Industry veteran Duane Parnham sat at a cozy dinner table with his family last Christmas when inspiration struck.

Watching his kids and in-laws engrossed in cryptocurrency trading gave Parnham, the CEO of Madison Metals (CSE: GREN; US-OTC: MMTLF), an idea for a new source of capital for the junior, which holds a suite of Namibia-based uranium assets.

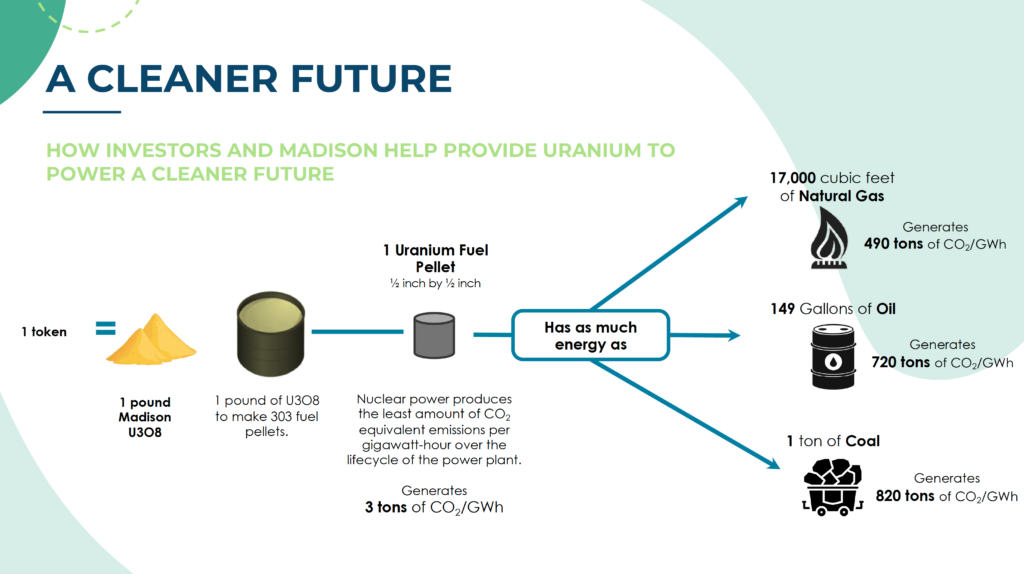

“We created a really interesting marketing ploy – attaching our in-ground verified uranium resources to a stable token backed by cryptocurrency. It’s an opportunity for investors to get leveraged to the uranium price, and we think the timing is perfect,” Parnham told The Northern Miner in an interview.

Madison is working on launching its unique strategy, aimed at disrupting traditional mining funding by tokenizing the company’s uranium resources, in the next six weeks. It signed a forward sales agreement with an international bank on June 1 to supply 20 million lb. of uranium via a token, providing an alternative funding source for the company.

“This disruption in how we fund junior mining companies using cryptocurrency and a forward sales agreement is a bit early for the traditional mining approach, but sometimes you have to take a little risk to do something unique and different,” Parnham says.

“If successful, it would provide us with continuous funds without diluting shareholder equity or taking on debt.”

The sales floor for transactions under the multi-year agreement is set at $45 per pound.

Credit: Madison Metals

Parnham, a seasoned entrepreneur, founded Forsys Metals, where he played a pivotal role in developing the Valencia uranium prospect in Namibia from 2006 to 2010. Under his leadership, Forsys grew from a US$45,000 startup to a market capitalization of US$860 million.

Throughout his more than 30-year career, Parnham has demonstrated his entrepreneurial flair by establishing and nurturing several resource-focused companies. Temex Resources, UNX Energy, Giyani Metals (TSXV: EMM), Canoe Mining Ventures (TSXV: CLV), and Broadway Strategic Metals are among these ventures.

Given his vast experience, Parnham saw a gap, recognizing the allure of the cryptocurrency market’s ceaseless nature. In his view, the uranium tokens can help top up its cash balance of US$1.5 million as of Feb. 28.

Uranium assets

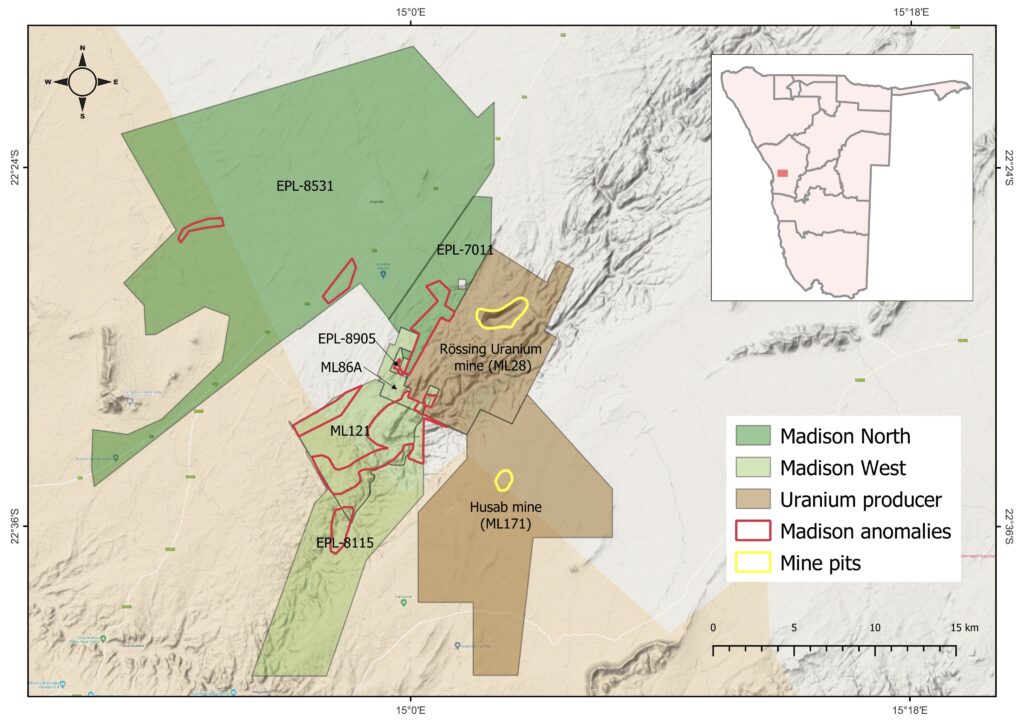

Underpinning the token venture, Madison consolidated its land holdings earlier this year under the property names Madison North and Madison West in Namibia.

Madison owns an 85% interest in Exclusive Prospecting Licences (EPL) 8531 and 8115. These licences are located in the prolific Erongo uranium province of Namibia, where Madison already holds rights to EPL 7011 (85% interest) and has an agreement in place to acquire a 90% interest in mining licence (ML) 86A and acquire a 24% direct interest in ML 121.

Parnham says the assets underline the best attributes of Namibia’s uranium potential in an underexplored area. Namibia is the world’s second-highest uranium-producing country and holds the fifth-largest total uranium resources in the world. In 2021, Namibia produced about 9.6 million lb. of yellowcake.

“When you look at the geological environment from where Valencia is, for example, then running through to Rössing and then looking to where Husab is, there’s an area that really hasn’t received a lot of exploration despite significant mining licences being issued for other commodities,” he says.

A map showing Madison’s key Namibian assets. Credit: Madison Metals

The little available data include grab samples in these areas that have returned grades a little under those of the established 330 parts per million (ppm) average of the Rössing mine, with some areas showing higher grades exceeding 1,000-2,000 ppm.

According to Parnham, the geological environment in the areas of interest suggests the presence of parallel uranium sheets, similar to quartz vein gold deposits. This new understanding is exciting and can increase the potential size of the resource.

The company is preparing plans for this year’s exploration campaign to formalize and add to the historical data and make progress toward an initial resource statement.

Despite the early stage of its assets, Parnham foresees a fast track for Madison to be in production in 10 years. The company acquired existing mining licences with its assets. Further, the deposits lend themselves to cheap open pit extraction using contract mining to reduce the initial capital outlay. Management is also working behind the scenes to negotiate toll mining agreements with the Rössing and Husab mines located trucking distance away.

Should the company secure partnership or tolling agreements with these mines or other players in the industry, it could provide them access to existing uranium processing infrastructure and potentially expedite their path to production.

If successful, this groundbreaking tokenization plan could reshape the landscape of junior mining financing, placing Madison at the forefront of a cutting-edge financial strategy in the resources sector. The company plans to provide more details upon launching the tokens in the coming weeks.

Madison Metals Tuesday last traded at 36¢ per share, having touched 25.5¢ and $1.50 over the past 12 months. It has a market capitalization of $8.5 million.

Be the first to comment on "How Madison Metals plans to disrupt junior finance with a uranium token"