Vancouver — Management of Peru Copper (PCR-T, CUP-X) has thrown its support behind a friendly $6.60-per-share takeover offer by Beijing-based Aluminum Corp. of China (ACH-N) (Chinalco).

The takeover agreement, valued at about $840 million, comes after Peru Copper announced in late May that it had entered into an exclusivity agreement regarding a potential transaction. The all-cash offer is a 21% premium to the 20-day volume-weighted average price leading up to that announcement.

Peru Copper’s board recommends shareholders accept the offer, and has entered into a lock-up agreement, along with other shareholders, representing about 34% of the company’s fully diluted outstanding shares.

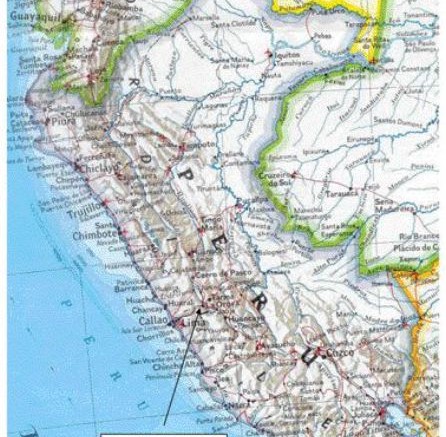

The company’s principal asset is the large, but low-grade Toromocho copper deposit in Peru.

“I and my fellow board members, and a number of other significant shareholders, believe it is a very attractive offer,” said Peru Copper founder and chairman David Lowell.

“Having assessed all options available to the company, we’ve concluded Chinalco’s offer is the best option available to all stakeholders in the company,” explained company co-founder and director Catherine McLeod Seltzer in a conference call following the announcement. “Development of Toromocho requires substantial financial resources and execution capabilities, and we are delighted that Chinalco is going to take the Toromocho project to the next stage of development.”

Concurrent to its takeover offer, Chinalco has also agreed to invest $70 million in the company, in a private placement consisting of about 13.2 million Peru Copper shares at $5.30 apiece. Its share subscription will give the senior company a 9.9% stake in the junior.

The financing will bolster Peru Copper’s current treasury of about $21 million, enabling it to meet an upcoming $30-million bond required under terms of its option agreement for Toromocho, signed in 2003 with Peruvian state-owned mining company Empresa Minera del Centro del Peru (Centromin).

Admitting it was already in the process of raising funding, the company described the placement as “the best offer we were able to attract from the market.”

Under the terms of its option agreement, Peru Copper has to complete a bankable feasibility study; Centromin will also be entitled to a floating royalty on copper production.

Toromocho is the prize for Chinalco in the deal. The porphyry copper project, in central Peru, hosts almost 1.4 billion tonnes of proven and probable reserves grading 0.51% copper, 0.018% molybdenum and 7.1 grams silver per tonne. An additional measured and indicated resource of 601 million tonnes of 0.37% copper 0.016% molybdenum and 6.8 grams silver has also been calculated.

An early 2006 prefeasibility study and technical report on Toromocho showed healthy economics for a proposed open-pit operation producing up to 273,000 tonnes (601 million lbs.) copper and 12 million lbs. molybdenum annually over a 21-year mine life. The study calculated a 16.7% internal rate of return after taxes, and a US$922-million net present value.

Project economics factored metal prices of US$1.10 per lb. for copper, US$10 per lb. for molybdenum, and US$6.50 per oz. for silver, as well as a discount rate of 8%.

Pretax operating costs are expected to come in at about US51.4 per lb. copper, rising to US68.3 per lb. when worker’s participation, government royalties and income taxes are included. Capital costs are estimated at $1.5 billion.

The project is forecast to have a very low waste-to-ore strip ratio of about 0.57:1 and has most of the necessary infrastructure — roads, water, power, railway and skilled labour pool — in place.

Additionally, recent exploration by Peru Copper has identified two large zinc- and copper-mineralized skarn zones peripheral to the large collapsed breccia pipe that hosts the main Toromocho deposit.

Chinalco is China’s largest diversified metals and mining company. Primarily focused on aluminum, it is also involved in exploration and development of copper, rare metals and other non-ferrous metals. It holds a 40.46% stake in Chalco, the largest primary aluminum producer in China.

Shares of the junior notched up 11 on the takeover offer to close at $6.46 apiece on strong volume. The stock price has a 52-week trading range of $3.65-$7.52, with its high following announcement of the exclusivity agreement.

Chinalco is entitled to a $21-million non-completion fee if the takeover does not occur, under specific circumstances, and holds the right to match any higher bids.

CHINALCO’S TAKEOVER OF PERU COPPER

THE ASSET: Toromocho porphyry Cu-Mo-Ag deposit in central Peru

THE DEAL: Cash offer of $6.60 per share, valued at $840M

RESERVES: Proven and probable reserves of 1.4 B t at 0.51% Cu, 0.018% Mo and 7.1 grams Ag; measured and indicated resource of 601 M t at 0.37% Cu, 0.016% Mo and 6.8 grams Ag

DEPOSIT VALUE: NPV US$922M and 16.7% IRR on after-tax basis

MINE PLAN: Conventional open pit — sulphide flotation process with heap-leach SX-EW circuit for oxide ore; 150,000-tpd operation; 21-year mine-life; $1.5B capex; Average annual output of 273,000 t (601 M lbs.) Cu and 12 M lbs. Mo plus Ag

OPERATING COSTS: Pretax estimate US51.4 per lb. Cu, or US68.3 per lb. with worker’s participation, government royalties and income taxes included

Be the first to comment on "Peru Copper endorses $840M Chinese bid"