Marimaca Copper (TSX: MARI) has reported a 44% lift in measured and indicated resources at its Marimaca Oxide Deposit (MOD) in Chile that will underpin an expanded operation in an upcoming feasibility study.

Part of Marimaca’s namesake project in the Antofagasta region, MOD now has measured and indicated oxide resources totalling 200 million tonnes grading 0.45% copper for 900,000 tonnes of metal. The update also outlined an inferred resource of 37 million tonnes grading 0.38% copper for 141,000 tonnes of metal.

The new estimate draws on 28,374 metres of new drilling completed since the previous estimate released in October 2022.

President and CEO Hayden Locke says that despite the new resource still coming in at the smaller end of resources by global standards, the company has managed to push through the “magical but arbitrary” level of 1 million tonnes of contained copper across all resource categories, “which means we’re now very much globally significant in terms of scale.”

The resource update represents the conclusion of an exceptionally successful two years of infill drilling at the MOD led by chief geologist Sergio Rivera and his team.

The oxide resource is at the heart of Marimaca’s strategy to become the next Chilean copper producer, but it can already see the future potential for the underlying sulphide mineralization.

Despite the significant resource growth at Marimaca since 2019, Locke says the orebody’s core and unique attributes its low strip ratio, a shallow higher-grade core expected to be accessible in the early mining years, and limited pre-stripping or significant cutbacks expected during operation have been preserved as the deposit has grown.

The new resource will inform a feasibility study slated to start later this year.

“What has been surprising for us is that the global resource, in terms of contained copper, increased once again in this infill campaign,” Locke says. “This is quite unusual and represents a meaningful upside against our previous technical and economic studies.”

BMO Capital Markets mining analyst Rene Cartier is optimistic about the resource growth. “Overall, the updated resource is seen as another de-risking event building increased confidence at Marimaca ahead of a (feasibility study),” he said in a note to clients.

With more than 900,000 tonnes of contained metal in the measured and indicated categories, he expects the feasibility to outline a significant reserve.

The company has completed 139,164 metres of drilling since the deposit’s discovery in 2016. A sixth phase of metallurgical testing is underway which is expected to define the optimized process design flowsheet.

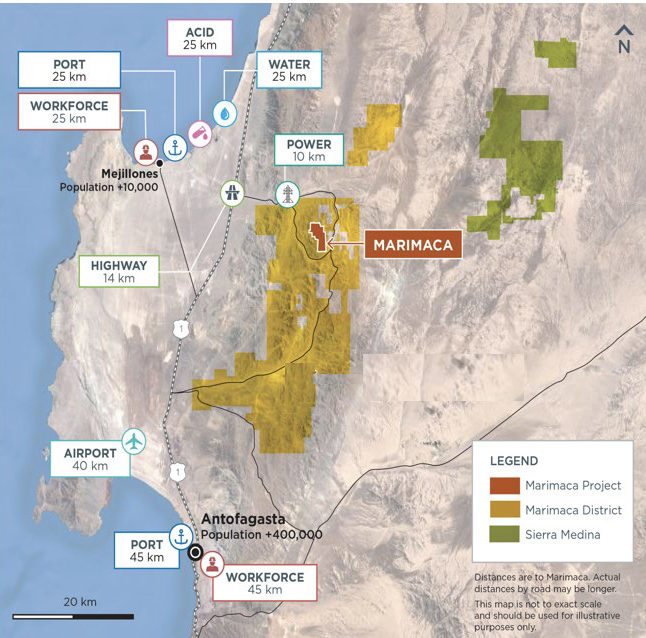

In August 2020, the company released a preliminary economic assessment for Marimaca, which confirmed its potential to be a low-capital-cost, high-margin copper mine. Locke pointed out at the time that the project significantly benefitted from its location with easy access to infrastructure, including power, transport and water, as well as a highly skilled local workforce and simple logistics.

Importantly, Locke says the high-grade core, which comprises the first six years of the PEA mine life, is expected to remain intact and accessible in a scaled-up development scenario. It includes about 50 million tonnes grading 0.7% total copper starting from the surface for about 350,000 tonnes of contained metal.

The mine plan calls for a low strip ratio of 1:1 maintained in constraining the pit shell, with all resources captured in a single continuous pit. “Low pre-strip and LOM strip ratio drive significant cost advantages,” Locke said.

The latest exploration results represent the final phase of definition drilling at the MOD ahead of the planned feasibility. Meanwhile, the Marimaca team focuses on the sulphide target and delineating near-mine satellite oxide targets, including Mercedes, Cindy and Mititus.

“We have just finished our first sulphide drilling campaign, and samples are in the laboratory pending assay results. We continue to be very excited by the potential at depth at Marimaca. We’re getting no credit for it now, but we expect that to change if we have exploration success,” Locke notes on the sulphide drilling progress.

Despite dipping slightly to $3.97 per share on early May 18 trades, Marimaca shares are up about 8% over the 12 months. It touched a high of $4.50 and a low of $2.45 over the period and has a market capitalization of $350.3 million.

Be the first to comment on "Marimaca Copper’s resource revamp lobs it into the ‘globally significant’ arena, says CEO"