Electric car sales could reach around 17 million in this year, accounting for more than one in five cars sold worldwide, according to the International Energy Agency (IEA).

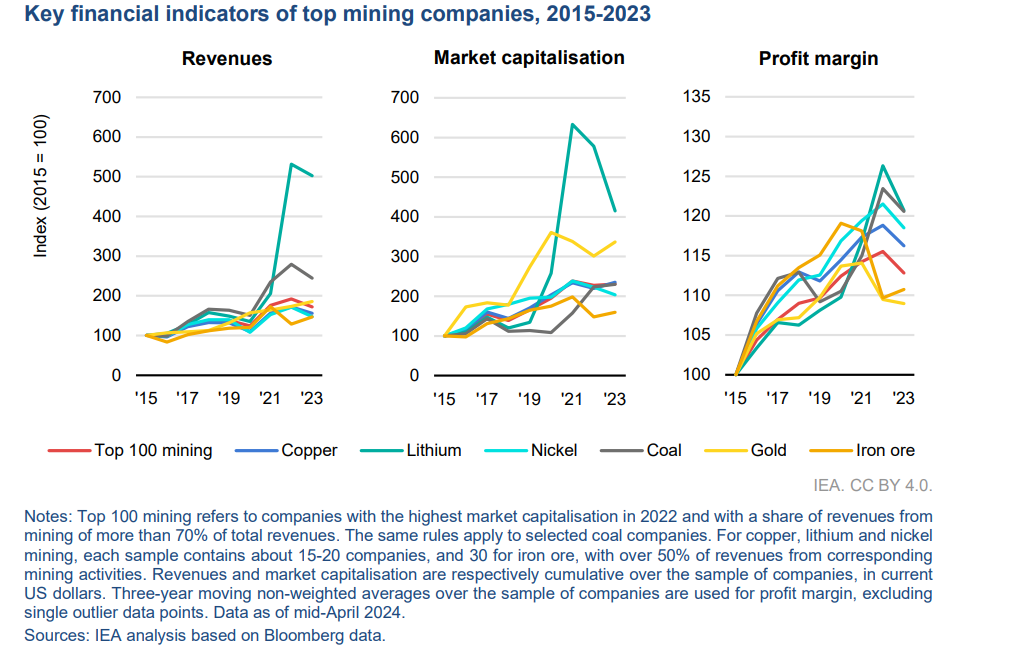

However, despite several years of significant cash flows driven by high metal prices and increasing volumes, many producers of the minerals essential for EVs are now encountering difficulties in financing both existing and new projects solely with their own revenues.

In its Global EV Outlook 2024, the IEA highlights the need for external sources to support large-scale capital expenditure in mining projects. Miners Albemarle (NYSE: ALB), Core Lithium (ASX: CXO), Liontown Resources (ASX: LTR) and Pilbara Minerals (ASX: PLS) recently announced project spending reductions, lower dividends, and job cuts.

Nickel and cobalt projects in Australia have also been delayed or halted, involving companies like BHP (LSE: BHP; NYSE: BHP; ASX: BHP), First Quantum Minerals (TSX: FM) and Wyloo Metals. In the United States, Piedmont Lithium (NASDAQ: PLL; ASX: PLL) Inc. is letting go of a quarter of staff.

“Over the 2024-2026 period, we could see progressive consolidation of critical mineral extraction and refining projects and businesses around lowest-cost producers,” the agency said.

Concerns have arisen regarding the pace of growth in the EV industry due to tight profit margins, fluctuating battery metal prices, high inflation, and the discontinuation of purchase incentives in certain countries.

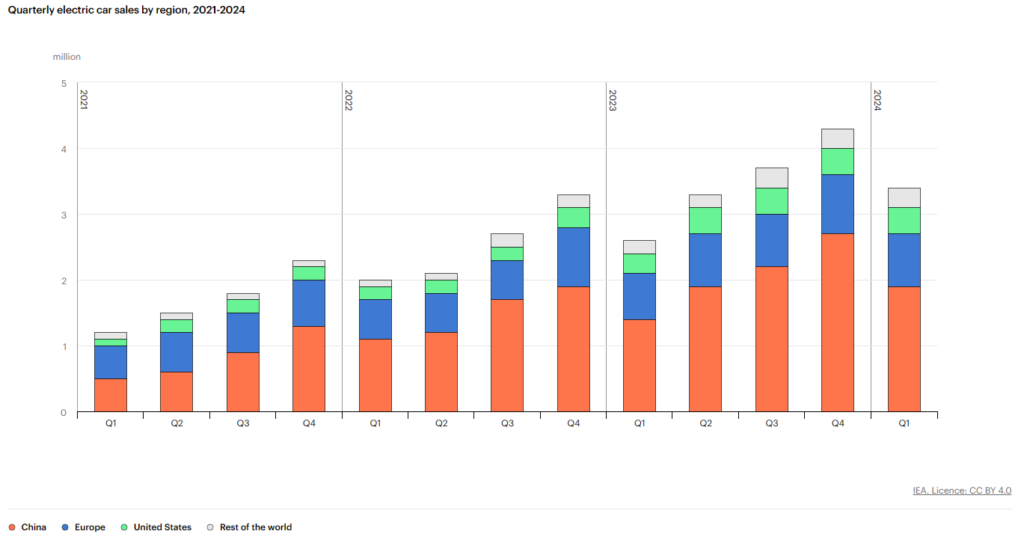

Despite the challenges, global sales data continue to demonstrate strength.

In this year’s first quarter, EV sales grew by around 25% compared with the first quarter of 2023, similar to the year-on-year growth seen in the same period in 2022.

This year, the market share of EVs could reach up to 45% in China, 25% in Europe and over 11% in the U. S. By comparison, these regions accounted for around 65% of total car sales worldwide.

Last year, Chinese car manufacturers played a significant role in the global EV market, producing more than half of all electric cars sold worldwide.

Demand for battery metals saw notable increases last year.

Lithium demand was around 140 kilotons (kt), representing 85% of total lithium demand and marking a more than 30% increase compared to 2022. Similarly, cobalt demand for batteries increased by 15% to 150 kt, constituting 70% of the total, while nickel demand stood at almost 370 kt, up nearly 30% compared to 2022.

“Mining and refining will need to continue growing quickly to meet future demand, to avoid supply chain bottlenecks and make supply chains more resilient to potential disruptions,” the agency said.

“Innovative technologies such as sodium-ion batteries can potentially mitigate demand for critical minerals, together with the rise of mature battery chemistries requiring lower amounts of critical metals, such as lithium iron phosphate.”

Be the first to comment on "Miners struggle to finance projects even amid surging battery metal demand, IEA says in forecast"