It turns out that the driving force behind the proposed merger between Goldcorp (G-T, GG-N) and Glamis Gold (GLG-T, GLG-N) is the Penasquito project in Mexico’s Zacatecas state, a low-grade, bulk-tonnage polymetallic project of huge proportions.

“This is absolutely a world-class asset,” stressed Goldcorp president and CEO Ian Telfer while pitching the merits of the stock swap, which calls for Glamis shareholders to receive 1.69 Goldcorp shares in exchange for each share held. The deal represented a 33% premium to the closing price of Glamis on Aug. 30, the day before the announcement, and a 35% premium to the company’s 20-day average trading price.

“If you took all the metal that’s at Penasquito and turned it into gold-equivalent, there’s thirty-five million ounces there, proven and probable.” Telfer said. “Before the end of this year there is going to be an additional reserve or resource calculation and I think to maybe some people that aren’t totally up to speed on the size and value of Penasquito, this is going to bring them onside,” Telfer predicted.

Penasquito comprises about three-quarters of Glamis’ reserve base.

“Our knowledge of that asset, which is a big part of the value of the company, the quality of the personnel and the relative valuations of the stocks by the analysts and by the market, led us to this 35% premium but it was arms-length, it was hard fought and I am telling you, you couldn’t have got it cheaper,” said Telfer.

Glamis expects to produce 620,000 oz. gold in 2006 at cash costs of about US$190 per oz. from its El Sauzal mine in Mexico, Marlin in Guatemala, San Martin in Honduras and its 66.7% interest in Marigold in Nevada. Its star performer currently is El Sauzal, which began commercial production in the fourth quarter of 2004 and is forecast to produce 230,000 oz. for 2006.

Glamis recently completed construction of the Marlin mine and began commercial operation in the fourth quarter of 2005. Despite some teething issues, Marlin is going to be a very nice mine for the company, with current proven and probable ore reserves totalling 2.4 million oz. gold and 40 million oz. silver. Marlin is expected to account for 215,000 oz. gold and 2 million oz. silver in 2006.

“This transaction doubles our reserves and resources, which I think is going to be the most important metric for gold mining companies going forward,” Telfer said. “We are very impressed by the cash flows and the future gold production that is going to come out of Glamis.”

The combined Goldcorp would have 11 or 12 operations producing 3 million oz. gold or more, said Telfer, as well as a management team with development and operations expertise.

“If you look at the two companies, one of them has a fantastic present and the other one has a fantastic future, and we think putting the two together is the right thing to do for Goldcorp going forward in the short-term, medium-term and the long-term,” Telfer said.

Kevin McArthur, president and CEO of Glamis concurred.

“Let’s call it present day cash flows and earnings, versus future NAV (net asset value); this is a good blend that’s going to make ultimate sense,” McArthur said. “We are creating a vehicle that has a chance to be called the premier gold company of the future. This is the blue-chip gold stock going forward for Canada.”

Western merger

Glamis acquired the Penasquito project by merging with Dale Corman’s Western Silver in May, just five short months ago, in an all-share deal valued at just over $1 billion. At that time, Penasquito had 671 million tonnes in measured and indicated resources containing the in situ equivalent of 8.7 million oz. gold, 614 million oz. silver, 4.1 million tonnes zinc and 1.7 million tonnes lead. An additional 247 million tonnes was inferred, representing an extra 2.8 million oz. gold, 192 million oz. silver, 1.4 million tonnes zinc and 600,000 tonnes lead.

A positive feasibility study completed in November 2005 by Tucson, Ariz.-based M3 Engineering & Technology showed the economic potential for a 50,000-tonne-per-day, open-pit operation that would produce gold, silver, zinc and lead using conventional heap leaching on the oxidized ore and flotation milling on the deeper sulphide mineralization. The study integrates two sulphide deposits, Penasco and Chile Colorado, which are 1.5 km apart, and the near-surface oxide mineralization into a 17-year life scenario to produce 3.3 million oz. gold, 220 million oz. silver, 1.4 million tonnes zinc and 631,000 tonnes lead.

The mine plan was based on proven and probable oxide-mixed ore reserves of 77.3 million tonnes grading 0.28 gram gold and 23.3 grams silver, for a recoverable 389,000 oz. gold and 14 million oz. silver.

Sulphide ore reserves totalled 258 million tonnes grading 0.51 gram gold, 30.2 grams silver, 0.69% zinc and 0.31% lead. This represented an in situ 4.2 million oz. gold, 250 million oz. silver, 2 million tonnes zinc and 881,000 tonnes lead, or, on a recoverable basis, 2.9 million oz. gold, 206 million oz. silver, 1.4 million tonnes zinc and 631,000 tonnes lead.

In June, Glamis announced a 30% increase in measured and indicated tonnes, including the doubling of the proven and probable gold ounces, and a staggering 945% jump in inferred tonnes.

“The growth at Penasquito is fantastic,” McArthur acknowledged. “It has surprised all of us. Penasquito has got to be the best deal we have done yet; this has really turned the company, adding a lot of shareholder value.”

The revised reserve and resource estimates are based on new interpretations and the results from over 67,000 metres of new drilling since the completion of the original feasibility study in 2005. Measured and indicated resources now total 872 million tonnes averaging 0.46 gram gold, 29.3 grams silver, 0.61% zinc and 0.28% lead, the in situ equivalent of 12.8 million oz. gold, 822 million oz. silver, 5.3 million tonnes zinc and 2.4 million tonnes lead.

A low-grade envelope of additional inferred resources is now a whopping 2.6 billion tonnes averaging a somewhat negligible 0.17 gram gold, 11 grams silver, 0.28% zinc and 0.09% lead.

“Western Silver certainly was a tip-of-the-iceberg acquisition for us,” said McArthur, adding that the open pit and underground areas have a lot of growth potential, as does the region. “We think the district is going to show a lot of upside to the company in the future.”

At the end of July, Glamis released an updated feasibility study reflecting a much larger project than was originally envisioned. The study, prepared by M3 Engineering, calls for the construction of an initial 50,000-tonne-per-day milling and flotation circuit, ramping up to 100,000 tonnes per day with the addition of a second circuit of the same size two-and-a-half years later. Separate zinc and lead concentrates would be produced.

Capital costs are more than double the original estimate, coming in at US$882 million, with an additional US$327 million in sustaining capital over the proposed 17-year life.

Annual production is expected to average 387,500 oz. gold, 23 million oz. silver, 137,400 tonnes zinc and 71,100 tonnes lead, or 1.3 million oz. on a gold-equivalent basis. Cash costs on a co-product basis are forecast to average US$125 per oz. gold (with lead as a byproduct), US$4.91 per oz. silver and US44 per lb. zinc, or a negative US$378 per oz. gold if all the other metals are accounted as a byproduct.

Proven and probable ore reserves now contain an in situ 10 million oz. gold, 575 million oz. silver, 3.6 million tonnes zinc and 1.7 million tonnes lead in 564 million tonnes of ore. The engineering design of the two expanded pits is based on long-term metal prices of US$450-per-oz. gold, US$7-per-oz. silver, US60-per-lb. zinc and US30-per-lb. lead.

The oxide cap hosts 87.1 million tonnes of heap-leachable ore grading 0.28 gram gold and 23.8 grams silver at recovery rates of 50% gold and 22-28% silver. Some 477 million tonnes of sulphide ore will be milled at an average gr

ade of 0.6 gram gold, 33.2 grams silver, 0.76% zinc and 0.35% lead.

By pushing the pits deeper in the revised feasibility study, the overall waste-to-ore stripping ratio is now 2.76:1, against 1.94:1 in the original feasibility study.

The base-case scenario projects an internal rate of return of 18.7% and payback period of 5.6 years, using metal prices of US$533 per oz. for gold, US$8.84 per oz. for silver, US79 per lb. for zinc and US42 per lb. for lead. About 35% of the projected revenue will come from zinc, 28% from gold, 28% from silver and 9% from lead.

The sulphide orebodies will be developed in sequence beginning with the Penasco pit, followed by the Chile Colorado pit. Overburden and oxide ore will be stripped to allow access to the sulphide ore. Oxide ore, as it is being encountered during the stripping, will be placed on a leach pad. The run-of-mine oxide material will be leached with sodium cyanide solution and gold-silver will be recovered through a Merrill-Crowe processing plant. The rate at which the oxide ore is placed on the leach pad varies from 10,000 to 50,000 tonnes per day during the first seven years of operation. Oxide recoveries are anticipated to be 50% for gold and 22-28% for silver.

Metallurgical flotation test work on sulphide ore from both the Penasco and Chile Colorado deposits were performed to provide a basis for projected plant recoveries. The testing revealed that recoveries in the Penasco pit correlated with three basic lithological categories: breccia, intrusive and sedimentary. Chile Colorado is predominantly sediment-hosted. Overall, about 77% of the sulphide ore is hosted in breccia, 13% is sedimentary-hosted and 10% intrusive-hosted.

Metallurgical tests on the different Penasco ore types show zinc recoveries ranging from 78% for breccia, 60% for intrusive and 50% for sedimentary, while lead recoveries range from 75% for breccia, 72% for intrusive and 60% for sedimentary. Recoveries of 77-79% gold and 79-81% silver are expected for the breccia and intrusive-hosted mineralization but fall off to 35% gold and 50% silver in the sediments.

Mill recoveries for Chile Colorado average 60% zinc, 60% lead, 27% gold and 71% silver.

‘Rail, roads and power’

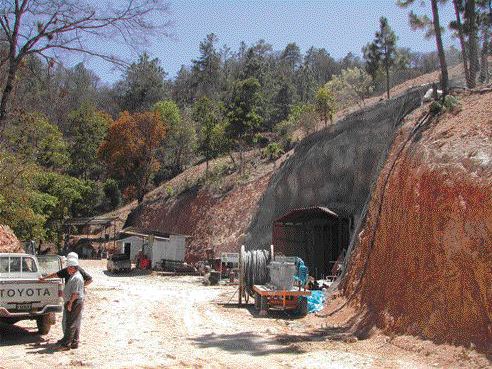

The Penasquito project is found in the western half of the Concepcion del Oro district in the northeastern corner of Zacatecas state, 200 km northeast of the city of Zacatecas and 12 km west of the village of Mazapil.

“It’s a mining state; there’s great infrastructure,” McArthur said. “There’s rail, roads and power, and there’s a highly trained and skilled work force. You couldn’t ask for a better place to build a big mine.”

The project site is at a generally flat elevation of 1,900 metres. The deposits occur in a wide valley, covered by 10-30 metres of alluvium and bounded to the north by the Sierra El Mascaron and the south by the Sierra Las Bocas.

The state of Zacatecas has a strong mining history, dating back to the 1500s when silver mining first started and the city of Zacatecas was founded. Consultants M3 Engineering & Technology have provided services for the recent Peoles Fresnillo expansion, as well as the greenfields Madero project. Both of these projects are polymetallic.

The Real de Angeles property, near the city of Zacatecas, operated as an open-pit mine from 1982 to 1998, averaging 17,000 tonnes per day with life-of-mine ore grades of 0.9% zinc, 0.58% lead, 70 grams silver and no appreciable gold. The life-of-mine stripping ratio was about 5:1.

Western Silver acquired 100% of Penasquito from Kennecott, a division of Rio Tinto (RTP-N), in 1998 by reimbursing the company some US$5 million in past exploration spending in the form of shares. The Penasquito acquisition was driven by the large scale of alteration and mineralization, which covered a 9-sq.-km area, a newly discovered zone of “possible” economic interest at Chile Colorado, two large mineralized breccia pipes/diatremes and several outlying targets that had returned high-grade intercepts.

Starting in 1994, Kennecott had consolidated the Penasquito land position and began carrying out extensive geochemical, geophysical and drilling programs to evaluate the area, primarily for large-tonnage porphyry copper systems. The only evidence of past exploration on the property was a short shaft and two shallow holes drilled in the 1950s on a small outcropping breccia zone. An aeromagnetic survey of the region defined a large, north-south-trending magnetic high that measured 8 by 4 km and was centred roughly on the outcropping breccia.

Detailed induced-polarization (IP), gravity and magnetic ground surveys led to the early discovery of two large mineralized diatreme breccia bodies — Outcrop breccia and Azul breccia, which intrude Upper Cretaceous-age Caracol Formation sandstones and shales. Outcrop breccia measures about 1,000 by 800 metres at surface. The Azul breccia has surface dimensions of 500 by 750 metres. Both breccia bodies occur at the intersection of major structural trends. Subsequent drilling by Kennecott primarily tested these breccias, as well as a well-defined copper anomaly between the two bodies.

In 1997, Kennecott completed 250 shallow rapid-air-blast (RAB) holes totalling 9,300 metres as part of an extensive geochemical sampling campaign across much of the Penasquito project area. The holes were designed to penetrate the overburden cover and sample the underlying bedrock. A strong silver anomaly on the southern edge of the Azul diatreme was drilled, resulting in the discovery of the Chile Colorado polymetallic zone.

Highlights of Kennecott’s discovery drilling on Chile Colorado included a 150-metre section in hole PN-28 averaging 1.05 grams gold per tonne, 72 grams silver, 1.45% zinc and 0.18% lead, starting 226 metres down-hole, and a 140-metre interval in hole PN-19 grading 0.43 gram gold, 130 grams silver, 2.5% zinc and 1.8% lead, beginning 170 metres down-hole.

The discovery of Chile Colorado wasn’t enough to keep Kennecott interested in Penasquito and it later farmed out the property to Western Silver. During the period 1994-1997, Kennecott completed 71 core and reverse-circulation holes totalling 23,500 metres.

Kennecott retains a 2% net smelter return (NSR) royalty on future production from both the Chile Colorado and Penasco areas. An additional 3% NSR royalty on production in the Penasco area is held by Grupo Industrial de Coahuila, as part of an underlying agreement previously reached with Kennecott, which can be bought out at any time for US$5 million.

After acquiring the project in 1998, Western Silver poked an initial nine holes into the partially defined Chile Colorado zone and adjacent Azul breccia pipe. The highlight of this work was hole WC-3, which intersected 99 metres averaging 0.38 gram gold, 189 grams silver, 2.48% zinc and 2.15% lead (including 51 metres of 0.56 gold, 312 grams silver, 4.11% zinc and 3.57% lead) in a 100-metre westerly stepout beyond Kennecott’s hole PN-28.

Penasquito occurs along the axis of an east-west-trending syncline in a sequence of sub-horizontal marine sandstones and shales of the Cretaceous age Caracol Formation. Mineralization, in the forms of veins, stockwork, chimney and mantos, is spatially related to two large breccia pipes consisting of variable percentages of Caracol and intrusive fragments. A large granodiorite stock is believed to underlie the entire area, and the sedimentary sequence is cut by a variety of intrusive dykes, sills and stocks of intermediate to felsic composition.

Drilling at Chile Colorado had defined an open-ended, elliptical mineralized zone measuring at least 400 metres long, 250 metres wide and 150 metres thick. The mineralization in this zone appeared to be related to a series of northerly striking, steeply dipping structures, which intersect a complementary set of east-west-trending mineralized fractures. Sandy and calcareous zones, as well as poorly defined breccias, exert a strong control on the location of high-grade mineralization.

Western Silver believe

d there was potential for at least 35 million tonnes averaging 0.3-0.5 gram gold, 90 grams silver and 2.5-3% combined zinc-lead. Even more telling, Western Silver suggested in 1998 that Chile Colorado could contain upwards of 200 million tonnes should the system extend 1,200 metres into the North Azul area as interpreted from 10 widely spaced holes.

In 2000, when junior exploration companies were struggling and unable to raise any sort of capital in the markets, Western Silver joint ventured the Penasquito and San Jeronimo properties to Mauricio Hochschild & Cia, a privately held, Peruvian-based mining company. Hochschild spent more than US$1 million on drilling and land payments before opting out of the joint venture in 2001. They completed a 14-hole program totalling 4,600 metres, with most of their work focused on further testing the potential of Chile Colorado. Hole MHC-4, collared 50 metres north and 200 metres west of WC-3, intersected a feeder-like zone of bonanza silver. A 37-metre section, beginning 153 metres down-hole, averaged an uncut 1,186 grams (or 38.1 oz. per ton) silver, 0.98 gram gold, 6.37% zinc and 1.02% lead, including a 3.3-metre-long interval that assayed 5,300 grams (171 oz.) silver.

Penasco

From 2002 until it merged with Glamis in May, Western Silver has continuously drilled the Penasquito project, completing 434 holes for a total of 217,705 metres to the end of June 2006. Towards the end of 2002, Western Silver discovered a new, much larger zone of mineralization, called Penasco, while testing a coinciding geochemical and geophysical anomaly near the southeast margin of the Outcrop breccia.

The Penasco deposit is in the east half of the Outcrop breccia directly above the projected throat of intrusive body. It is ovoid in shape, at least 500 metres wide in an east-west direction and 1,000 metres long north-south. It has formed around a complex series of small quartz-porphyry stocks and dykes, with some felsic dykes. The sulphide mineralization occurs as disseminations and veinlets of medium- to coarse-grained sphalerite-galena-argentite, other unidentified silver sulfosalts, minor tetrahedrite-polybasite and common gangue of calcite-rhodochrosite-quartz-fluorite.

At Chile Colorado, mineralization normally occurs as both veining and narrow fracture filling, hosted in weakly silicified sandstone, siltstone or shale. Sphalerite and galena associated with carbonate and pyrite occur as massive veins and as discrete crystals and disseminations in the sediment sequence.

Ongoing drilling at Penasquito has focused on the exploration and delineation of three principal areas: Chile Colorado, Azul (Azul breccia, Azul NE and Luna Azul) and Penasco, including El Sotol, adjacent to Penasco.

There are five core rigs currently drilling on the property, with plans to add a sixth. As condemnation drilling nears completion, the focus will remain on exploration of the zone between the southern end of the Penasco pit and the northern end of the Chile Colorado pit, working to convert resources to reserves.

“It looks like that is going to become one pit eventually,” said McArthur. “Recent drilling has given us that encouragement that this is going to grow even further and we are going to extend the mine life out beyond (17 years). We also see encouragement for concurrent underground mining at a future date.”

In addition, there is a deeper, higher-grade resource beneath the pits that offers the potential for underground block-caving methods further down the road, post open-pit mining.

The project timeline at present calls for the completion of permitting by mid-2007, initial production from heap leaching of oxide ore in the second half of 2008, and full operation of the milling circuit by late 2009.

Friendly combination

The proposed combination between Goldcorp and Glamis has been structured as a “friendly” plan of arrangement and has been approved by both boards. The agreement provides for the acquisition of all outstanding Glamis shares by Goldcorp in a basic stock-for-stock swap. Goldcorp and Glamis shareholders will hold 60% and 40% of the new Goldcorp, respectively. The merger is expected to close in November, subject to regulatory approvals and the support of at least two-thirds of Glamis shareholders.

McArthur says the new company will be strong financially, which will help with the “huge capital outlays” Penasquito requires.

“There is not the overhang on financing Penasquito now and that’s very important for the company going forward,” he said. “We expect to finance this through the company’s cash flow.”

McArthur also believes a strong selling part of the deal is Goldcorp’s Mexican mining group, Luismin, with its 100 years of experience.

“They are one of the finer mining organizations in Mexico, which is very important seeing as this will be the largest mine in Mexico, so the synergies here are immense.”

“We have total confidence in our ability to bring this project into production,” Telfer concurred. “We think this is going to be seen, as time goes on, as one of the great orebodies of the world and that’s what drove us to do this transaction.”

There may be plans to spin out some of the silver to raise some of the capital to help fund development. Silver Wheaton (slw-t, slw-n), a pure-play silver company held nearly 60% by Goldcorp, was granted the right to negotiate exclusively concerning the potential purchase of a portion of the future silver production from Penasquito, for a period of 180 days once the Glamis merger has closed. Silver Wheaton already has an agreement in place to purchase all of the silver production from Goldcorp’s Luismin gold mining operations in Mexico.

Silver Wheaton doesn’t own or operate mines directly, and instead holds rights to buy silver production from mines owned and operated by other companies.

Be the first to comment on "Goldcorp sees the future in Penasquito"