VANCOUVER — Excitement is building over uranium deposits outside the prolific Athabasca basin. And joint-venture partners Kivalliq Energy (TSXV: KIV; US-OTC: KVLQF) and Roughrider Exploration (TSXV: REL) are hoping to add to a growing number of discoveries that are changing the way explorers view the region.

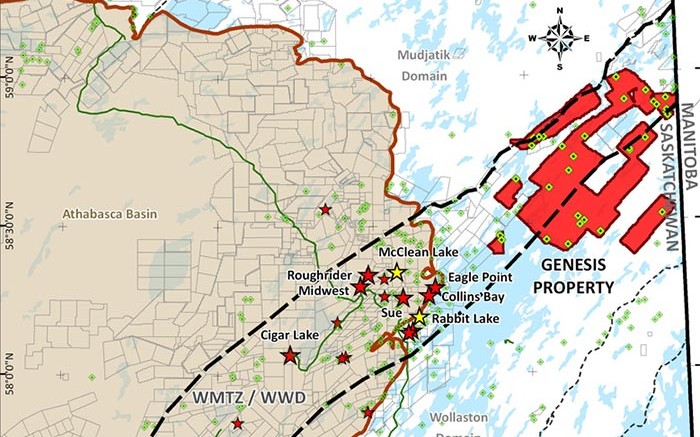

The companies are in the midst of planning a mid-year exploration campaign at the 2,000 sq. km Genesis project, which straddles the Wollaston-Mudjatik transition zone and extends 90 km northeast to the Manitoba border.

The Western Wollaston and the Wollaston-Mudjatik transition domains are high-strain zones within reworked Archean and Paleoproterozoic rocks of the Hearne subprovince, which hosts most of the basement and unconformity-type uranium deposits across the Athabasca basin.

The Wollaston-Mudjatik theory also underpins the exploration efforts of Chuck Fipke’s Northern Uranium (TSXV: UNO; US-OTC: NOURF), which is advancing its nearby Northwest Manitoba project on the flipside of the Saskatchewan-Manitoba border.

Genesis’ story runs in tandem with Hathor Exploration’s discovery of the Roughrider deposit, which led to a $650-million takeover by Rio Tinto (NYSE: RIO; LSE: RIO) in 2011. Many of the Genesis concessions were under Hathor’s control and saw sporadic work through the mid-2000s, though the property hasn’t been drilled since 1979.

The common denominator in the deal is Dale Wallster, who serves as Roughrider’s chairman and sits on Kivalliq’s board of directors. Wallster was heavily involved in the original Roughrider discovery and kept his eye on Genesis’ core concessions, which became available and were staked by Kivalliq in early 2014.

“We were operating a joint venture up there back in the 2000s, and completed a lot of airborne geophysics, lake-sediment geochemistry and real boots-on-the-ground prospecting,” Wallster recounts during a phone interview.

“It was all primarily regional work, and then Hathor made the Roughrider discovery in 2008, so obviously that became the focus. The critical element to the land position is that it’s all Mudjatik transition zone geology that you can follow beneath the basin, and the implication of that geology is that it’s key to the genesis of the incredibly rich uranium deposits you find in the eastern Athabasca,” he adds.

Under terms of the joint venture, Roughrider can earn an 85% stake in Genesis for $1 million in cash, 4 million shares and $5 million in exploration expenditures. The company could increase its stake to 100% by issuing Kivalliq 15% of its stock upon a takeover offer. The companies jump-started exploration efforts last year with a $1.2-million program, operated by Kivalliq’s technical team.

The campaign included 6,000 km of airborne magnetic, electromagnetic (EM) and radiometric surveying that outlined 410 km of conductors across the property. The companies also completed 291 lake-sediment samples, 1,300 enzyme-leach soil samples and 162 biogeochemical samples.

“We were following the success down at Patterson Lake, where you have this basement-hosted discovery on the margins of the Athabasca, and we realized the Genesis ground was still open all the way to the Manitoba border. We did a compilation and evaluation of the area and picked up anomalies from historic work that were basically left hanging,” Kivalliq president Jeff Ward comments.

“There’s a whole bunch of uranium anomalies on the property, and the structures you’re hoping to find. You get beautiful wrap-around features and conductors right where you want them. Those are backed up by boulder trains, uranium in soils and our biogeochemistry,” he continues.

The 2014 program at Genesis led to six new target areas: Jurgen 1, Jurgen 2, Johnston/GAP, Kingston, Daniel’s Bay and Sava Lake.

The twin Jurgen targets emerged as high-priority areas after the companies established preliminary soil grids overlying EM conductors. Enzyme leach analysis of the soils revealed a number of uranium values at, or above, the 95th percentile close to the conductors, which indicates promising drill targets.

Roughrider and Kivalliq finished a follow-up program in March, with more grid geophysics and biogeochemical sampling at Jurgen 1 and 2.

“What I find interesting is that historically people would have just gone out and said: ‘Well, we’ve found a conductor, let’s start drilling.’ Given the way the markets are, I believe we need to be a lot smarter about how we’re defining targets,” Wallster explains.

“We need to get as much bang for our buck as we can, so I think the way to go is using that geochemistry to prioritize the EM targets. Then we follow that up with further ground geophysics and biogeochemistry to really define the drilling,” he adds.

The other side of the story for Kivalliq is the nearby Hatchet Lake project, which it acquired from Rio Tinto for $220,000 in cash and a 2% net smelter return royalty in early February. Ward points out that Hatchet has $750,000 in exploration data from programs conducted by Rio and Hathor, with many of the previous target-generation techniques mirroring efforts underway at Genesis.

Hathor collected 420 lake-sediment samples at the site and flew versatile time domain electromagnetic (VTEM) surveys that defined 30 individual conductive trends with a combined strike length of 53 km. In 2008, Hathor collected another 837 soil and 215 rock samples, with 19 of the samples returning assays greater than 0.2% uranium oxide.

Later exploration by Rio included 306 soil samples, 1,153 biogeochemical samples and 31 rock samples. Rio’s work identified soil anomalies that coincided with boulder trains and outcrops, as well as geochemical signatures associated with uranium mineralization.

“I firmly believe we’re looking at some of the most prospective ground for uranium that exists. The absolute key to exploration in the area is that you’ll be looking at relatively short drill holes,” Wallster says. “The targets aren’t at significant depths below surface, although you could have uranium mineralization at 400 to 500 metres. But you’ll be looking for relatively shallow deposits that potentially outcrop at surface. The critical thing is you’ll be able to drill with greater efficiency.”

Since completing its qualifying transaction in July 2014, Roughrider has traded within a window of 10¢ to 30¢, and closed at 15.5¢ per share at press time. The company held $1 million in cash, and has 22 million shares outstanding for a $3.4-million market capitalization.

Kivalliq has traded within a 52-week window of 12¢ to 23¢, and closed at 14¢ per share. The company closed the first tranche of a $2.7-million non-brokered private placement on April 20, wherein it issued 10.2 million units priced at 15¢.

Each unit consists of one flow-through share and one non-flow-through warrant priced at 18¢ and exercisable for two years. Kivalliq has 196 million shares outstanding for a $26.5-million market capitalization.

Be the first to comment on "Kivalliq, Roughrider see promise outside the Athabasca"