Glamis Gold (GLG-T, GLG-N) took a downward slide last week as falling gold prices and cuts in production conspired to weigh down the Reno, Nev.-based company’s shares.

With assets in Nevada, Guatemala, Mexico and Honduras, Glamis has been one of the more actively traded stocks over the course of gold’s recent bull run. Its shares have traded between $19.56 and $47.40 since last summer.

But some of that attention turned negative on June 6, when the company announced it was lowering its 2006 production forecast to 620,000 oz. gold from 670,000 oz., and raising its cash cost projections to US$190 per oz. from US$160-170 per oz.

Since then, Glamis shares have lost almost 20% of their value.

Ron Coll, an analyst with Jennings Capital, says some of that loss can be attributed to a general shift in the market’s attitude. With falling gold prices, the market took a negative psychological turn last week and investors were looking for news to sell on. The Glamis announcement fit the bill, Coll says.

Both Coll and Blackmont Capital’s Richard Gray, say the fall in the company’s share price can be seen as a good entry opportunity. Both pointed to the company’s low costs and strong growth as factors that bode well for its future.

Coll maintained his $40 target and Gray maintained his $46 target on the news.

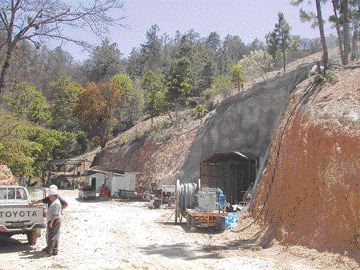

The drop in production and rise in cash costs was mainly due to mechanical problems with the leach tank agitators at the company’s Marlin project in Guatemala. While Glamis says the issues have largely been addressed, the frequency of the failures led to low process plant availability and reduced gold and silver recoveries.

Glamis says it expects permanent improvements to the processing facility to be finished within two months.

And, it says, gold and silver production has not been lost, only delayed — meaning the impact will be limited to 2006 production.

One analyst said until those improvements are made, there is a degree of uncertainty around whether Glamis will be able to meet its target of producing 700,000 oz. gold by 2007.

More troubles

In addition to problems at Marlin, the company was hit by lower-than-expected production at its Marigold mine in Nevada.

Slow leach times and a depleted mining fleet were blamed for production losses there.

Despite the bad news, the company and analysts say there is still plenty to be optimistic about.

Case in point: the company’s El Sauzal mine in Mexico is exceeding production forecasts — even if that surplus is not enough to cover the production losses at the other mines — and exploration at its Penasquito project, also in Mexico, looks positive.

A new feasibility study for Penasquito is expected in late summer.

Glamis describes Penasquito as “one of the world’s largest bulk-minable silver and gold deposits.” The project’s infrastructure includes road and rail transportation, two ocean ports, and two smelters.

Be the first to comment on "Problems at Marlin, Marigold"