The O’Brien mine, halfway between the towns of Rouyn-Noranda and Val-d’Or along the Larder-Lake-Cadillac fault, was considered the highest grade gold producer in Quebec between 1926 and 1957, when the underground operation churned out 1.20 million tonnes grading 15.25 grams gold per tonne for 587,121 oz. gold.

Today, the historic mine is part of Radisson Mining Resources (TSXV: RDS; US-OTC: RMRDF) O’Brien project, where the junior exploration company has carved out a resource estimate that begins 600 metres to the east and along strike of the mine’s Shaft No. 2.

Completed in March 2018, and using a cut-off grade of 3.5 grams gold, Radisson’s O’Brien deposit contains 1.13 million indicated tonnes averaging 6.45 grams gold for 233,491 contained oz. gold and another 1.16 million inferred tonnes grading 5.22 grams gold for 194,084 oz. gold.

The O’Brien deposit remains open at depth below 550 metres, a significant indicator, the company says, given that the old O’Brien mine reached a depth of 1,100 metres and remains untested below that level.

In October 2018, Radisson hired Richard Nieminen to head up exploration. The geologist, who has worked in Canada, the U.S., and several countries in Africa, was twice a member of geological teams that received the AEMQ Prospector of the Year award for the discovery of deposits in Quebec — West Ansil in 2005 and Bracemac-McLeod in 2007.

“He was new to the project and his approach was that the O’Brien mine had been looked at as a small jewelry box and he thought there could be something bigger here and wanted to find the key,” says Hubert Parent-Bouchard, the company’s head of corporate development.

“While digging deeper into the resource model he couldn’t find the source of the gold, or at least structures controlling the higher grade mineralization,” Parent-Bouchard continues. “He suggested to get a structural geologist to look into the model, and we could then perhaps understand how the gold got there and improve targeting for next rounds of drilling.”

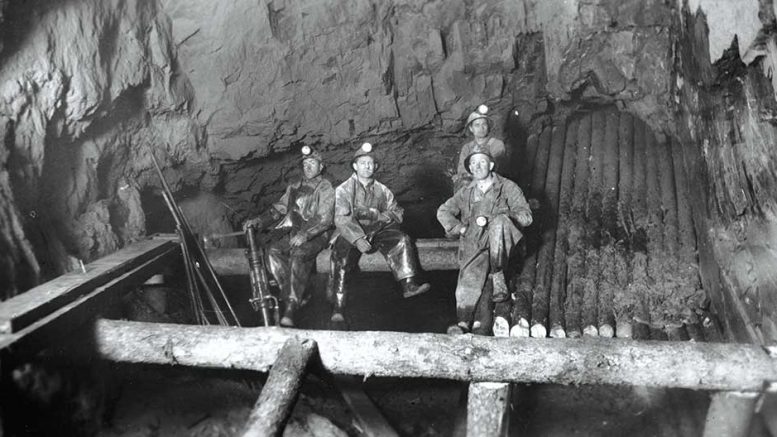

Touring the O’Brien gold project in north western Quebec. Credit: Radisson Mining Resources.

Radisson engaged Kenneth Williamson as an independent consultant to look at the existing model in December 2018. Williamson holds a masters degree in structural geology and started his career in 2004 at Goldcorp’s Red Lake mine under Rob McEwen’s tenure. Since then he has specialized in structural geology interpretation, 3D litho-structural modelling and mineral resource estimation. Williamson has participated in the creation of multiple 3D geological models, including the unified Red Lake Gold Mines geological model, as well as the regional scale Matagami mining camp 3D litho-structural model, among others.

By February 2019, Williamson had come up with a new interpretation of the project based on current and historic drill holes and noted that the majority of the historic production came from the gold-bearing veins that are cross-cutting each other, or what is described as a conjugated vein system. He also observed three different orientations of the veins: east-west like the Larder-Lake Cadillac fault and sub-parallel to the penetrative foliation; east-northeast associated with sinistral cross faults; and east-southeast hosted by dextral cross faults.

“Basically, what he saw was a conjugated system of veins, which is intimately associated to the structures interpreted from the 3D litho-modelling work, and where these veins cross each other — or the systems cross each other — is where you get the highest grade and the widest thicknesses,” Parent-Bouchard explains, pointing as evidence to drill hole 18-84 in the project’s 36E zone, reported in November 2018.

The drill hole intersected 37.5 grams gold over 13 metres starting 420-metres downhole, and is in an area where two vein systems cross each other.

“Williamson’s findings were a breakthrough because, based on this, we could hope to identify multiple ore shoots at the crossings of different vein systems,” Parent-Bouchard says.

The structural geologist then examined the O’Brien mine and realized that 90% of the production came from three main veins out of a total of 14, and that the three veins show a geometry supporting the new interpretation of the deposit. From the 3D modelling work, he also identified steep eastward plunging ore shoots in the F zone, 36E, Kewagama and Vintage zones.

“That was very exciting, and we could find from reports that, in some areas, the head grades of those ore shoots were well above 900 grams gold per tonne,” Parent-Bouchard continues.

The next phase is to search for deeper mineralization below the mineralization identified in the resource estimate, which extends to a depth of 550 metres.

The company plans to complete a resource update in the coming weeks. The update will incorporate results of 16,201 metres of new drilling since the previous estimate of March 2018,and will include for the first time, mineralization from the F zone, which is contiguous to the 36E zone, and sits to the west of the current resource. (The company has drilled about 12,000 metres in the F zone.)

“It’s going to be a game-changer for the company,” Parent-Bouchard says of the new structural interpretation. “Right now, the resource estimate based on the previous model has a head grade of around 6 grams per tonne, but by focusing and constraining the conjugated systems, there are strong reasons to hope for higher grades and lower tonnage so it would make the project more economical.”

Radisson has planned a $2.2 million, 20,000-metre drill program for 2019, and Parent-Bouchard estimates the all-in drilling will cost $110 per metre. The drill program will focus on deeper drilling for resource expansion (12,000 metres) and exploration drilling (8000 metres) to the west of the O’Brien mine, an area, he says, that really hasn’t been looked at in any detail since the 1990s.

“By using our new model to expand the resource at depth and for exploration west and north of the deposit, our hope is that we can replicate the discovery of the O’Brien mine,” he says. “If we can replicate O’Brien two or three times, the project has the potential for more than 1.5 million oz. gold between surface and 1,000 metres depth.”

Due to their close proximity, all of the zones at the project could be accessed via the same mining infrastructure, the company says. The 36E and Kewagama zones are within a 1.5 km corridor directly south of the Larder Lake Cadillac Break.

In 2017, the company identified a new zone 100-150 metres to the north of the O’Brien mine it called the Vintage zone. The zone is parallel to and between 30 to 85 metres north of the Larder Lake Cadillac Break, and gold mineralization has been identified over a strike length of 825 metres.

The company has released assay results from a number of the zones this year. Assays from the F Zone include 6.13 grams gold over 5 metres at a vertical depth of 420 metres in drill hole 18-86W1 and 8.83 grams gold over 2 metres at a vertical depth of 220 metres in drill hole 18-87W1. Results from the 36E zone include 22.96 grams gold over 2 metres from 439 metres downhole in 18-85.

Radisson has $700,000 in the bank, and plans to raise $2 million-$3 million to finance its 2019 drill program.

Radisson is trading at 11.5¢ per share in a 52-week range of 8.5¢ to 15.5¢. The company has a $15.8-million market capitalization.

Be the first to comment on "Radisson shifts focus in new model of O’Brien"