Perth, Western Australia — When Pierre Lassonde, president of

The conference is being organized by the Australasian Institute of Mining & Metallurgy and the New Zealand government’s Crown Minerals, and taking centre-stage will be subsidiary Newmont Waihi Gold, which is proving to be the linchpin in an exploration revival.

Newmont Waihi’s open-pit Martha mine is in the township of Waihi on the base of the North Island’s Coromandel Peninsula. Although the mine is winding down and should end by mid-2006, the next phase of life will occur underground on the Favona Lode, close to the company’s gold plant.

When Newmont took control of Australia’s biggest gold miner, Normandy Mining, at the start of the new millennium, there was immediate speculation that some of the peripheral and small-fry operations would go, and Newmont executives, including Lassonde, had intimated that the Waihi operations were on that list. Indeed, at the end of 2004, at least three companies, understood to be Canadians, were in Waihi undertaking due diligence for a buyout. But Newmont not only had a change of heart; it sent out Lassonde as an emissary to assure the Waihi community, the workforce, and the New Zealand government that the company was there to stay.

What brought about this change?

Despite being a mine that was producing around 150,000 oz. gold and 1 million oz. silver, and one that many analysts considered to be below the mining giant’s focus, it was a good performer. And this performance was achieved even with stringent operating conditions, which included a prohibition on weekend mining, as well as noise abatement for both mining and exploration (drill rigs have operated in steel containers to muffle noise).

Just before reversing the sales decision, Newmont sold off the Wiluna gold operations in Western Australia’s northeastern gold fields to a management buyout that then floated Australian-based

At the same time, Newmont Waihi’s exploration team was not only coming up with strong search results on Favona; it was also improving the potential of nearby Union Hill.

An aggressive exploration campaign of NZ$6 million last year and a similar budget for this year has also shown a major extension just east of the Martha open pit plus drill targets within 6 km of Waihi.

The company’s New Zealand team is working to extend Martha’s life span and advance the decline into Favona so that there is little time lost between ending one operation and starting another.

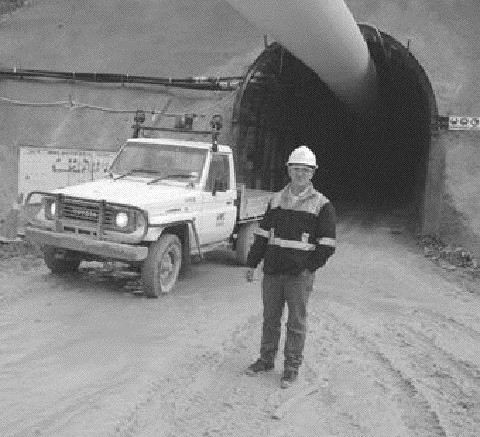

When we visited Waihi, late in May, the Favona decline had been extended 250 metres. When commissioned, it is likely to produce less than 100,000 oz. gold per year initially, and Newmont will have a hungry mill until it develops other deposits.

The Coromandel, with its bonanza-grade epithermal gold deposits, was the springboard that launched New Zealand’s mining industry, as well as the country’s initial wealth upon Europeanization. But today it is the heartland of “green politics” (as well as a place famous for growing illicit green plants for those funny cigarettes . . . with now-abandoned and remote old mine adits an ideal place to nurture those plants).

The Waihi district has no reservations about mining, for the old Waihi underground mines were the town’s economic mainstay until the 1950s. Now, there is concern about what job cuts will occur from a reduction in the tonnage being run through the mill.

In the first quarter, Martha incurred the lowest equity global mining cash cost of any Newmont operation: US$164 per oz. The mine produced 44,000 oz. gold and about five times that amount of silver. The mined gold grade was about 5 grams per tonne.

Since its beginning in the 1870s, Martha has produced more than 6.4 million oz. gold and 44.8 million oz. silver.

Currently, the Favona Lode is estimated to contain 350,000 oz. gold grading 10-11 grams gold per tonne. The silver grade is about four times higher.

The next upgrade by Newmont Waihi will involve not only Favona but the Union Hill area, between Martha and Favona.

In a few years’ time, the Martha plant could be receiving additional feed in the form of high-grade ore from the old Talisman mine at Karangahake, 5 km from the mill. Here, New Zealand-based

The Talisman has produced more than 1 million oz. gold and 4 million oz. silver, and Heritage’s managing director, Peter Atkinson, is hoping to begin mining so as to produce 50,000 oz. gold annually.

The starting point is a recently announced resource upgrade from the 8-level adit workings on the Talisman. That resource is equivalent to 205,000 oz. gold and 800,000 oz. silver. Atkinson hopes to establish a mining resource for at least five years of operation.

This is likely to be a shoestring operation designed to give Heritage the cash flow to plough into greenfield targets around Karangahake, including its promising Rahu property, where limited drilling has produced positive results.

Because Heritage is unlikely to justify a gold plant and as Newmont Waihi will have an under-used mill by 2007, there should be a meeting of the minds.

Newmont Waihi has followed the example of predecessor Normandy by setting up community and local government consultations. As a result, the community of Waihi is being kept in the loop on what is transpiring.

The community is aware of Martha’s mining life and the general progress on Favona, and plans to make the spent open pit a tourist and community facility.

This strong penchant for communications, something the mining industry often neglects or to which it pays only lip service, has proved beneficial for the community. An example of this was a big mine subsidence about five years ago that saw one home slip into a crater and residences having to be removed and areas sterilized, including the company’s original administration centre.

The anti-mining movement made great claims about unsafe mining, but subsequent investigations showed the subsidence was inevitable, caused by the failure of underground mining companies in the 1920s to fill stopes. As a result, voids were created, which travelled progressively to surface.

— The author is a freelance writer based in Perth, Western Australia.

Be the first to comment on "Newmont’s Kiwi mouse still roars"