A feasibility study has outlined a nine and a half year mine life for McEwen Mining’s (TSX: MUX; NYSE: MUX) 100%-owned Fenix project in Sinaloa state, Mexico.

The Fenix project is a proposed redevelopment plan for the company’s El Gallo complex, and involves building a mill at the existing mine site that initially will reprocess the existing heap leach material, and then transition to process ore from open pits at the El Gallo Silver, Palmarito, Carrisalejo and El Encuentro deposits.

The feasibility – published on the final day of 2020 – envisioned average annual production of 26,000 oz. gold in Phase 1 (years one to six) and 4.2 million oz. silver-equivalent in Phase 2 (years seven to nine and a half).

Using base case prices of US$1,500 per oz. gold and US$17 per oz. silver, the feasibility estimated an after-tax net present value at an 8% discount rate of US$32 million and post-tax internal rate of return of 28%. Those numbers rise to an NPV of US$98 million and IRR of 55% at US$1,900 per oz. gold and US$25 per oz. silver.

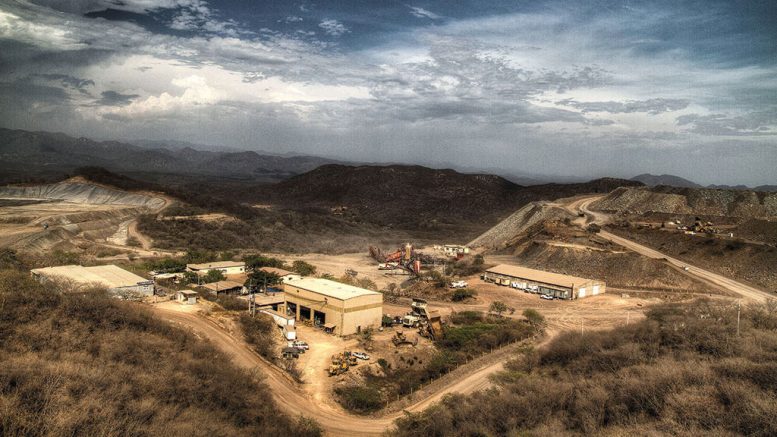

A rendering of the planned Fenix project at McEwen Mining’s El Gallo gold-silver mine. Credit: McEwen Mining.

The study estimated initial capex in the first phase of US$42 million and a further US$24 million of incremental capex in year six. Using the base case, the after-tax payback period is 3.6 years and drops to 2.8 years at higher metal prices.

During the first phase in years one through six, cash costs are estimated to run to US$1,035 per oz. gold and all-in sustaining costs to US$1,042 per ounce gold. During the second phase in years seven through to the end of the mine life, cash costs are forecast to be US$14.20 per oz. silver-equivalent and AISCs will come in at US$14.28 per silver-equivalent ounce.

The company will store tailings in a mined-out open pit at the El Gallo gold mine, which it says “creates multiple benefits, most importantly a secure containment of tailings enabling better reclamation results.”

“The critical path environmental permits are in hand for the first phase of production,” Rob McEwen, the company’s chairman and chief owner stated in a press release. “Our next steps will involve detailed engineering, assessment of procurement options, and the evaluation of financing alternatives.”

The current operation at the El Gallo gold mine is a fully permitted site. SEMARNAT, Mexico’s Federal Environmental Authority, granted a permit in September 2019 for Phase 1, which allows the company to add a mill and leach circuit near the existing facilities to reprocess material from the heap leach pad. The permit amendment also covered the backfilling of a previously mined pit with mill tailings, as part of a concurrent closure plan for the El Gallo gold mine.

Permits for Phase 2 are required to expand the footprint of the process plant, and the haul road, and to augment the tailings volume allowed in the depleted pit.

According to the company’s Nov-Dec. 2020 presentation, management is targeting annual production of 300,000 gold-equivalent ounces in 2025, up from 160,000 to 170,000 gold-equivalent ounces in 2021. Production will come from El Gallo, its Fox complex in Timmins, Ontario, Gold Bar in Nevada, and San Jose in Santa Cruz, Argentina.

McEwen is the company’s top shareholder with 20% (82.2 million shares), followed by Van Eck Associations (18 million), BlackRock (10.2 million); and Mirae Asset Global Investments (8.2 million).

Over the last year, McEwen Mining has traded in a range of 76¢ and $2.02 per share. At presstime in Toronto the company was trading at $1.27 per share. The miner has about 409 million common shares outstanding for a market cap of about $519.2 million.

Be the first to comment on "McEwen Mining completes feasibility for Fenix in Mexico"