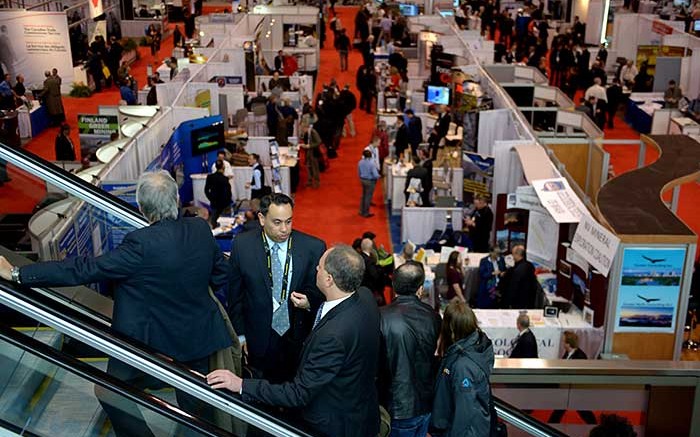

This year’s Prospectors & Developers Association of Canada (PDAC) convention drew 23,578 attendees from over 100 countries. While the crowd for the world’s largest mining event, held at the Metro Toronto Convention Centre, was slightly smaller than last year’s more than 25,000 participants, the mood was more positive, PDAC president Rod Thomas told The Northern Miner.

The following is an edited transcript of an interview with Thomas from the four-day event, which ended on March 4.

The Northern Miner: How has the PDAC convention evolved? How long have you been involved with the PDAC?

Rod Thomas: I first came here as a student in the 1970s. And for a student, in those days, it was the free sweets and so and so forth, and that was the main attraction. But I have been coming for close to 40 years, I suppose. It has grown a lot, of course. Back then it was held in the Royal York, and I think we probably had an attendance in the order of 2,000 people.

I didn’t really get involved as a volunteer until the early 1990s. At that time, one of the directors asked me to help them vet or set up the Investors Exchange. We had 18 booths in a small room in the Royal York — it was free at the time. There were a lot of people interested in exhibiting, so we had to go through the list of companies to make sure that everything was legit, so to speak. But we didn’t do a very good job because Bre-X was one of those companies, as we later found out, of course.

That was my first involvement with the PDAC. I participated in the convention-planning committee and looked after some of the technical sessions and the core shack for a number of years. Then eventually in 2006, I became chair of the convention and ran the convention in 2006, 2007 and 2008. In those three years, we went from 14,500 in 2006 to 17,000 and something in 2007, and in 2008, it was over 20,000. And that of course coincided with the last gasp, if you will, in the boom in the commodities, culminating in the great financial crisis in August 2008.

TNM: What is PDAC’s role in the industry?

RT: It’s a great networking opportunity. We always say it is where the world’s mineral industry meets. We have delegates from over 100 countries. That Investors Exchange that was 18 booths back in the early 1990s is around 550 right now. And we do charge now, it is no longer free, but we don’t vet companies any more.

It offers opportunities for investors to look at potential investments in the resource sector. We offer the aboriginal program, and we actually put a lot of effort into attracting aboriginal participants in the convention. We have grown over the last 10 years, from very few, perhaps a few dozen self-identified aboriginals, to now in excess of 500 aboriginal participants.

TNM: What other changes have you seen at the conference in the recent years?

RT: We have grown tremendously, so we keep adding more product, in terms of the technical sessions and depth and breadth. We have a lot more short courses, so we put a lot of emphasis into professional education.

I think in terms of what we are, it’s a great value proposition in the industry. I think a case in point is even though things aren’t so great now, we still have tremendous attendance at the PDAC.

I work for a Brazilian company — I have a day job, even though I am president— and there are eight Brazilians from my parent company coming up to the convention. And this is the only time I would ever see them all in one place.

TNM: How would you describe the mood of this year’s convention compared to last year’s?

RT: Cautiously optimistic … last year was, I wouldn’t want to use the word miserable, but I think last year there wasn’t a lot of optimism. People were sort of wondering what was going to happen. But now we have seen a bit of M&A activity in the market, there are some deals being done. While it is still tough for smaller companies to raise money, there are some indicators, I think — particularly the M&A activities — that suggest that we’re in the very early stages of a recovery.

TNM: The federal government just announced it would extend the 15% mineral exploration tax credit (METC) by another year, and possibly allow juniors to claim more costs related to obtaining an exploration permit. How does this help the junior mining sector?

RT: PDAC has actually advocated for doubling of the METC and the extension of its term to three years. We felt that would be a good idea because it is so difficult for small companies to raise money and that might be a catalyst, if you will, for the retail investor to put money in. But we started that before the precipitous fall in oil prices, and we understand the government’s finances are constrained, so we are really grateful that Minister [Joe] Oliver has extended the METC at 15% for an additional year. Under the current circumstances, we expect the federal government to be prudent in terms of its finances, and we are thankful that they extended that for another year.

TNM: What do you think of the government’s proposal to allow juniors to deduct more activities as Canadian exploration expenses?

RT: We think that is great because in today’s world, companies spend an awful a lot of money on permitting and Aboriginal consultation and so on and so forth. They are legitimate expenses, and we have been advocating on that for some time. So we are very happy about that, too.

TNM: Can you comment on exploration trends or challenges the industry faces?

RT: It is getting increasingly more expensive to explore: we have to explore deeper, we have to explore farther away. And infrastructure is a big issue in Canada in terms of our industry … that is why we were delighted to hear the [government’s] proposal to consider a road from Pickle Lake through the various communities to the Ring of Fire. We think that’s a move in the right direction.

TNM: What is your outlook for the conference next year, in terms of attendance?

RT: Geologists are always optimistic. The conference has grown substantially over the years. I think in these markets we are just pleased to maintain the interest that we have, and we will continue to improve where we can.

TNM: Where do you see commodity prices heading next year?

RT: We had three down years, and by the end of this year, I think we should start to see some improvement. That is my crystal ball.

Be the first to comment on "Cautious optimism surfaces at 2015 PDAC"