It’s dj vu all over again in Nova Scotia, with Acadian Gold (ADA-V, ADGLF-O) following in the footsteps of Seabright Resources by putting together a large land package of gold projects and doing a deal to acquire the past-producing Gays River base metal mine.

Acadian is the leading player in the historic Nova Scotia gold fields.

“We hold the greatest number of advanced gold projects in this domain; we have one of the largest land positions and we have the largest 43-101-compliant gold resource,” says Acadian’s president, William Felderhof.

The company controls 37 properties covering 800 sq. km, including four advanced-stage projects — Beaver Dam, Forest Hill, Goldenville and Tangier. These four projects collectively host National Instrument (NI) 43-101-compliant measured and indicated resources totalling 527,500 oz. uncut (or 401,500 oz. cut), plus inferred resources of 826,700 oz. uncut (648,800 oz. cut).

Acadian’s objective is to expand the resource base, with the idea of developing multiple mining operations that feed a central processing mill. In addition, Acadian is investigating the potential for open-pit, bulk-tonnage mining of gold targets in the Meguma terrain, an approach that has received little attention in the past with the exception of Atlantic Gold’s (ATV-A) Touquoy project.

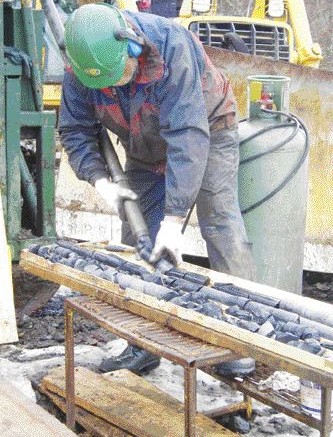

Acadian continues to advance the Beaver Dam gold project where it is in the midst of drilling off a 700-metre-long potential bulk-tonnage open-pit target, called the Main zone. Recent drilling has returned 36 metres of 1.65 grams gold per tonne in hole 36, 28 metres averaging 1.31 grams in hole 37, 23 metres grading 2.27 grams in hole 39, and 28 metres of 1.71 grams in hole 46.

The Beaver Dam property is 100% owned by Acadian and comprises 12 sq. km of mineral claims, 80 km northeast of Halifax. The property was the focus of extensive exploration and development work by Seabright Resources in the 1980s, including more than 50,000 metres of drilling in 271 holes, underground development and a bulk-sampling campaign.

Historic gold production in Nova Scotia has typically come from high-grade shoots in narrow quartz veins. Gold was first discovered in Nova Scotia in 1861 and over the course of the next 80 years or so, a recorded 1.2 million oz. was mined sporadically from over 60 small-scale operations scattered across the southern half of the province in the Meguma terrain. Most of the discoveries were found by “boot and hammer” in the late 1800s and early 1900s.

The Meguma terrain underlies much of southern and western Nova Scotia, and is separated from Avalon terrain rocks in the northern part of the province by the major east-west striking Cobequid-Chedabucto fault boundary. Gold mineralization in the Meguma has been found primarily in narrow mesothermal quartz-vein systems hosted in a Cambrian-to-Ordovician turbidite sequence of meta-sedimentary rocks. The Meguma group is subdivided into a lower meta-sandstone-dominated Goldenville Formation and an overlying slate-dominated Halifax Formation.

These rocks were subjected to intense compressional and regional greenschist facies metamorphism during the Acadian Orogeny, forming a series of upright, isoclinal, northeasterly striking folds. Late in the folding sequence, a complex array of quartz veins — many of them auriferous — were emplaced into the Meguma.

These narrow-vein, coarse-grained gold deposits are associated with flexural folding and occur in the hinges or along the limbs of steeply dipping, tight, anticlinal structures.

Most of the early mining operations never ventured beyond a depth of 200 metres, though there were notable exceptions. The Sterling barrel lead in the Oldham district of Halifax Cty. was worked to a depth of more than 450 metres. In recent years, several of the historic camps were drill-tested to depths exceeding 400 metres, including Dufferin and Tangier. Seabright Resources encountered gold-bearing quartz veins to a depth of more than 600 metres while drilling the Beaver Dam project in the 1980s, returning values of 14.5 grams across 1 metre, 18.8 grams over 2.4 metres, and 31 grams over 1.2 metres.

During the mid-to-late 1980s, Nova Scotia enjoyed a gold exploration boom led by Seabright — a boom that was fuelled in part by flow-through financing. During its height, there were some 35 junior companies exploring for gold in Nova Scotia, with annual spending approaching $100 million in 1987 and 1988.

Seabright was originally formed by Halifax-based businessman Terrence Coughlin, who zeroed in on the province’s historic gold mining camps in the early 1980s. Seabright concentrated its efforts on establishing the underground potential at several projects, including Beaver Dam, Forest Hill and Caribou. The company went underground at Beaver Dam, chasing the individual veins via a decline in 1986 and conducted extensive bulk sampling on seven different levels to a depth of 105 metres.

“They were trying to sort out the distribution of the gold mineralization relative to what they saw from the drilling program on surface,” Felderhof says. “They recognized there were some problems; for instance, they would be drifting on a vein and, all of a sudden, the mineralization would shift over to a vein a couple of metres away.”

These vein deposits, notorious for their narrow, rich pay zones and spectacular, coarse-grained, nuggety gold specimens, proved to be “pockety” in nature and prone to major dilution problems. The quartz veins are limited in size, ranging from 0.5 to 20 cm in width. However, exploration programs in the late 1980s also noted a lower-grade style of disseminated gold in argillite sequences at Beaver Dam, Moose River and Fifteen Mile Stream. The Tuoquoy gold deposit at Moose River is a good example of this style of mineralization.

Today, there is little evidence of the former mining activity at the Beaver Dam site. All buildings and structures were removed. The site was completely rehabilitated upon closure of the mine in 1989. The portal and open-cut were filled with waste rock, backfilled with soil, contoured and seeded.

In conjunction with the Beaver Dam project, Seabright carried out extensive underground bulk sampling at Forest Hill, 40 km southeast of Antigonish and 150 km northeast of Halifax, where a 230-metre-deep shaft had been sunk to explore the Schoolhouse package of veins. Eventually, 10,000 metres of underground workings were established on the 155- and 200-metre levels of Forest Hill, complemented by 22,500 metres of surface and underground drilling in 242 holes. It is estimated that at least $20 million was spent by Seabright, and subsequently Westminer Canada, on exploration and development at Forest Hill.

Acadian began its assessment of the Forest Hill property in 2003 and has since completed 82 holes in 12,300 metres of surface drilling. Based on a re-evaluation of all the data, Forest Hill is independently estimated to contain an indicated resource of 225,000 tonnes grading 24 grams uncut, equivalent to 174,000 oz. If assays are cut to 50 grams, the average grade falls to 14.9 grams or 108,000 contained ounces gold. Inferred resources hold an additional 153,000 oz. in 383,000 tonnes grading an uncut 12.4 grams gold per tonne.

“The bulk of the resources are in the Teasdale shaft area and a new discovery that we made in 2004,” Felderhof explains. “We finished all the surface drilling we wish to do at Forest Hill and we are currently engaged in engineering with regards to a detailed mining plan on how next to tackle the project from underground. We feel there are enough resources now to go underground.”

Beaver Dam

Acadian has shifted its focus to Beaver Dam because of its promising open-pit potential. A recent technical report prepared by Mercator Geological Services says that underground sampling and diamond drilling results show that Beaver Dam hosts “significant widths of low-grade, quartz veined and slate-hosted gold mineralization grading in excess of 2.5 grams per tonne.”

Seabright con

cluded that gold-bearing quartz vein mineralization at Beaver Dam was generally associated with three main argillite sequences known as the Austen, Papke and Crouse zones. Underground mapping showed these argillite packages, up to 25 metres thick, could be traced along strike for 350 metres.

A 10,000-tonne, bulk sample was taken by Seabright from an open-pit cut on the Austen zone in 1987. Channel sampling across the mineralized veins and argillite host rock showed an average grade of 2.81 grams, which compared favourably to a reconciled grade of 2.45 grams for the 8,822 tonnes milled at Gays River.

“This preliminary review suggests that the combination of high-grade and low-grade auriferous zones supports a model for low-grade gold mineralization over wide widths,” states the company technical report.

Acadian began drilling the Main zone in July 2005. The first round of drilling was designed to increase the near-surface resource density by testing the first 50 metres of depth. The holes were spaced to confirm Seabright’s earlier drilling and to infill information gaps due to incomplete sampling and widely spaced holes.

Highlights from the first round of 16 holes included 31 metres of 2.28 grams (including 18 metres of 3.38 grams), 43 metres grading 1.69 grams (including 2.52 grams across 27 metres), 24 metres averaging 5.9 grams (including 1.1 metres of 108 grams), and 52 metres grading 2.64 grams (including a 1-metre section of 89.4 grams).

In contrast to a historic focus on narrow, high-grade intercepts, Acadian’s exploration approach has been to test the potential for wide zones of lower-grade, near-surface gold mineralization.

“This is an important development for the Nova Scotia gold fields, which is generally viewed as only having potential for lode gold deposits mined from underground,” Felderhof says. “Beaver Dam is more of an open-pit target than an underground target.”

The results to date suggest that the bulk of the mineralization is associated with quartz veined intervals, however, the argillite and greywacke host rock is also carrying anomalous gold values.

In December 2005, Mercator Geological Services updated a 43-101 compliant resource model for Beaver Dam based on the results of 18 new holes, in addition to 238 historic drill holes and underground sampling. Acadian’s first round of drilling added 150,000 oz. to the overall resource. Measured and indicated resources now stand at 2.9 million tonnes grading 2.97 grams, equivalent to 279,000 oz. (or 213,000 oz. based on a cut average grade of 2.27 grams). Inferred resources total 2.9 million tonnes averaging 3.36 grams for an additional 311,000 oz. (or 244,000 oz. using a cut 2.63 grams).

Acadian’s drilling results suggest that individual argillite packages and intervening greywacke can be grouped to form a single mineralized zone, which can be traced downdip for over 600 metres and along strike for at least 600 metres.

The bulk of the gold resources (90%) in the current geological interpretation occur in a 70-metre-wide zone to a depth of 200 metres and over a strike length of 500 metres. Gold at Beaver Dam occurs as fine to coarse-grained free visible particles, in association with 2-5% pyrrhotite, pyrite, chalcopyrite and arsenopyrite sulphide mineralization.

The mineralization occurs in a mixed argillite and greywacke sequence on the south limb of a steeply dipping overturned anticline that strikes in an east-west direction.

Acadian is drilling off the Main zone on a 20 by 25-metre spacing down to a depth of 150 metres. The junior has completed more than 68 holes to date at Beaver Dam; assays remain pending for 22 of the new holes.

“We don’t know yet how deep we can take this pit,” Felderhof explains. “We’re calling our open-pit target down to 150 metres and we’re still working at extending the strike length.”

A second rig has been added to the project to start testing some of the other bulk-tonnage targets, including the Mill Shaft zone, which sits 800 metres along strike, west of the Main zone.

Atlantic Gold

Other companies working in the Nova Scotia gold fields include Atlantic Gold (formerly known as Diamond Ventures), an Aussie-listed junior flying under the radar as it advances the Touquoy project through feasibility studies. With current resources totalling 653,500 oz., of which 84% is in the measured and indicated category, a 1.5-million-tonne-per-year milling scenario could produce 90,000 oz. gold annually over a life of six years.

The Touquoy deposit, 60 km northeast of Halifax and 19.5 km southeast of Beaver Dam, stands apart from the typical Meguma terrain gold deposit in that the gold is disseminated throughout the host sediment and is essentially unrelated to quartz veining.

Atlantic Gold earned a 60% interest in the project from privately led Moose River Resources by spending $2.2 million on exploration and making $200,000 in cash payments. By securing project financing, Atlantic can earn an additional 15% interest in the Exploration Block, which comprises a major part of the property outside of the currently defined resource.

Last year, Atlantic Gold completed an infill drilling campaign consisting of 129 holes, or 10,480 metres, with the objective of confirming and upgrading a previously defined 405,000-oz. resource. As a result, the single-pit Touquoy deposit, alone, contains a measured and indicated resource of 8.3 million tonnes grading 1.8 grams gold per tonne, or 468,000 oz. to a projected depth of 150 metres. An additional 86,500 oz. in 1.4 million tonnes of 1.9 grams is inferred. The stripping ratio is modelled at about 3.5:1.

Another 99,000 oz. is outlined at Touquoy West in two satellite deposits, 2 km away. Based on historic drill data, the Higgins & Lawler and Stillwater zones contain 870,000 tonnes of indicated resources grading 1.9 grams, along with 650,000 inferred tonnes averaging 2.2 grams.

Metallurgical test work on the Touquoy deposit indicates a favourable low mill-work index and very high total recoveries of 98% using conventional carbon-in-leach technology, with gravity accounting for about 80%.

Along with feasibility studies, Atlantic is working on the key environmental assessment report, which is nearly complete.

On the assumption that Touquoy is big enough to support a 90,000-oz.-per-year milling operation over a targeted 7-year life, a scoping-level study projected cash operating costs US$232 per oz. and total costs of just over US$300 per oz. At an estimated capital cost of $50 million, Touquoy has the potential to deliver an after-tax 30% internal rate of return and a payback period of 2.4 years.

The board and management of Atlantic Gold comprise former long-term executives and directors of Plutonic Resources, a 500,000-oz. producer that was taken over by Homestake Mining in 1998.

Elsewhere in the Meguma terrain, Orex Exploration (OX-V) is assessing the bulk-tonnage potential of the Goldboro project, 185 km northeast of Halifax. The company completed a first-phase drilling program of 23 holes, for 2,400 metres in 2005, attempting to get a better handle on the grade while it tested new targets and extensions of the historically mined Boston-Richardson corridor. A 43-101-compliant resource estimate is being prepared.

Be the first to comment on "Nova Scotia enjoying gold revival"