DENVER, COLORADO –It looks like Rob McEwen is at it again.

While Goldcorp (G-T, GG-N) made him one of the mining world’s more iconic figures, McEwen, as the largest shareholder and chief executive of Minera Andes (MAI-T, MNEAF-O), is no doubt enjoying the company’s recent run.

Minera has climbed 33% since the company announced that legal issues between it and its partner at the San Jose silver-gold project in Argentina, Hochschild Mining (HOC-L), have come to an end.

The settlement announcement came on Sept. 20 and on Sept. 23 in Toronto, Minera’s shares closed at $1.48.

Speaking at the Denver Gold Forum, the day news of the settlement was released, McEwen said the dispute had been settled amicably and that now the company could focus on unlocking the potential of the project.

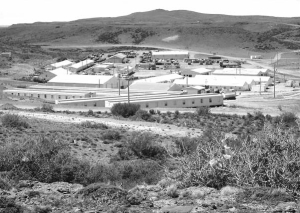

Minera Andes has a 49% stake in San Jose while Hochschild holds the remainder. Second quarter production at San Jose came in at 1.2 million oz. silver and 19,707 oz. gold from a measured and indicated resource of 2.6 million tonnes grading 480 grams silver per tonne and 7.39 grams gold per tonne.

Minera Andes also owns 100% of a portfolio of gold and silver exploration properties bordering Andean Resources’ (AND-T, AND-A) Cerro Negro project — recently the target of a Goldcorp bid.

Speaking to investors at the forum, McEwen argued that applying the metrics supplied by Goldcorp’s bid for Andean to San Jose, combined with the value of its Los Azules copper project and the company’s exploration ground around San Jose, Minera Andes should have a market cap of between $625 million and $750 million. The Sept. 23 close gave the company a market cap of $391 million.

Los Azules, which Minera Andes wholly owns, has an indicated resource of 137 million tonnes of 0.73% copper for 2.2 billion lbs. copper and an inferred resource of 900 million tonnes of 0.52% copper for 10.3 billion lbs. The project sits in northern Argentina.

As for the settlement with Hochschild, the dispute between the two companies had largely to do with how cash flows from the now producing mine would be distributed.

The tale goes back to the early days of the San Jose project, before any project financing was in place. At that time each company put funds into the joint-venture company known as Minera Santa Cruz.

Subsequent to that, Hochschild arranged a project financing loan but in order for any repayment of that loan or the initial loans to begin, Minera Andes had to sign off on documentation related to the project financing.

Minera Andes withheld that signature as it disputed the terms of the documentation — a chief one being that Hochschild’s project finance loan would be paid off before the initial loans made by Minera Andes and Hochschild’s were repaid.

Hochschild brought the case to court to force a signature out of Minera Andes, as cash flows from the mine couldn’t be used towards any debt repayment until the signature was there.

Minera Andes also says it resisted signing over disagreements on protections for shareholders and other terms of the agreement.

Minera Andes agreed to sign on after winning a key concession: cash flows from the mine would be split 50/50, with half going to repay Hochschild’s project finance loan, and half going to pay the initial loans that both Minera Andes and Hochschild put into the joint venture.

That means Minera Andes will get repaid much sooner than previously anticipated.

The company should see $5.9 million come its way this year, following which the amount outstanding on its portion of the loans will be $32.8 million.

Once the project finance loan is repaid, each company will receive profits in proportion to their ownership.

Be the first to comment on "Minera rides high after settling with Hochschild"