Sometimes a discovery is so big, it takes generations to discover, define and develop – in order to become a mining district that produces metals for future generations.

Over the past two decades, the Lundin Group technical team has found a cluster of giant copper-gold deposits in the Andes – the region that produces 40% of the world’s copper. Their Vicuña district deposits include Filo Corp.’s (TSX: FIL) Filo del Sol and Lundin Mining‘s (TSX: LUN) Josemaria in San Juan province, Argentina; and NGEx Minerals’ (TSX: NGEX) 69%-owned Los Helados in Chile’s Region III, plus its Lunahuasi discovery in San Juan.

And this year, the younger generation led by brothers Jack and Adam Lundin made a $4.8-billion deal with the world’s biggest miner, BHP (NYSE: BHP; LSE: BHP; ASX: BHP) that’s likely to catapult base metals producer Lundin into the copper big leagues. That’s why The Northern Miner has named Jack, the company’s president and CEO, and Adam, Lundin’s chair, our Persons of the Year for 2024.

The transaction gives the $11-billiion market cap Lundin an equal seat at the table to develop Vicuña’s deposits on the Argentina side, Josemaria and Filo del Sol.

“This has the potential to become one of the world’s biggest copper, gold, silver mines ever to be developed and operated,” Jack told The Northern Miner in October.

But it also offers the Lundin brothers an opportunity to build on the family legacy started in early 1960s by their grandfather, Adolf, and their father Lukas, who first brought the group into Argentina in 1989.

“This is a vision that started a long time ago that we’re carrying forward, but it also is at a scale that we, or my dad or grandfather never could have imagined it to become,” the CEO said.

Jack Lundin, president and CEO of Lundin Mining. (Supplied)

The deal includes the $4.1-billion takeover of Lundin Group, Filo Mining, and a US$690-million payment by BHP to Lundin for half of Josemaria. Filo shareholders voted in favour of the deal in late September and it received approval in an Ontario court in October.

Family mission

The Vicuña story started in the late 1990s. Lundin geologists staked claims in the remote, high-altitude region, targeting an unexplored gap between two well-established mineral belts in the Andes — Maricunga to the north and El Indio to the south.

For 34-year-old Jack and 37-year-old Adam, not even in their teens at the time, the development of the immense district has become something of a family mission.

“As we were growing up and hearing about the exploration that was going on in the district, it was always something very exciting for us to be able to kind of be a part of,” Jack said.

The Vicuña exploration team, including Wojtek Wodzicki, Bob Carmichael, Diego Charchaflie, Patricio Jones, Martin Rode, and Alfredo Vitaller, received the Prospectors & Developers Association of Canada 2024 Thayer Lindsley award for their discoveries over the past 20 years.

Now the Lundin brothers are using their complementary skill sets to take the district, which stretches about 35 km along the Chile-Argentina border, to the next level — production.

Jack holds a mineral resource engineering master’s degree and has worked on project builds, including Lundin Gold’s (TSX: LUG; US-OTC: LUGDF) Fruta del Norte, and is the technical, detail-oriented sibling.

Adam, who worked in investment banking for eight years before entering the family business in 2017, keeps an eye on the big picture and new opportunities.

“He has a very strong business acumen, something that I think he took from our father and our grandfather to keep our entrepreneurial spirit alive,” Jack said of his brother.

Adam Lundin, chair of Lundin Mining. (Supplied)

He also brings an intimate knowledge of the Vicuña district, having served as president and CEO of both Filo Corp. and Josemaria Resources (part of Lundin Mining since 2022).

Big deal

Lundin currently produces just under 400,000 tonnes of copper per year from six mines. Josemaria alone would churn out over 130,000 tonnes of copper, nearly 225,000 oz. of gold and 1 million oz. of silver a year over a 19-year mine life, based on a 2020 feasibility study.

Filo del Sol could add 66,000 tonnes of copper, 168,000 oz. of gold and 9.3 million oz. silver over a 13-year life, according to a 2023 prefeasibility.

So why bring BHP into the mix when Josemaria is already owned by Lundin Mining, and Filo by a Lundin Group company?

Well, scale for one thing.

“It’s impossible today to be able to buy into a producing top-tier asset like Escondida or Collahuasi, Adam said.”The way we have to do that is to develop one, and now we’re doing it with BHP.”

BHP’s financial resources, technical know-how, and similar focus on sustainability should speed development of the district. That’s a big plus as the market reckons with a looming demand rise coupled with too little investment in new supply.

“What the industry lacks is that investment into the long-term, large-scale projects like Josemaria and Filo. We want to make sure that we can do that and add production in the near term,” Jack said.

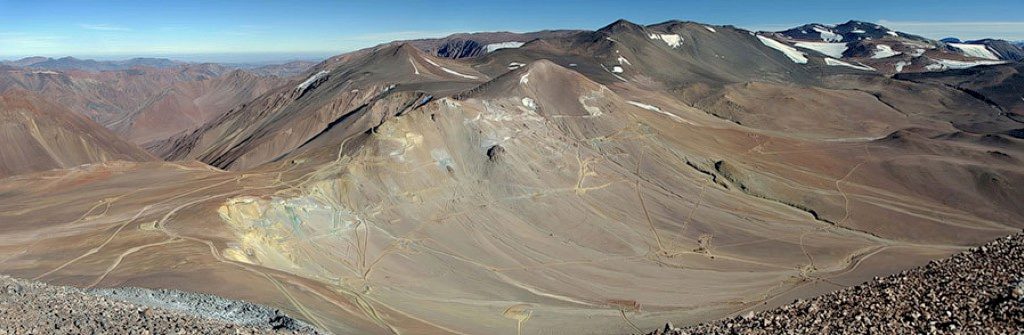

Filo Corp.’s Filo del Sol copper-gold-silver project in Argentina. Credit: Filo Corp.

Developing Filo and Josemaria together also gives a clear line of sight to production for Lundin and Filo shareholders, he said. Existing infrastructure at Lundin’s 70%-held Caserones mine in Chile, is also expected to speed development and lower costs.

Lundin has long been searching for a development partner for Josemaria. Canaccord Genuity analysts recently estimated it will cost US$6.2 billion to develop — twice the amount outlined in a 2020 feasibility. So having a partner with BHP’s heft will be both practical and transformational.

BHP, meanwhile, has been on a copper kick as it projects demand for the key energy transition metal to grow by roughly 70% by 2050. BHP swallowed up copper miner Oz Minerals for US$6.4 billion in 2023, and earlier this year launched a failed US$49-billion bid for Anglo American (LSE: AAL).

BHP entered the Vicuña district in 2022 when it invested $100 million in Filo.

Its arrival gave the two companies a chance to get to know one another, from the management teams down through operations, Jack said. They soon saw the benefits of combining the projects and working together, he added.

The partners expect to release a preliminary plan outlining staged development of the projects in next year’s first half. Production will likely begin with Josemaria, possibly supplemented by some oxide production from Filo. The deeper Filo sulphides from the Aurora zone, discovered in 2021, would provide the bulk of full-scale production in a later stage.

Jack and Adam Lundin (far left and left) at Lucara Diamond’s Karowe mine in Botswana. (Supplied)

Argentina risk

New President Javier Milei’s RIGI bill to stimulate foreign investment, which was introduced last December and passed into law just three weeks before the BHP-Lundin-Filo tie-up was announced, was another push to seal the deal. The country, rich in copper, gold and lithium, has long struggled with inflation and suffered two debt crises in the past 20 years.

Under the RIGI program, projects in select sectors that cost at least US$200 million could see their income tax reduced to 25% from 35%, a pledge of tax stability for 30 years, and other tax, customs and exchange benefits.

“That’s something that’s definitely been needed in Argentina to get confidence for investments like ours and definitely something that was a key trigger point for BHP to make a significant investment,” Jack said.

That said, the Lundins have always had a knack for gauging political risk and timing – having had big successes in Argentina with International Musto and Argentina Gold in the 1990s.

It seems to be a lesson well learned by Adam and Jack, who feel the need to do right by their family legacy started by their grandfather, and continued by their father, who passed away in 2022 at age 64.

“With the business, I feel like I owe it to the generations before us to make it better,” Adam said. “They spent so much time with us and were such great role models. We owe it to them to take it one level further.”

Be the first to comment on "Jack and Adam Lundin are TNM’s Persons of the Year for 2024"