SITE VISIT

Santiago, Chile — Vancouver-based Los Andes Copper (LA-V, LSANF-O) plans to begin a prefeasibility study at its Las Vizcachitas copper project in central Chile by the middle of 2008, just a year after taking over the project.

After abandoning projects in China, the company assumed control of Las Vizcachitas, and its current name, in April this year, paying fellow junior Global Copper (GLQ-T, GOCPF-O) US$10.4 million plus 6.2 million shares and 3.9 million warrants for the property.

The first task was to clear up after a group of goatherds who had occupied the site since exploration was last carried out, recalls Los Andes CEO and president Roger Moss during a recent visit to the project.

They preferred to sleep outside and use the camp buildings to house their flock.

The remains of their campfire can still be seen outside the offices where Moss and a team of Chilean geologists pore over maps and plan drilling campaigns.

Located three hours out of Santiago, and halfway up the winding Putaendo River valley that is dotted with cacti, the project was first explored by Placer Dome in the early 1990s.

The project was then taken on by General Minerals, which got as far as completing a feasibility study for an open-pit mine at the site.

The 1998 study, by Kilborn SNC-Lavalin, proposed a 10,000-tonne-per-day operation producing around 60,000 tonnes a year of copper in concentrates.

But the slide in copper prices at the end of the last century dashed any development hopes and the project was shelved until being picked up by Global Copper. Global’s Regalito copper discovery, also in Chile, is being developed by Japan’s Pan Pacific Copper under the name of Caserones.

Global is now concentrating on Relincho, a few hundred kilometres north of Las Vizcachitas, giving Los Andes its opportunity.

Exploration to date has suggested a porphyry copper-molybdenum deposit, measuring 3 by 1.5 km, containing a smaller area of strongly leached capping, copper oxide and chalcocite mineralization and breccia-hosted copper sulphide and molybdenum mineralization.

Previous work

Before signing off on the project, Global completed a National Instrument 43-101 report confirming an indicated resource of 144 million tonnes grading 0.52% copper and 0.015% molybdenum plus inferred resources of 211 million tonnes grading 0.46% copper and 0.016% molybdenum, at a 0.4% copper cutoff.

Although the goatherders broke up some of the core boxes for firewood, Moss and his team were happy to find samples from most of the 69 holes drilled by the project’s previous owners still intact and in good condition.

They are now forming the basis for Los Andes’ current exploration program.

Lying just over 2,000 metres above sealevel, Las Vizcachitas is much lower than many of the other exploration projects in the area, Moss notes.

This allowed the company to begin a first phase of drilling with two rigs during the southern winter, while other projects in the area, such as Anglo American’s (AAUK-Q, AAL-L) neighbouring Morro Colorado, were buried under several metres of snow.

“We held onto the rigs, otherwise I don’t think we would have got them back,” Moss says of the hard to come by equipment.

The results from the first 5,000 metres of drilling over nine holes have been positive and in line with the findings of previous exploration.

Assaying samples contained up to 324 metres of mineralized rock grading 0.45% copper and 0.011% molybdenum.

One worry has been dykes of late non-mineralized materials intervening between the original copper-bearing intrusive rock, but so far, they have proved a rarity in the porphyry deposit.

With the encouraging results of the first campaign now published, Los Andes has announced a second phase of drilling that will see another 15,000 metres at the site.

The program will concentrate on infill drilling to push inferred resources (delineated by a Global Copper) into the indicated category as well as stepout drilling to push back the edges of the known mineralized zone, Moss says.

As well as expanding the deposit to the north, west and east, Moss says the company is looking at drilling deeper than previous owners.

“Some of the historical drilling ended in pretty good mineralization so we think that there is some potential at depth,” the geologist says.

Early next year, the company plans to begin metallurgical testing to provide further data for the planned prefeasibility study.

The program of activities will be funded by a US$6-million private placement.

Unexplored areas

The company is also keen to see what other possibilities lie in the unexplored parts of the Las Vizacachitas site. Of the 59-sq.-km concession, only 2 sq. km have been drilled, Moss notes.

A third geologist will be employed to scout out interesting colour anomalies spotted on Google Earth farther up the valley.

Ahead of next year’s prefeasibility study, Los Andes also plans to complete negotiations with Chilean investors who own a 49% stake in a concession in the centre of the property, simplifying ownership of the project.

Although many elements have yet to be defined, Moss says the planned mine should be on a similar scale to the one General Minerals proposed a decade earlier.

Production could begin three years from completion of the prefeasibility, although given the current boom in mining investment and the shortage of the necessary men and machines, that it is an optimistic timeframe, he adds.

But existing infrastructure in the area bodes well for a mine at the site.

While Chileans normally associate copper mining with the arid far north, the agricultural valleys around Santiago are dotted with some of the world’s largest copper mines.

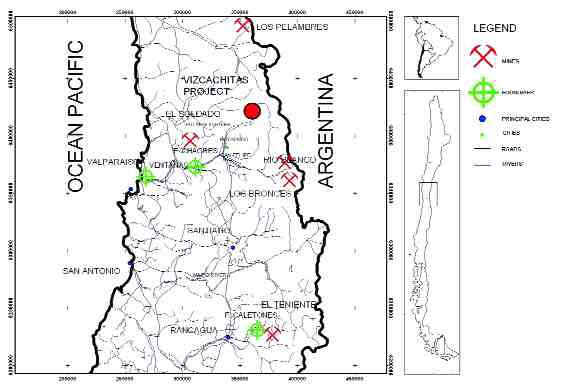

Close neighbours of Las Vizcachitas include Anglo American’s Los Bronces and Codelco’s Andina, which exploit the giant Rio Blanco deposit, while the Los Pelambres mine, operated by Antofagasta Minerals (ANFGY-O, ANTO-L), lie farther north.

The railway line that moves concentrate from the Andina mine to the port of Ventanas for shipment abroad passes just a few kilometres away.

Alternatively, concentrate could be sold to the Chagres and Ventanas smelters (owned by Anglo American and Codelco, respectively), which lie farther down the Aconcagua valley.

— The author is a freelance writer based in Santiago, Chile.

Be the first to comment on "Los Andes studies Las Vizcachitas"