Quebec’s Ministry of Finance and Economy is interested in taking a minority stake in Oceanic Iron Ore’s (TSXV: FEO; US-OTC: FEOVF) Hopes Advance iron ore project in the Ungava Bay region.

In a letter of intent, Quebec officials said the terms of its financial contribution would be defined as Oceanic Iron Ore reaches an agreement with a senior strategic partner — which the company told The Northern Miner in mid-July could take place within the next six months.

Oceanic says the government’s financial contribution will come from the province’s Mining and Oil Capital fund, which has been allocated a $750-million budget for investment in the non-renewable natural resources sector. The fund was announced in November 2012 as part of the government of Quebec’s anticipated 2013–2014 budget.

The letter of intent will be a critical step in securing a senior strategic partner and getting financing for the project’s initial capital expenditure, which is estimated to be $2.9 billion. “It adds credibility to the project and our ability to develop it, and that’s important in terms of potential Chinese investors,” says Alan Gorman, Oceanic’s president and chief operating officer.

“Many of the companies that we have been talking to in China are state-owned companies,” he adds, “and when they look at the prospects of a foreign investment, there is always much more confidence and credibility attributed to a potential investment if there is concrete, tangible evidence that the government is supportive, and in this case the Quebec government has indicated that they will participate as a minority partner.”

Daniel Greenspan of Macquarie Equities Research says the letter of intent shows potential investors outside of Canada that the project is backed by the government, and that “having the provincial government as a partner should provide significant benefits to Oceanic in its own right, including access to officials, clarity on bureaucratic processes and having a partner with aligned goals, including a shared interest in development of infrastructure in the northern part of the province.”

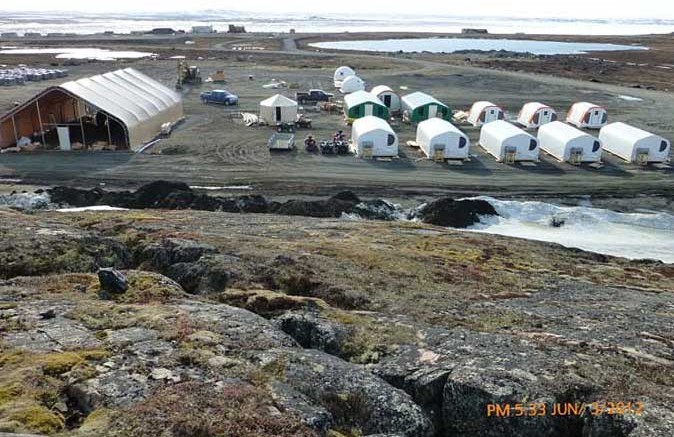

Hopes Advance is located 20 km from tidewater in the northern extension of the Labrador Trough in Quebec’s Nunavik region. Results of a prefeasibility study completed in November 2012 outlined 31-year mine life and a base-case, pre-tax net present value of $5.6 billion, supported by proven and probable reserves of 1.4 billion tonnes grading 32.2% iron, and a life-of-mine operating cost of US$30 per tonne.

At full production, the company says Hopes Advance would be the largest iron ore mine in North America. Production could conceivably start in 2017 at a rate of 10 million tonnes per year, expanding to 20 million tonnes per year in 2027.

Gorman adds that the project meets a number of the government of Quebec’s strategic initiatives, including developing the north and investment in non-renewable and natural resources. “It is accretive to generating future revenue for the province,” he continues, in addition to providing taxation and employment. When the mine and processing facility are in operation Hopes Advance would employ about 385 people on a full-time basis, and post-expansion this number would rise to 500 people. “It’s in the Nunavik region,” Gorman adds, “so the Inuit constituents in that part of the province are afforded a decent, long-term economic base.”

An evaluation of the project’s economic benefits by KPMG Secor late last year concluded that the project would create an estimated $1.9 billion in economic value for the province.

Oceanic last traded at 9¢ within a 52-week trading range of 8¢ to 22¢. Greenspan of Macquarie has a 12-month target price of 35¢.

Be the first to comment on "Quebec gives Oceanic a vote of confidence"