Integra Resources Corp. (TSXV: ITR; NYSE American: ITRG) has released a pre-feasibility study (PFS) on the DeLamar gold-silver project in Idaho, outlining a two-pronged approach to both affordable near-term and sustainable long-term production.

Company founder, president and CEO George Salamis tells The Northern Miner the PFS captures the company’s “crowning achievement” following two years of work by the Integra team and its various consultants.

Following on from the success of the 2019 preliminary economic assessment, this PFS is a materially different and more significant scale project, entailing both heap leaching and milling.

“Despite inflationary pressure currently overhanging the mining industry from a capital and operating cost perspective, the project continues to demonstrate strong positive economics and a high degree of optionality in terms of the scale, mining/processing scope and capital cost of gold-silver mines to be built at the project,” says Salamis in an interview.

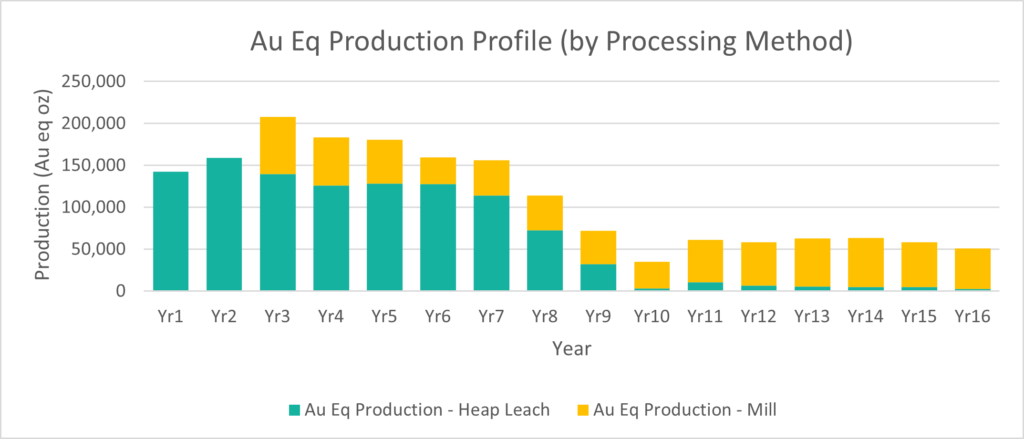

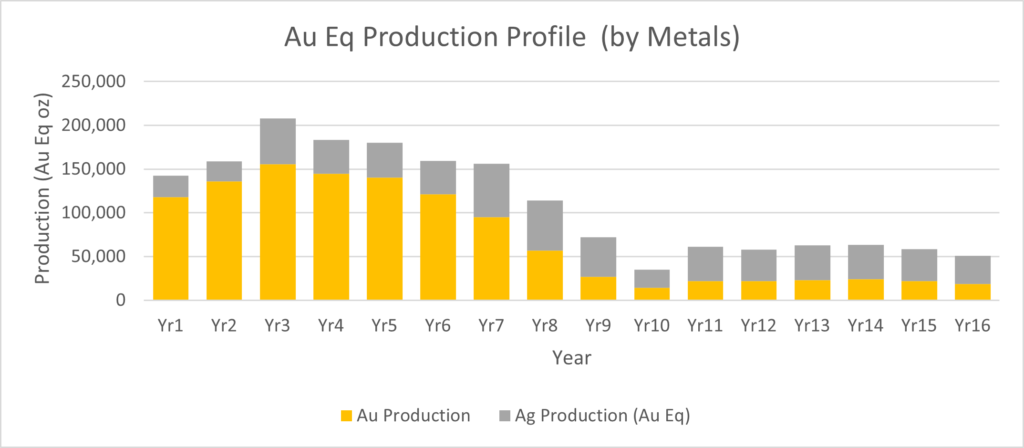

The two-stage US$282million project envisions a larger scale open pit mining scenario that combines heap leaching and milling to achieve an average production level of 163,000 gold-equivalent ounces per annum for the first eight years and a total mine life of 16 years.

DeLamar and the neighbouring Florida Mountain mines will have all-in sustaining costs of US$955 per gold-equivalent ounce on a co-product basis.

“Critically,” says Salamis, “the project has a clear path to future non-oxide processing enhancements and resource growth upside, including increased gold and silver recoveries using Albion processing methods. It entails a process with much lower capital costs than traditional oxidation plants and has yielded promising results in recent test work,” according to Salamis.

Additionally, this study does not incorporate any high-grade gold-silver potential below the Florida Mountain resource envelope.

“The staged approach to development also means that the company starts production with heap leach only that can be developed with far lower capital and operating cost requirements, capable of producing an average of 136,000 gold-equivalent ounces per annum at a site level AISC of $813 per ounce (co-product basis).

“We believe that in an inflationary environment, such as our shareholders and stakeholders are currently experiencing, having a multi-phase development stage is critically important and demonstrates maximum flexibility and transparency,” says Salamis.

The PFS contemplates a 35,000 tonnes per day heap leach in Stage 1 that will process oxide and mixed ore from both the DeLamar and Florida Mountain deposits and a 6,000 tonnes per day mill to be built in Stage 2 to process sulphide ore.

The heap leach and mill deliver an after-tax NPV (5%) of US$412 million and 27% after-tax IRR at US$1,700 per ounce gold and US$21.50 per ounce silver.

Critically, the PFS shows DeLamar will become the third-largest US-based silver producer, with silver accounting for about 35% of the revenue stream.

Salamis says the sulphide expansion will take place at the company’s discretion and will be financed with internal cash flows.

The PFS was based on proven and probable reserves of 1.8 million ounces gold at 0.45 grams per tonne and 92.4 million ounces silver at 23.27 grams per tonne.

At $2.54 apiece, Integra shares quoted in Toronto are down more than 41% over the 12-month frame, giving it a market capitalization of $157.75 million.

Be the first to comment on "Integra Resources builds optionality into a compelling DeLamar development case"