Self-styled royalty consolidator Metalla Royalty & Streaming (TSXV: MYA; NYSE-AM: MTA) has signed a deal to acquire a portfolio of eight precious metals royalties from First Majestic Silver (TSX: FR; NYSE: AG) in exchange for US$20 million in Metalla scrip.

The deal will add about 7 million silver-equivalent ounces at about US$2.90 per oz. on royalties covering an underlying 343 million oz. of metal to Metalla’s holdings.

The Vancouver-based company said that once closed, First Majestic will hold about 8.5% of its outstanding shares, subject to a four-month holding period, and become a cornerstone shareholder.

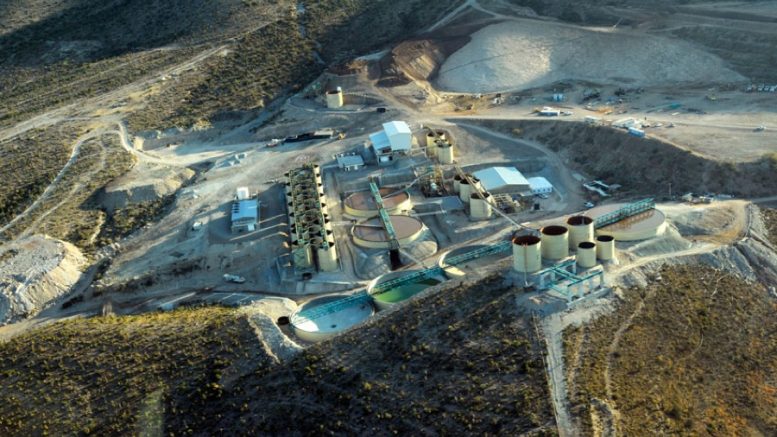

The acquired portfolio includes one producing gold royalty on First Majestic’s La Encantada gold operation, four development silver royalties (Del Toro, La Guitarra, San Martin, La Parrilla), and three advanced exploration silver royalties (Plomosas, La Joya, La Luz) — all on assets in Mexico.

Critically, Metalla said in a news release the royalties cover 100% of all the concessions on the eight properties, with significant exploration upside covering 1,750 sq. km of ground.

According to Metalla, adding eight royalties from First Majestic will expand its portfolio to 79 royalties and streams, increase cash flow, and enhance Metalla’s development pipeline. It also diversifies its counterparty base,

But BMO Capital Markets Research mining analyst Rene Cartier estimates the transaction to be dilutive to its modelled value for Metalla value since most of the acquired portfolio is non-producing assets with “less than clear” visibility for asset restarts or production.

“Of the eight royalties acquired, the La Encantada royalty is the only asset producing where Metalla is acquiring a 100% gross value royalty on the gold produced, limited to 1,000 oz. annually. Mirroring our production estimates, we do not see the cap threshold achieved, and reflect a mine life of 4.5 years at this time,” wrote Cartier in a note to clients.

Of the other First Majestic assets in the portfolio, only San Martin (2% NSR) is expected to achieve production in the future.

“Aligning our outlook, production is estimated in 2025 over a six-year mine life,” Cartier wrote. “At this time, no production is assumed from Del Toro (2% NSR), La Parrilla (2% NSR), and La Luz (2% NSR), where these assets are seen as future optionality.”

The analyst notes Metalla has been quiet this year on the corporate development front.

“The predominantly silver-focused transaction this morning indicates that royalty portfolios are still available in the market, and although we estimate the transaction is dilutive to our [net asset value at 5% discount] model, improved visibility for asset restarts and exploration success could provide upside to our estimates and highlights the embedded optionality, particularly at higher silver prices, in our view,” said BMO. “Given the all-share transaction, First Majestic has aligned itself with Metalla for future growth and re-rating potential.”

Metalla has grown its portfolio by offering sellers a combination of cash and scrip, giving third-party vendors a chance to monetize their royalty interests in a tax-efficient manner while maintaining exposure to the assets, Metalla says. Over time, sellers should also benefit from Metalla’s rising share price.

The transaction is expected to close during the first quarter of 2023.

First Majestic focuses on silver and gold production in Mexico and the U.S. The company currently owns and operates the San Dimas silver-gold mine, the Jerritt Canyon gold mine, the Santa Elena silver-gold mine and the La Encantada silver mine.

Earlier in November, Vox Royalty Corp. (TSXV: VOX) acquired the rights to a portfolio of four different NSR royalties from First Quantum Minerals (TSX: FM) for $650,000.

The portfolio includes a 2% NSR on a portion of the Estrades project owned by Galway Metals (TSXV: GWM), a 0.49% NSR on the Opawica project owned by Imperial Mining (TSXV: IPG), a 2% NSR (including a 1% buy-back for $3 million) on the Winston Lake project owned by Metallum Resources (TSXV: MZN) and a 2% NSR on the Norbec & Millenbach concessions owned by Falco Resources (TSXV: FPC).

At $6.85, Metalla’s Toronto-quoted equity is down about 36% over the past 12 months, having traded between $4.72 and $10.40. It has a market cap of $304.75 million.

First Majestic shares are down 21% over the past 12 months at $11.90, which gives it a market cap of $3.2 billion.

Be the first to comment on "Metalla buys First Majestic Silver royalty portfolio"