Power Ore (TSXV: PORE) is buying the Opemiska copper mine complex in Quebec from Explorateurs-Innovateurs de Québec (Ex-In), a private company.

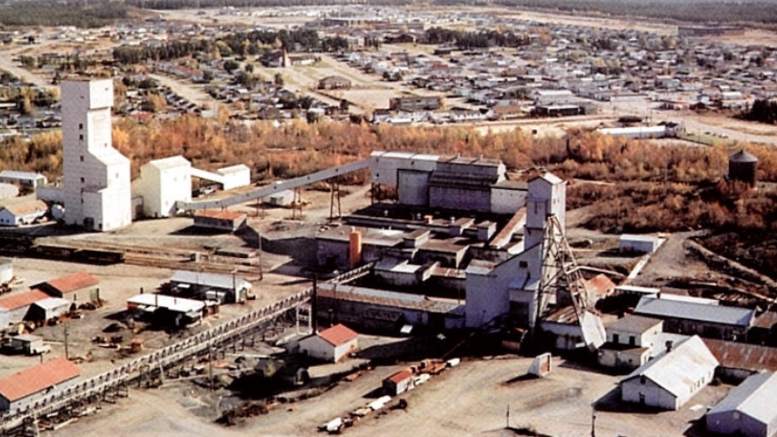

Opemiska consists of two past-producing underground mines operated by Falconbridge from 1953 to 1991. Located near the town of Chapais, Springer and Perry produced 23 million tonnes at 2.4% copper and 0.3 gram gold per tonne.

“We’ve taken a bet on copper on the macro level. We like the fundamentals on the supply and demand sides.”

Stephen Stewart

CEO, Power Ore

“It was an underground operation, but it was near surface,” Power Ore CEO Stephen Stewart says in an interview with The Northern Miner. “We can put a pit on this thing.”

The Springer mine produced more than 650 million lb. copper at 2.54% copper and more than 200,000 oz. gold at 0.48 gram gold. Perry produced over 385 million lb. copper at 2.19% copper and at least 5,800 oz. gold at 0.02 gram gold.

Stewart says that Opemiska has been on his radar since 2011, and that Power Ore has been working to acquire it since going public in June 2018.

“It was a long time coming to define that deal and we’re very happy with it,” Stewart says.

“We’ve taken a bet on copper on the macro level. We like the fundamentals on the supply and demand sides.”

Stewart explains that Power Ore sees supply issues on the horizon for copper. At the same time, the company, as its name implies, supports electrification — in terms of electric vehicles, and solar and wind power.

“At some point renewables are going to be at cost parity with fossil fuels,” Stewart says. “And then it’s game-over for fossil fuels.

“Copper is sort of dominated by the big guys. There are very few high-quality copper projects — certainly even fewer in Canada, and that’s where we focus. In a sense, overnight we’ve become a player in the copper space.”

After picking up the property, Ex-In began digitizing Falconbridge’s historical data. Power Ore’s vice-president of exploration, Charles Beaudry, knows the family who is the vendor, and has worked on parts of the data over the last seven years.

Staff of the property vendor completes an IP survey at Opemiska in 2010. Credit: Power Ore.

In 2010, Ex-In drilled 5,700 metres across 20 holes at Opemiska. It also commissioned RPA to evaluate Springer and Perry. In a non-National Instrument 43-101 compliant report, RPA concluded that Springer could host as much as 30 million tonnes grading 1.4% copper and 0.02 gram gold, and Perry could host as much as 1.3 million tonnes grading 1.3% copper. It also lined up a new underground target at Perry.

After the RPA report, Ex-In drilled another 1,250 metres across 13 holes, and trenched and surveyed the property.

“We’re very data driven,” Stewart says. “For us, it’s a veritable gold mine of information. This is not a discovery. This is a new interpretation of something that was a very high-grade, underground situation.”

To acquire its interest, Power Ore will issue Ex-In 8 million shares and 8 million warrants over the next 3.5 years. Over that same period of time, it must pay Ex-In $1.5 million and incur $3 million in exploration costs at Opemiska.

Ex-In will keep a 2% net smelter return royalty that Power Ore can buy back for $4.5 million.

Power Ore’s focus now is to vet Ex-In’s data — a process Stewart estimates could take four months.

“After we clean the data we’ll have a geological model and a very good understanding of the in-situ resource as it remains,” he says.

Stewart notes that other explorers near Opemiska have found cobalt and molybdenum.

As a result Power Ore will treat Opemiska like a potentially polymetallic project. It will go back and re-assay some of the core for those metals.

Although the company doesn’t have any hard timelines, it intends to put together an Opemiska resource and eventually a preliminary economic assessment.

Explorateurs-Innovateurs de Québec founder Edwin Gaucher (left) and geologist Joe Bakiako Kongo examine core samples at the Opemiska copper project in 2015. Credit: Explorateurs-Innovateurs de Québec.

Power Ore had previously been focused on its Mann silver-cobalt mine property near Cobalt, Ont., but says its focus has shifted to Opemiska.

“Mann is a great project,” Stewart says. “We like Mann, but this is on another scale.”

The company flew a magnetic survey over Mann earlier this year that the company says will help it define areas for future drilling and exploration. The company also sampled stockpiles at Mann in September 2018 to determine which held mineralized material. Highlights included 1.39% cobalt, greater than 10,000 grams silver and 0.04% copper from one sample, and 5.72% cobalt and 403 grams silver from another.

“There’s incredible stuff in the Cobalt area,” Stewart says, “but it’s limited in size. There needs to be a consolidation. Somebody’s going to go in there and scoop up all these viable projects, and then they’re going to have centralized mills, and these little hub and spoke mines.”

About 25 km west of the Mann property sits the company’s MacMurchy nickel property. A hole drilled at MacMurchy in 2008 returned 7.43% nickel over 1 metre.

“That’s a lot of smoke there,” Stewart says, “but it needs more drilling and attention.”

Shares of Power Ore are trading at 6¢ with a 52-week range of 4¢ to 45¢. The company has a $1.7-million market capitalization.

“For Opemiska, this is not about playing timing or cost of capital, this is about developing a really nice, sizable copper asset in Canada where there just aren’t any comparables that we have found, so that’s where out attention’s going to be.”

Be the first to comment on "Power Ore picks up historic Opemiska complex"