The price of platinum could reach new 23-year highs in the next six months as the deficit between supply and demand persists and if investment funds continue to maintain long positions, says Johnson Matthey in its Platinum 2003 Interim Review.

Platinum is forecast to trade between US$700 and US$820 per oz. in the first half of 2004, while palladium is expected to hold between US$140 and US$220 per oz.

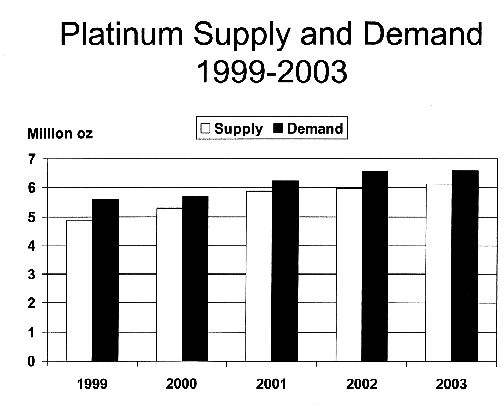

Demand for platinum continues to exceed supply, though the deficit in 2003 is believed to have narrowed to 480,000 oz. Total platinum supply is believed to have risen by a little over 2% to a record 6.11 million oz., mainly as a result of producers raising output in South Africa.

Total physical demand for platinum is expected to remain robust in 2003, inching up by 0.5% to 6.59 million oz. U.S. auto companies will buy more platinum this year after drawing on inventories in 2002, and new demand for platinum has been created by an autocatalyst retrofit program for heavy-duty diesel vehicles in Japan.

In the jewelry sector, however, high prices have put the brakes on demand from Chinese manufacturers, while Japanese demand has been hit by a rise in industry bankruptcies.

In 2003, investment has poured into commodities, pushing the platinum price to its highest since March 1980 and giving palladium prices a boost. Fund activity is likely to continue to affect platinum and palladium prices in the short term.

The palladium price is expected to remain fairly soft as supply continues to outweigh demand, resulting in a surplus this year of 670,000 oz. Total palladium supply is expected to surge 20% in 2003, probably reaching 6.3 million oz., largely as a result of higher Russian sales. Total palladium demand is projected to rebound to 5.6 million oz., up by 16% on 2002, as auto and electronics sector buying recovers after last year’s reductions in metal stocks.

— The preceding is from an information bulletin published by London-based Johnson Matthey.

Be the first to comment on "Platinum on upswing"