The Philippines has renewed the contract for OceanaGold‘s (TSX: OGC; ASX: OGC) Didipio gold and copper mine for another 25 years, after almost two years of the operation being halted due to a dispute with a provincial government over the company’s license to operate.

The renewed Financial or Technical Assistance Agreement (FTAA) applies retrospectively from June 19, 2019, and keeps financial terms and conditions unchanged, OceanaGold said. It does however provide an additional 1.5% of gross revenue to be allocated to regional communities and provinces that host the operation, the company noted on July 14.

OceanaGold kicked off the renewal of the 25-year permit in 2018. After it expired in June 2019, the company kept Didipio operating under a temporary licence, but a blockade backed by the local government forced the Brisbane-based miner to suspend operations a few weeks later. It also had to lay off hundreds of workers.

“The company’s first operational priority is the rehiring and training of its Philippine workforce, which will include a focus on safeguarding workers from the current risks associated with Covid-19,” OceanaGold said in the statement.

The miner, which plans to restart Didipio “as soon as possible,” said operations will resume initially with the milling of stockpiled ore of about 19 million tonnes.

Didipio, which began production in 2013, has an 11-year mine life based on proven and probable underground reserves of 21.2 million tonnes grading 1.51 grams gold per tonne, 0.38% copper and 1.78 grams silver per tonne, for contained metal of 1.03 million oz. gold, 80,000 tonnes of copper and 1.21 million oz. silver.

OceanaGold aims to achieve full underground production capacity within 12 months.

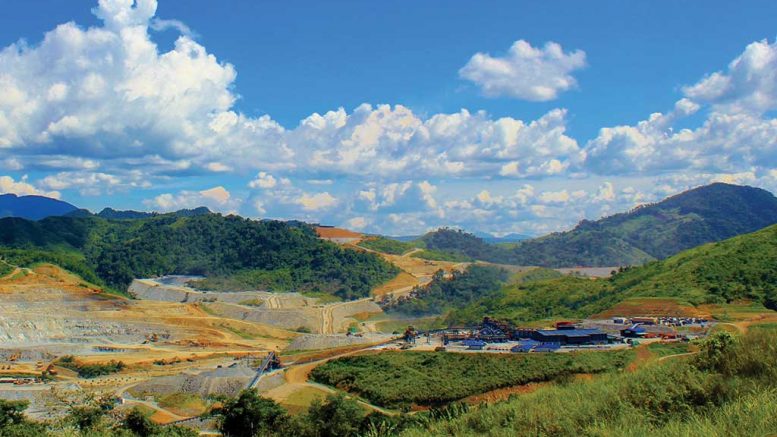

The mine, 270 km north of Manila, is a major direct and indirect employer in the provinces of Quirino and Nueva Vizcaya and a significant contributor of socio-economic benefits for the local and national economies.

OceanaGold also has assets in New Zealand and the United States.

“The return of Didipio comes at a great time with commodity prices, particularly that of copper, clearly in a bull cycle,” Sam Pazuki, the company’s senior vice president of corporate development, wrote in an email to the Northern Miner. “We will provide additional details on the restart plans in the coming weeks, however, once fully operational, Didipio will produce approximately 10,000 ounces of gold a month and 1,100 tonnes of copper a month.”

Brian Quast, a precious metals analyst at BMO Capital Markets, noted that idle concentrate at Didipio will improve the company’s balance sheet. “OceanaGold has an estimated US$50 million of copper concentrate on site at Didipio that the company has not been able to sell due to the delayed FTAA renewal,” Quast wrote in a research note. “With the renewal taking effect immediately, we expect OceanaGold to monetize this inventory. This infusion of cash comes at a crucial time, with OceanaGold having net debt of US$163 million at Q1/21 and a capex-heavy remainder of 2021.”

Quast has an outperform rating on the company and a target price of $3.25 per share. At presstime in Toronto OceanaGold was trading at $2.29 per share within a 52-week range of $1.58 and $4.01 per share.

Farooq Hamed of Raymond James raised his target price following news of the FTAA renewal to $3.25 per share from $3.00 per share and also has an outperform rating on the company. “With operational guidance expected shortly, we have made preliminary estimates of Didipio production starting in 4Q21 and ramping through 2022 with full mining rates being achieved in 4Q22,” he wrote in a research note. “Our preliminary estimates include production of ~8koz gold and 1.5kt copper from Didipio in 4Q21 and 2022 production of 92koz. gold and 12kt copper.”

–This story was last updated on July 21.

Be the first to comment on "Updated: OceanaGold to restart Didipio mine after new deal with the Philippines"