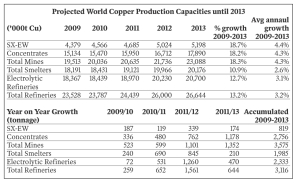

Annual copper mine production capacity at mines is expected to grow at an average rate of 4.3% per year between 2009 and 2013 to reach an output of 23.1 million tonnes in 2013, according to a new directory of copper mines and plants.

The International Copper Study Group has released the 2009 edition of its Directory of Copper Mines and Plants.

The directory, released biannually, examines over 1,000 companies and provides projections for global distribution of capacity by country, size and process type.

The new study builds on the July 2009 edition’s projections showing a 350,000- tonne increase in capacity for global mines, a 570,000-tonne increase for smelters and an increase of one million tonnes for refineries.

Mines are expected to produce 23.1 million tonnes in 2013, a 19% increase from 2009. Of the total increase, copper in concentrate capacity is expected to climb by 2.7 million tonnes or 4.3% a year to reach 17.9 million tonnes. On the other side, solvent extraction- electrowinning (SX-EW) production is expected to increase by 820,000 tonnes or 4.4% per year to reach 5.2 million tonnes. The majority of new mines and expansions are located in Brazil, Chile, the Democratic Republic of the Congo, Mongolia, Peru, the United States and Zambia, and account for around 2.6 million tonnes of the projected mine capacity increase during this period.

This study also takes into account capacity at mines that are on care and maintenance at presstime, and full capacity plants that are operating at reduced production levels.

On the smelter side of things, capacity is expected to grow 2.6% per year to reach 20.2 million tonnes in 2013, a 2 million tonne or 11% increase from 2009.

At the top of the wave is Asia, contributing 1.8 million tonnes with expansions and new projects in China, India, Indonesia and Iran. Africa follows with developments in Zambia. North America will see smelting capacity fall 12%, or 250,000 tonnes, due to a recent string of closures in Canada.

Refineries will reach 26.6 million tonnes in 2013, according to the study. About 2.3 million tonnes of the expansion is expected to come from electrolytic refineries and 820,000 tonnes from electrowinning capacity. Growth of electrolytic refinery capacity growth is pegged at 3.1% per year, exceeding the projected growth in smelter capacity. Electrowinning capacity growth at the refinery level is expected to average 4.3% per year. China is expected to lead the pack with 1.5 million tonnes of the world refinery capacity coming from its electrolytic refineries. India, Indonesia and Iran follow, making up for 25% of the world’s capacity or 830,000 tonnes from electrolytic capacity increases. The DRC, Peru and Zambia are expected to increase electrowinning capacity by 600,000 tonnes or 20%.

The directory can be purchased from the ICSG at www.icsg.org .

Be the first to comment on "ICSG Sees Growth For Copper Mines And Plants"