Montage Gold (TSXV: MAU; US-OTC: MAUTF) plans to start building its US$712 million Koné gold project in Côte d’Ivoire late this year after an updated feasibility study nearly doubled its net present value.

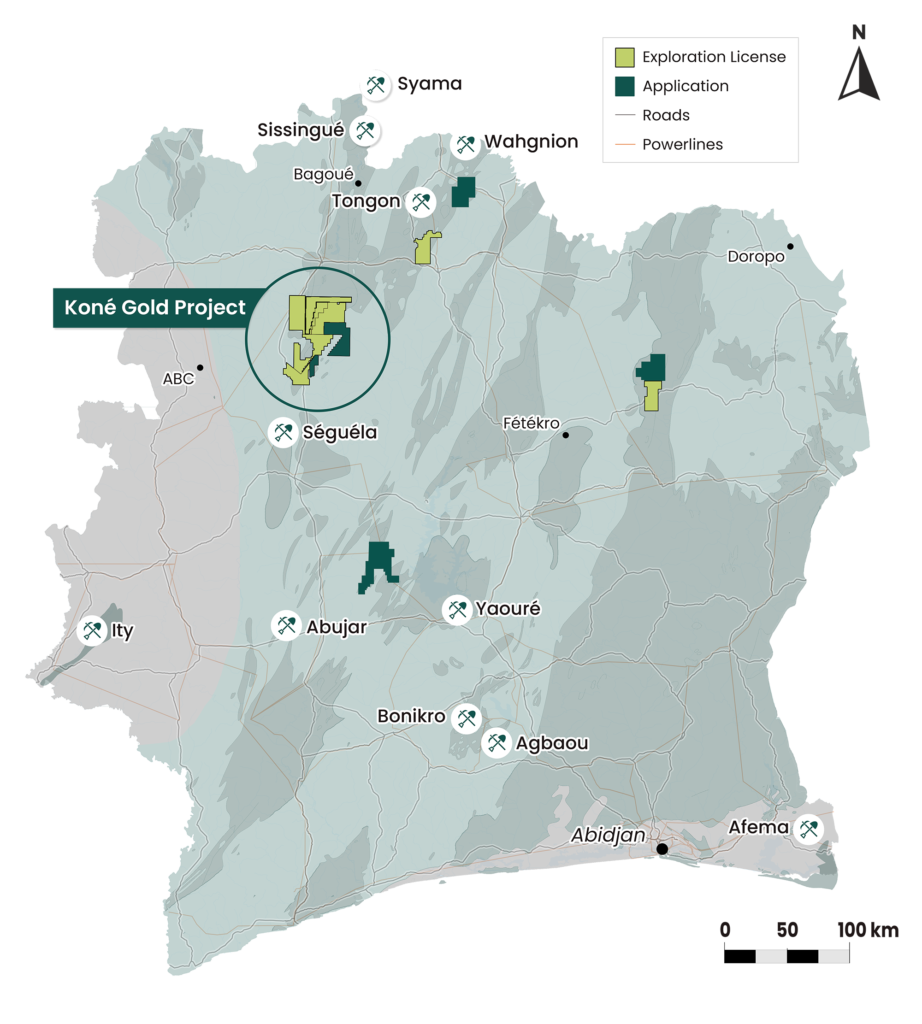

The project 470 km northwest of coastal Abidjan, the West African country’s largest city, has a net present value of US$1.1 billion at a 5% discount rate with a 31% internal rate of return, Montage said on Wednesday.

That compares with US$746 million (46% less) at a 5% discount rate and 35% return in an April 2022 study. The new report is based on a gold price of US$1,850 and versus US$1,600 nearly two years ago. The new study benefits from including the Gbongogo Main deposit of 12 million indicated tonnes grading 1.45 grams gold per tonne for 560,000 oz. gold, Montage said.

“This change has materially de-risked the financial parameters of the project and demonstrates the significant impact of discovering higher grade satellite deposits,” CEO Rick Clark said in a release. “We will now focus on repeating this success as we advance the next near-term satellite deposits within the project, notably Diouma North and Petit Yao.”

Koné’s forecast construction cost rose 31% from US$544 million in the 2022 study. The project may become Côte d’Ivoire’s largest gold mine with an average annual gold production of 349,000 oz. during its first three years at an all-in sustaining cost of less than US$1,000 per oz. and a payback period of 2.6 years.

New reserve

The 2,259-sq.-km property holds 174.3 million probable tonnes grading 0.72 gram gold for 4 million oz. contained gold, according to a new estimate this week. Koné may produce 3.6 million oz. gold over a 16-year mine life, Montage said.

All-in sustaining costs are forecast at US$899 per oz. in the first three years and US$998 over the life of the mine.

Overall life-of-mine capital costs increased 5% compared with the former report to US$877 million although sustaining capital fell by US$126 million, Montage said.

The company says it expects permits to be approved by October. It’s starting more drilling this month on Diouma North and Petit Yao. Diouma North is 2 km south of Gbongogo Main and less than 500 metres from the planned haul road. Recent drilling there cut 17.5 metres grading 2.75 grams, 11 metres at 2.21 grams and 14 metres at 2.16 grams.

Petit Yao, 3 km from the planned haul road, has shown drill results of 12 metres grading 4.15 grams, 6 metres at 10.82 grams and 3 metres at 15.51 grams, Montage said.

Shares in Montage Gold closed 3¢ higher on Wednesday at 70¢ apiece, valuing the company at $129.7 million. They’ve traded in a range of 51¢ to 80¢ over the last 52 weeks.

Be the first to comment on "Montage hikes Koné gold project economics in Africa"