AMOS, QUEBEC–Maple Gold Mines (TSXV: MGM; US-OTC: MGMLF) is building exploration momentum at its flagship Douay and Joutel projects in Quebec’s Abitibi gold belt, where it is working with Agnico Eagle Mines (TSX: AEM; NYSE: AEM) in a 50-50 joint venture to jointly unlock their regional potential.

On February 2, Maple Gold Mines and Agnico Eagle signed a joint venture agreement under which the parties formed a 50-50 joint-venture that incorporates Maple Gold’s Douay gold project and Agnico’s Joutel gold project into a consolidated property package. The Douay and Joutel projects, the latter hosting Agnico’s past-producing Eagle, Eagle West and Telbel mines, are contiguous properties located in the James Bay subregion of Northern Quebec.

Maple also has an option with Globex Mining Enterprises (TSX: GMX) to acquire a 100% interest in the Eagle mine property next to Joutel, which holds significant exploration upside, and is not currently part of the joint-venture agreement.

“The goal is to create a new sustainable gold producer in an area of embarrassing riches,” CEO Matthew Hornor tells The Northern Miner on a recent sponsored site visit, adding that mergers and acquisitions activity in the Abitibi has exceeded $25 billion since 2013. “As was the case with the historical and currently producing gold mines along the Abitibi, things get bigger and higher grade at depth in the region. We hope to demonstrate the same feature at our projects.”

The Abitibi gold belt that spans from eastern Ontario into western Quebec has been responsible for producing more than 250 million ounces of gold. The geological feature hosts some of Canada’s largest mines, including the 662,918 oz. per year Canadian Malartic open pit mine jointly owned by Agnico Eagle and Yamana Gold ( TSX: YRI; NYSE: AUY; LSE: AUY) and Kirkland Lake Gold’s (TSX: KL; NYSE: KL; ASX: KLA) 601,566 oz. per year Detour Lake mine.

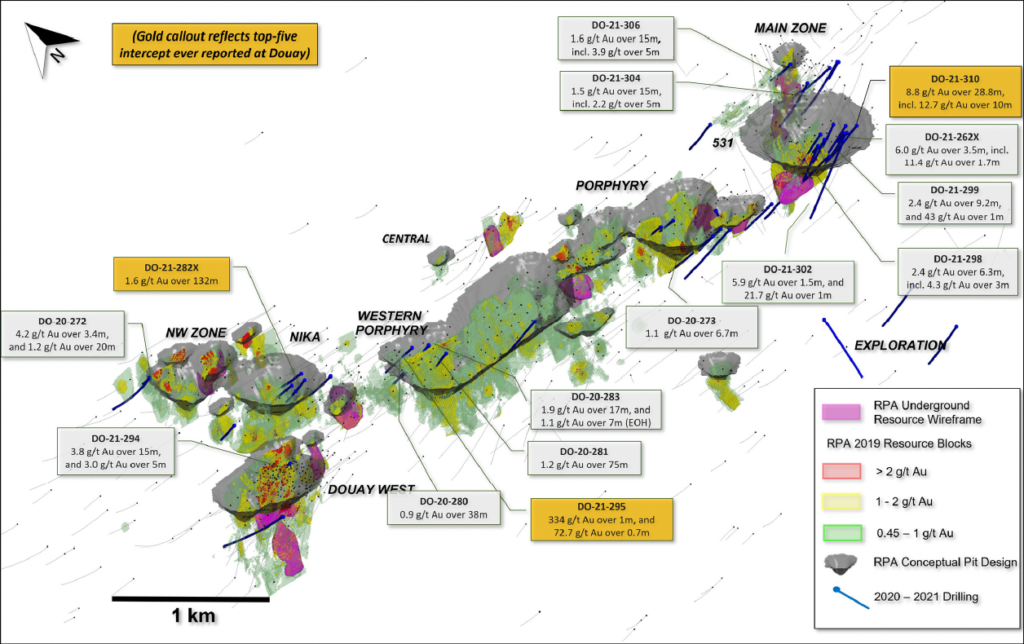

A map showing Maple Gold Mines’ Douay project resource areas. Credit: Maple Gold Mines.

Maple Gold Mines has made good progress on its flagship Douay project, completing a resource update in 2019. The work established a resource base of 8.6 million indicated tonnes grading 1.52 grams gold per tonne for 422,000 oz., and an inferred resource of 71.2 million tonnes at 1.03 grams gold per tonne for 2.35 million ounces.

On a 100% basis, the attributable in-situ gold resource at Douay is about 2.77 million oz. gold.

The work after the resource milestone has been focused on resource expansion and discovery potential across the 357 sq. km land package that remains virtually royalty-free, aside from the 2% net smelter return royalty Maple Gold retained when signing the deal with Agnico.

The company is already comparing the mineralized footprint beyond the pit-constrained resource model to some of Canada’s largest mines, including Canadian Malartic and Detour Lake.

“We are starting to see exploration momentum at Douay,” Hornor said. “While the project has been around for about 45 years, five out of ten of the top intercepts were produced by Maple Gold since 2018.

Significantly, earlier in October, Maple Gold reported assays from the final nine holes completed during the 10,217-metre winter drill campaign at the Douay.

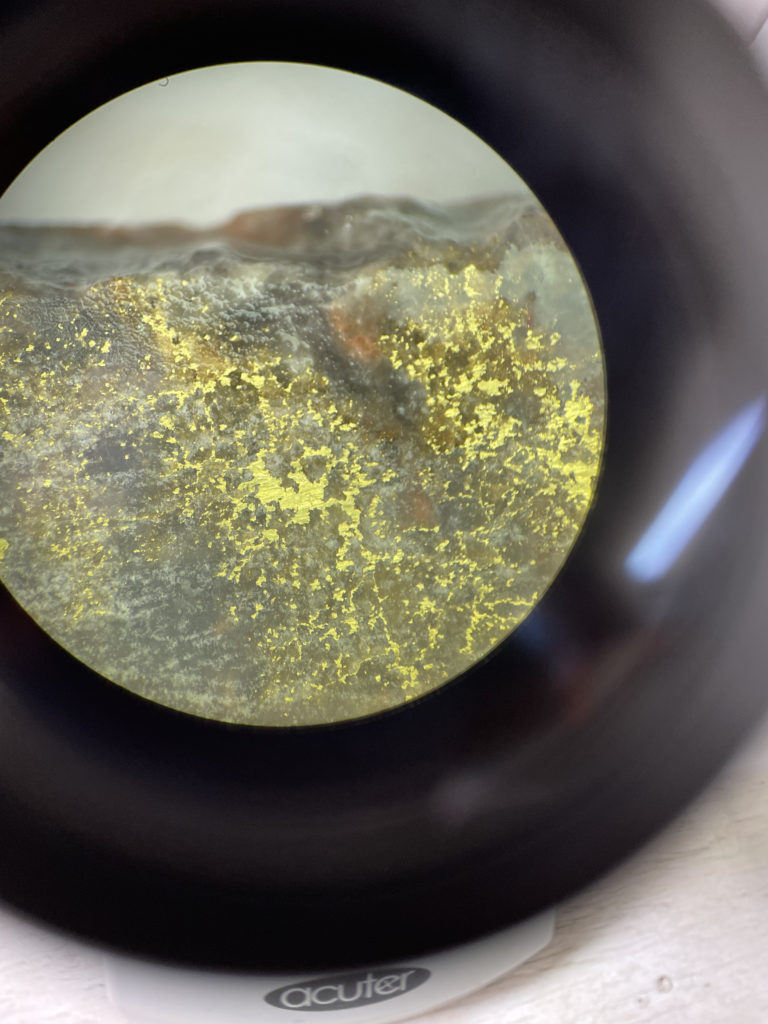

Drill hole DO-21-295 intersected 334 grams gold per tonne over 1 metre from 57 metres downhole within the western portion of the Porphyry zone, representing one of the highest-grade intercepts ever encountered at Douay. The hole also intersected 72.7 grams gold per tonne over 0.7 metre from 358 metres downhole, beyond the northern extent of the 2019 RPA NI 43-101 resource estimate Porphyry zone conceptual pit.

Visible gold as seen through a microscope lens in drill hole DO-05-04. It is part of a sample that returned 2,888 g/t gold over 0.5m at Douay. Credit: Kiran Patankar.

At Douay’s Main zone, DO-21-304 intersected 1.5 grams gold per tonne over 15 metres (from 428 metres downhole), one of the better sediment-hosted intercepts reported to date. In addition, DO-21-306 intersected 4 grams gold per tonne over 5 metres from 143 metres downhole within a broader and more variable grade envelope that averaged 1.6 grams per tonne over 15 metres. Additional multi-gram gold intercepts were obtained from other drill holes in this area.

“The JV’s maiden drill campaign returned three of the top five intercepts ever reported at Douay in terms of gold accumulation (grade multiplied by thickness), validating our targeting methodology,” Hornor said.

Maple Gold’s vice-president for exploration, Fred Speidel, added that encountering multiple bonanza-grade gold zones flanking either side of the Casa Berardi North fault highlighted the significant exploration potential for the Porphyry zone’s sparsely drilled northern flank.

“The deeper bonanza-grade gold mineralization in hole DO-21-295 remains open to the east, with just a single drill hole over more than 600 metres, which provides a compelling exploration target for follow-up drilling,” Speidel said. “We are excited to build upon the impressive results from the JV’s maiden drill campaign, with drilling expected to resume in the Nika and 531 zones in Q4 2021.”

These additional new bonanza-grade (greater than 34 grams gold per tonne) intercepts in DO-21-295 underscore the potential for two distinct styles of mineralization at Douay, according to Speidel. First, more typical lower-grade disseminated gold mineralization is closely associated with an alkaline intrusive complex; second, a structurally controlled, locally bonanza-grade overprint associated with major deformation zones found in a variety of rock types.

Maple Gold also received assays for multiple drill holes within Douay’s Main zone, where mineralized zones are relatively narrow, sub-vertical and typically higher than deposit-average grade.

The DO-21-304 results confirm the continuity of the Main zone mineralization below the base of the current 2019 RPA conceptual pit. This may extend the underground resource wireframe to below the hole 70556 intercept, which is not currently included in the resource estimate due to broad spacing between drill holes. The current Main zone conceptual pit extends to a maximum depth of 145 metres, with known mineralization now extending to over 450 metres deep.

Maple Gold has now reported all assay results from the winter 2021 drill campaign and expects to update the resource for Douay before year-end. The updated resource estimate will include more than 19,000 metres of additional drilling since the 2019 mineral resource estimate, including over 15,000 metres within the current resource area.

The Joutel gold project also hosts several regional exploration targets along a 55-km strike length of the Casa Berardi deformation zone.

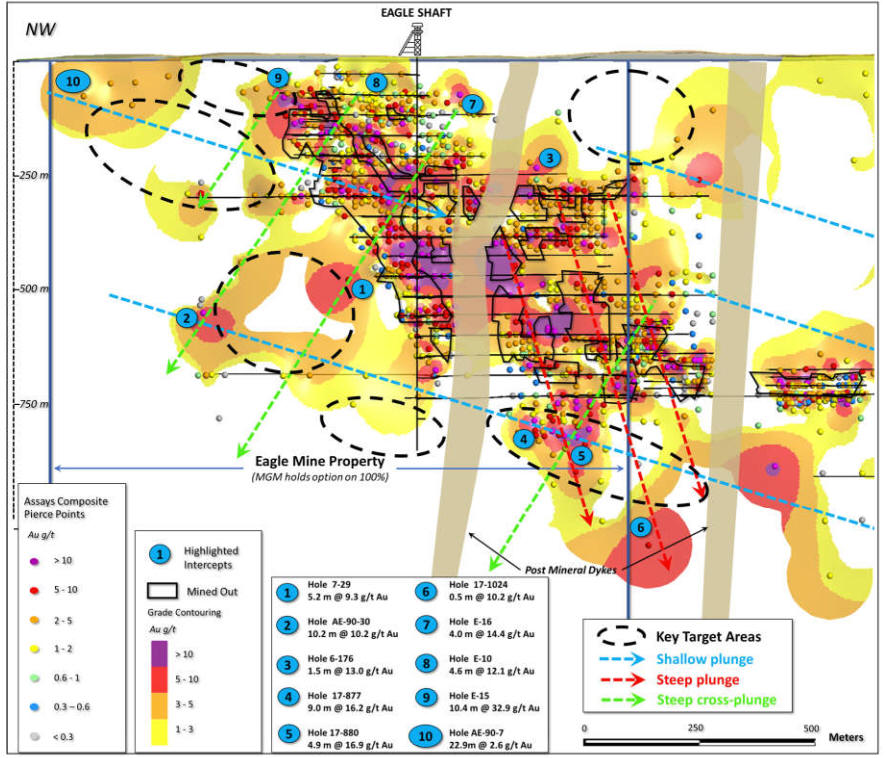

Significant historical drill intercepts adjacent to areas that have seen only limited drilling to date (such as 32.9 grams gold per tonne over 10.4 metres, 16.2 grams gold per tonne over 9 metres and 10.2 grams per tonne over 10.2 metres) all point to the potential of high-grade gold mineralization remaining at Eagle.

Maple Gold senior geological technician Pavel Golovkin at drill hole at DO-21-282X which results returned 132 m of 1.58 g/t gold – a top 5 grade-thickness intercept ever encountered at Douay. Credit: Henry Lazenby.

Speidel said the company’s 3D modelling and grade contouring work has identified numerous high-priority drill targets. With a new 3D model in hand, the company will focus on priority drill targeting and permitting, followed by drilling at Eagle in Q4 and a winter drilling campaign at Telbel in the first quarter of 2022.

In addition to the Douay project, Maple Gold is earning a stake from Globex in the past-producing Eagle gold mine, contiguous to the Joutel property and 60 km southwest of Matagami in Quebec.

Ownership of the mine will for the first time consolidate the historic high-grade Eagle-Telbel underground mines at the Joutel project.

The Eagle and Telbel underground mines and the Eagle West open-pit mine produced 1.1 million oz. of gold between 1974 and 1993 as part of Agnico’s first gold camp. The old production shaft at the site is about 950 metres deep. During the second-to-last year of operation at Eagle, Agnico drilled a hole that returned 10.2 metres of 10.2 grams gold per tonne.

Despite being developed and mined, the Eagle and Telbel deposits remain largely intact, Speidel said.

Globex drilled six widely spaced holes at Eagle between 2008 and 2015, including 12.4 metres of 2.9 grams gold per tonne beginning at 347 metres, including 4.8 metres of 5.4 grams gold per tonne.

A key difference in the work Maple Gold is conducting here is that, unlike Globex, it has access to the historical exploration database. The company had recently completed compiling this data into the first 3D model for Eagle-Telbel, which is expected to inform a 2,500 to 3,000-metre Phase I drill program at the 100% controlled Eagle project.

Eagle is a 77-hectare property that hosts the historical Eagle mine and covers a vital segment of the past-producing Eagle-Telbel mine trend and operated under much lower gold prices than those prevailing today. Eagle is not currently a part of the Joutel joint venture project with Agnico Eagle, which, according to Hornor, gives Maple Gold the ability to “chart it’s own destiny” at Eagle.

A model of the Eagle deposit shows a long section with grade contouring and target areas within the main mine horizon. Credit: Maple Gold Mines.

“When combined with the 3D model results from the Telbel mine area, these latest results from Eagle highlight the potential for near-mine extensions along the entire Eagle-Telbel mine trend as well as along sub-parallel target trends,” Speidel said. “Acquiring this strategic ground that hosted Agnico’s first gold mining operation with the benefit of an extensive drilling database and modern tools will allow us to effectively test high priority target areas that have seen only limited exploration activity since mine closure in 1993.”

Maple Gold will acquire a 100% interest in the Eagle property by paying Globex a total of $1.2 million in cash and shares over five years and spending $1.2 million on exploration over four years, which can be accelerated at Maple Gold’s discretion. Globex will retain a 2.5% gross metal royalty that can be reduced to a 1.5% GMR in return for a cash payment of $1.5 million.

Maple Gold is well-capitalized, reporting $18 million in cash as of June 30, with an additional $21 million in potential proceeds from warrants. Agnico is also expected to pay about $18 million in joint-venture funding for the Douay and Joutel exploration programs.

At press time in Toronto, Maple Gold shares were trading at 32c apiece, capitalizing it at $102.8 million.

Be the first to comment on "Site visit: Maple Gold moves the needle at Douay and Joutel in Quebec"