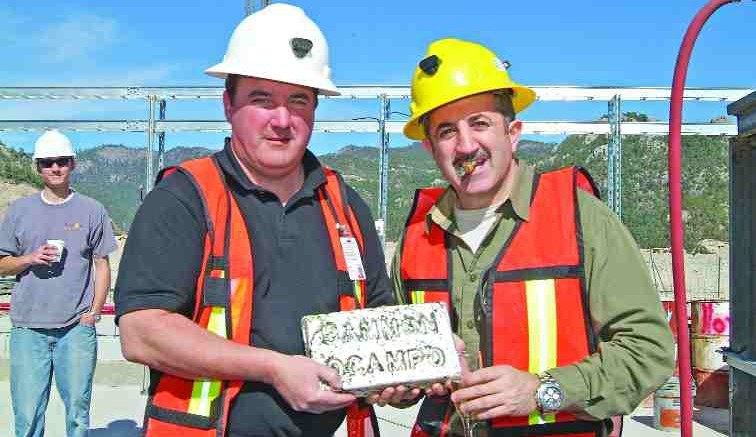

Accusations of misguidance and hype could be a sign of more trouble to come for Gammon Gold (GAM-T) as a new management team works to fix a series of startup problems at two gold operations in Mexico.

The company posted a US$25.5-million loss for the second quarter after it fell significantly short of production goals at its Ocampo and El Cubo mines in Chihuahua state, Mexico.

Management said it could be the second quarter of 2008 before the company meets its feasibility study goal of 400,000 oz. gold equivalent (200,000 oz. gold, 10 million oz. silver) per year.

Gammon sold about 59,000 oz. gold-equivalent (32,000 oz. gold, 1.4 million oz. silver) in the second quarter, a 16% drop from the 70,000 oz. gold-equivalent oz. (37,000 oz. gold, 1.6 million oz. silver) Gammon produced in the first quarter.

Gammon’s cash costs per gold equivalent ounce tallied to US$474 per oz. for this year’s second quarter. But once two cash production write downs are factored in (US$2.5 million and US$5.7 million, respectively), cash costs soared to US$614 per gold equivalent oz. A Canaccord Adams bulletin dated Aug. 13, 2007, says Gammon provided cash cost guidance of around US$200 per oz. only four months earlier.

Gammon’s share price had dropped to $9.36 at presstime, from a 52-week high of $21.76 in March.

Gammon is likely looking at a lawsuit from Indianapolis, Ind.-based Midas Funds for US$3 million in damages, plus another US$10 million in punitive damages. Midas has already filed a complaint with a New York state court in which Midas accuses Gammon of overstating its target production to persuade investors to buy shares in its April financing, in which Gammon raised $200 million at $20 per share.

Gammon has not yet been served Midas’s complaint but Gammon CEO Russell Barwick, who was appointed in the second quarter, says the claim is without merit.

“We believe the first quarter results disclosed what was needed at the time,” Barwick says. “We have made a commitment to provide even more detail, which we’ve done.”

Wendell Zerb, a senior mining analyst with Canaccord Adams, says Gammon would have had access to operational data at the Mexican mines for the first quarter.

“Theoretically, the company should have had a pretty good feel for how that quarter was from an operational standpoint,” Zerb says.

Looking back, Zerb says, Gammon needed to raise equity because of its weak balance sheet. He says if the poor first quarter performance had been disclosed, the company would have raised equity at a lower share price.

First quarter results were released May 10, sending the stock into a tailspin.

How much information Gammon was obligated to disclose remains the question at large.

A hint of a class action lawsuit could be found on StockHouse.ca where lawyer Dimitri Lascaris posted a note in search of Gammon shareholders.

“I can only say that we’ve been examining the affairs of the company closely and we have reason to want to speak to shareholders,” says Lascaris, who claims to take on more securities class action suits than any lawyer in Canada. Lascaris added that the details of the April financing interest him.

Gammon has circled the wagons by hiring a more experienced management team. During the last two months, Gammon appointed Barwick, a new chief financial officer, chief operating officer, and added two new positions: president of Mexican operations and a corporate director of Mexican operations. The team is addressing a laundry list of operational issues.

Manish Vora, analyst and director of research at Monness, Crespi, Hardt & Co. in New York City, says he was surprised at the second quarter results but is pleased with the new management appointments.

“All along the company had alluded to the operations going smoothly,” Vora says. “We are disappointed that in the past there was a lot of misinformation and promotion from the company.”

Vora, who personally owns stock, views Gammon as a long-term investment.

“It’s likely a good asset and they have the right team to make the changes,” Vora says.

But Zerb, Vora and others are seeking hard numbers.

“There’s so little information for investors and analysts to sink their teeth into,” Zerb says. “The guidance has been so poor that you really have to see concrete results before you can make any strong opinions.”

Barwick says his new management team needs both experience and time before that happens.

“I believe the project will improve quarter on quarter,” says Barwick, while asking investors to be patient. “There is no instant switch on the wall.”

Barwick, who admitted there have been more problems than usual in this startup, says investors should look at the mine as one in its infancy.

“Startup projects always have some wrinkles,” he says.

Barwick has been involved in the construction and commissioning of a number of mines, and says the problems are not new. “We are seeing gold in the pit where it’s meant to be … we are seeing gold underground where it’s meant to be,” he says.

Barwick’s optimism doesn’t sit well with Zerb, who says new management has downplayed the operational results so far, noting the significant pre-production period at Ocampo. The mine had its first gold pour in February 2006, began to ramp up in June 2006, and declared commercial production in January 2007.

“They wrote it off as early growing pains,” Zerb says. “It’s not just a matter of small corrections quarter over quarter.”

The Ocampo leach pad, crusher and mill operated at less than 70% capacity during the second quarter of 2007. Lightning struck the mill which caused some problems and then two motors stopped working. Gammon complicated matters further by mining a low-grade area.

Barwick says the region’s rainy season has slowed down the Ocampo crusher leading him to warn that results won’t improve much in the third quarter.

A fourth crusher is being installed at the open pit, which will increase daily throughput capacity by 10-15%. And a third tailings filter is being added at the mill to increase high-grade throughput by 33% or 2,000 tonnes per day from 1,500. The filter should be in place by the first quarter of 2008.

At El Cubo, new management personnel have declared some of the underground equipment obsolete and are replacing it in an effort to bolster efficiency. The same goes for two older mills, which Barwick says would look at home in a museum. A newer, more efficient mill was restarted in the second quarter but was only working at 45% capacity. And the company is tweaking the underground mine plan where grades are as much as 30% lower than expected.

Barwick is confident the changes will have an impact.

“This is the end of the second quarter of a mine that is supposed to go for twelve or thirteen years and possibly beyond that,” Barwick says. “I don’t believe the project has any fatal flaws.”

Be the first to comment on "Honeymoon over for Gammon Gold"