at 0.9 million tonnes grading 2.2 grams gold per tonne for 64,000 oz. gold. Roxgold also completed maiden resource estimates for three other deposits at the Séguéla project. Ancien has 1.1 million tonnes averaging 6.6 grams gold per tonne for 224,000 oz. gold; the Agouti deposit contains 1.3 million tonnes grading 2.6 grams gold per tonne for 110,000 oz. gold; and the Boulder deposit has 1.9 million tonnes grading 1.2 grams gold per tonne for 72,000 oz. gold.

The company released drill results from the Agouti deposit in February including 16 metres of 13.5 grams gold per tonne from 16 metres in drill hole 553; 8 metres of 23.9 grams gold per tonne from 91 metres in drill hole 605; and 9 metres of 12.2 grams gold from 43 metres in drill hole 500.

In February the company announced a new high-grade discovery at its Boussoura project in southern Burkina Faso, about 190 km from Yaramoko and 10 km north of the country’s border with Côte d’Ivoire. Highlights included 14 metres of 10.5 grams gold per tonne from 134 metres in drill hole GAL-002 and 9 metres of 8.2 grams gold per tonne from 204 metres in drill hole GAL-007.

Roxgold has a $383-million market cap.

SolGold

Workers driling at SolGold’s Alpala copper-gold property in Ecuador. Credit: SolGold.

SolGold (TSX: SOLG; LSE: SOLG) is advancing its flagship Alpala deposit in northern Ecuador’s Imbabura province and expects to complete a prefeasibility study before the end of the first quarter of 2020.

The Alpala copper-gold porphyry deposit is the main target on the company’s Cascabel concession in the Andean copper belt, about a three hour drive north of Quito and 180 km from the deep-water port of Esmeraldas and 30 km from a hydropower network.

A preliminary economic assessment released in May 2019 outlined an underground block cave operation at a pre-production capital cost in the range of US$2.4 billion to US$2.8 billion.

At a staged ramp-up to an annual throughput rate of 50 million tonnes, the PEA estimated Alpala would have a mine life of 57 years, with average metal production of 150,000 tonnes copper, 245,000 oz. gold and 913,000 oz. silver in concentrate per year.

Alpala contains 2.1 billion indicated tonnes grading 0.41% copper and 0.29 gram gold per tonne, or 0.60% copper equivalent (at a 0.2% copper-equivalent cut-off), plus 900 million inferred tonnes grading 0.27% copper and 0.13 gram gold per tonne, or 0.35% copper equivalent, at the same cut-off.

According to SolGold, Alpala “has produced some of the greatest drill hole intercepts in porphyry copper-gold exploration history,” with drill hole 12 intersecting 1,560 metres grading 0.59% copper and 0.54 gram gold per tonne, including 1,044 metres of 0.74% copper and 0.54 gram gold per tonne.

During 2020 the company is planning a pilot plant operation at Alpala treating about 30 tonnes of core and coarse rejects.

In October 2019 SolGold discovered a new copper-gold-silver-molybdenum porphyry system at its Cisne Loja project in southern Ecuador. It found outcropping porphyry-style copper, gold, silver and molybdenum-rich mineralized veining over an area of 2 km by 1 km. Rock chip results included one sample grading 4.32% copper, 4.51 grams gold per tonne and 20.8 grams silver per tonne and a second grading 2.52% copper, 3.11 grams gold and 12.5 grams silver, with both samples returning additional molybdenum grades.

In November 2019, BHP Billiton (NYSE: BHP) spent US$22 million to boost its stake in SolGold from 11.1% to 14.9%, making it the company’s largest shareholder.

SolGold has a $760-million market cap.

Teranga Gold

An employee holds a gold bar at Teranga Gold’s Wahgnion gold mine in Burkina Faso. Credit: Teranga Gold.

Teranga Gold (TSX: TGZ; US-OTC: TGCDF) is a West Africa-focused gold producer. Its flagship Sabodala gold mine is the largest gold mine in Senegal. The mine has produced over 2 million ounces since its first gold pour in 2009, and last year produced 241,276 oz. gold. The company forecasts the open-pit mine will produce more than 1 million oz. gold between 2018 and 2022, and generate free cash flow of US$230 million.

Sabodala is near Senegal’s border with Mali and is 650 km east of Dakar in the West African Birimian greenstone belt. Multiple deposits feed into a central mill. Sabodala’s current reserves sit at 55.7 million tonnes grading 1.35 grams gold per tonne for 2.4 million oz. gold. Teranga owns 90% of the mine and the government of Senegal has a 10% free-carried interest.

In February Teranga announced it is acquiring the Massawa gold project, about 30 km from Sabodala, from Barrick Gold. When the transaction closes in March, Teranga will own a 90% stake in the asset and the government a 10% interest.

Massawa is one of the highest grade undeveloped open-pit projects in Africa and provides opportunities for capex/opex synergies with Sabodala’s mill and infrastructure, the company says. Teranga is targeting first gold production from Massawa in the second half of 2020. Massawa’s historic mineral reserves stand at 20.9 million tonnes grading 3.94 grams gold per tonne for 2.6 million oz. gold.

In November 2019, the company announced commercial production at its second gold mine, Wahgnion, in southwestern Burkina Faso, 510 km southwest of the capital city of Ouagadougou. Like Sabodala, Wahgnion has multiple deposits feeding a central mill. Last year the mine produced 47,492 oz. gold and is expected to produce an average of 132,000 oz. gold a year over a 13-year mine life. Wahgnion’s reserves stand at 31.07 million tonnes grading 1.61 grams gold per tonne for 1.6 million oz. gold.

The company has exploration programs in Senegal, Burkina Faso and Cote d’Ivoire. Its Golden Hill project in Burkina Faso has 6.4 million indicated tonnes grading 2.02 grams gold per tonne for 415,000 oz. gold and 11.95 million inferred tonnes averaging 1.68 grams gold per tonne for 644,000 inferred ounces.

The company has a $900-million market cap.

Be the first to comment on "Global Exploration Snapshot: West Africa and South America remain popular"