Mangshi City, Yunnan Province, China — With annual gold output approaching 7 million oz., China has climbed to fourth place in recent years among the world’s gold-producing countries, behind South Africa, the U.S., and Australia, but ahead of Russia, Peru and Canada.

While that’s not a big surprise, given China’s abundant mineral endowment, cheap labour and rapid industrialization, what is remarkable is that this high gold output comes not from a few giant mines, but mostly from several thousand tiny ones scattered throughout the country.

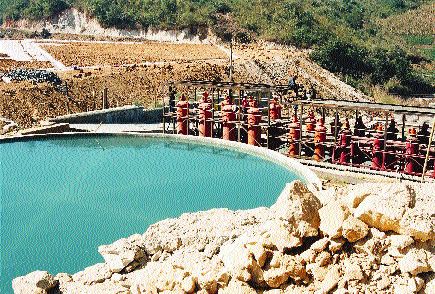

A typical example of this “small-is-beautiful” kind of operation is the highly profitable Guanlingpo, or Luxi (pronounced “Loo-shee”), open-pit, heap-leach gold mine in southwestern Yunnan province, just north of the border with Myanmar.

Guanlingpo is nestled in the farmlands of Luxi Cty., 25 km southwest of the regional centre of Mangshi City (population 335,000) and 500 km west-southwest of the provincial capital Kunming.

While the elevation is high, topographical relief is moderate and the climate subtropical, with dry and rainy seasons.

A paved highway passes close to the mine, though the nearest Chinese railroad is 400 km east.

Geologically, the mine is in the northern portion of the 40-km-long, northeast-striking Luxi gold belt, where primary, “Carlin-style” gold mineralization is controlled by low-angle thrust faults associated with contacts between Permian-age carbonate rocks and Jurassic-age clastic sediments.

In the Guanlingpo mine area, the belt is expressed as the northeast-striking Shangmanggang structure, which appears to extend some 2 km to the southwest, based on recent auger drilling and geophysical work by Canadian junior

The Guanlingpo gold mine sits on a 0.53-sq.-km mining licence, with ownership split three ways: the Yunnan Nuclear Geological Exploration Brigade 201, with 35%; the municipality of Luxi, with 35%; and the Yunnan Gold Bureau at 30%.

Brigade 201, which serves as mine operator, is based in Kunming and owned by the Yunnan provincial government. Since early 2004, Sparton has been partnered with the Brigade in exploring sulphide mineralization under the Guanlingpo mine, and both oxide and sulphide material in the rest of the Luxi belt (a full, on-site report on Sparton will be published in an upcoming issue.)

Comments Sparton President and CEO Lee Barker: “Our partner, the Brigade, is a small group that’s young, very active, and technically competent; they’re not stodgy, old bureaucrats.”

The Brigade discovered the Shangmanggang gold district in 1988 during a regional geochemical exploration program for uranium, and followed up the discovery with district-scale geological mapping over the next decade.

Most gold mineralization at the mine is hosted in middle Jurassic sediments, which consist of a silicified, carbonaceous, pyrite-rich siltstone unit, interbedded with limestone. The mineralization occurs in four neighbouring deposits, with 80% of the gold occurring in what is now pit no. 1.

In 1990, the Brigade estimated a total resource for the four Guanlingpo deposits of 6.5 tonnes gold at a grade of 5.02 grams gold per tonne.

Mining and heap leaching of run-of-mine oxide material began in 1991, with a head grade of 4.72 grams gold.

In its first year, the mine produced 6.6 kg (212 oz.) gold from 3,900 tonnes of material. The best year was 2001, when it produced 225 kg (7,224 oz.) gold from 77,000 tonnes of ore.

Today, the mine has a full-time staff of only 30 people but, at the height of mining activities, some 300 people — mostly local farmers — are employed.

Mining is all by open pit, and carried out with backhoes and 4-tonne dump trucks, which cost about C$11,000 apiece. Typically, mining begins in early November and ends in January. The mined material is not extensively defined by drilling, and mining is simply stopped at the oxide-sulphide contact. (Below the oxide ore is gold-mineralized sulphide material that is not amenable to heap leaching.)

Workers line the leach pad base with two layers of thin clear plastic and a third layer of thicker, striped plastic. These sheets overlap but are not glued or welded together.

A drainage blanket of coarse rock is then placed — by hand — directly over the plastic liners.

From there, the ore heaps are built 3-5 metres in height with run-of-mine (not crushed) material.

Leaching is carried out from December until May, when the rainy season starts. Material is leached for one season and then levelled to make way for more plastic lining and the next lift.

The carbon-adsorption plant comprises a set of 8 columns, each holding 500 kg of carbon. Cyanide and lime consumption are 250 grams and 10 kg per tonne of ore, respectively. The cyanide is imported from Europe while the lime and carbon are sourced from within China.

In 2004, the Guanlingpo mine was due to produce about 161 kg (5,200 oz.) gold from ore grading about 1.5 grams gold.

Barker says the mine produced another 157 kg (5,040 oz.) gold this year from 210,000 tonnes grading about 1.75 grams gold per tonne. This year, the operators were able to extend leaching into June, owing to an unusually dry early summer.

So far, the Guanlingpo mine has produced more than 7 tonnes (225,000 oz.) of gold.

In a 2004 study of the Guanlingpo mine prepared by Sparton Director John H. Paterson, he reported that the Guanlingpo mine was still able to generate a robust profit margin of 40-50% even at a head grade of 1.5 grams gold per tonne.

Going forward, plans are to extend the mine’s life by another 6 years by dropping the average grade to 1 gram gold and lowering the cutoff grade to 0.8 gram from 1 gram.

The economic success of Guanlingpo gives Sparton confidence that it could profitably mine the low-grade oxide gold mineralization it is now delineating along strike from Guanlingpo.

The history of the Guanlingpo mine typifies how China’s small gold producers are treating oxide-type, residual gold mineralization by simple, low-cost heap-leach or vat-leach methods.

However, Guanlingpo also shows how these operators are often unable to generate the capital required to expand operations and develop the primary mineralization underlying these surface deposits.

As a result, Chinese operators are increasingly open to developing joint ventures with foreign miners such as Sparton, which have the financial muscle and complementary technical expertise to help unlock China’s seemingly bounteous sulphide gold resources.

Be the first to comment on "I love Luxi"