U.S.-based coal miner Ramaco Resources (NASDAQ: METC) saw its stock price fall over 13% on Wednesday amid lower sales expectations due to higher production costs in the coming months. That was despite the company reporting strong performance in the first half of the year..

According to the Lexington, Ky.-based company, total coal output reached 876,000 tons, up 32% year on year, driven by significant growth at the Elk Creek complex in West Virginia, which produced 605,000 tons—a 26% increase from the previous year.

Notably, the Berwind (also in West Virginia) and Knox Creek mines (in Virginia) contributed 271,000 tons, marking a 47% rise from the same quarter in the preceding year.

While the numbers showcase commendable progress, the company faces significant hurdles . Delays in transportation hurt total sales, resulting in about 85,000 tons of coal remaining unsold. Moreover, market dynamics led to a decline in the realized price per ton of coal sold, settling at US$163—a 24% reduction compared to the second quarter of 2022. Concurrently, cash mine costs per ton sold witnessed a 3% increase, reaching US$109, reflecting ongoing challenges.

Headline earnings, adjusting for non-recurring items, fell 38% yearly to US$30 million.

Ramaco remains undeterred, focusing on strategic initiatives to enhance its operations. Despite the hurdles, the company’s outlook for the second half of 2023 remains positive. It anticipates growth in sales to contribute to a reduction in cash costs per ton sold, laying the foundation for improved financial performance.

Ramaco maintains a strong financial position, boasting liquidity totalling US$62.8 million as of June 30. This includes US$33.9 million in cash and an additional US$28.9 million available under its revolving credit facility. While the increase in accounts receivable by US$17.8 million and inventories by US$22.5 million reflects the industry’s dynamic nature, the company remains proactive in addressing these shifts.

Ramaco revised lower its volume targets for 2023. Ramaco now aims for sales volumes of 3.1-3.6 million tons, down from the previous guidance of 3.3-3.8 million tons. The projected sales volumes for the second half of 2023 are expected to increase notably compared to the first half. BMO Capital Markets mining analyst Katja Jancic acknowledges that this increase presents a certain level of risk, given the prevailing market conditions, she wrote in a note to clients Wednesday.

Jancic said there are concerns over Ramaco’s lower expected sales volume and higher costs. The analyst highlights the potential risks associated with the weighted sales projection for the year’s second half, particularly given ongoing rail issues and a softer demand environment.

“These factors may impact Ramaco’s performance, making it a challenging period to navigate,” she said.

“Following Q2’23 results, we are lowering estimates on lower expected sales volume and higher costs, with meaningful H’23 sales weighting a risk, in our view…”

Jancic highlights Ramaco’s financial outlook, pointing out that the company’s contracted sales volume for 2023 stands at around 3.1 million tons, representing about 95% of the estimated production for the year. The average pricing for these sales is around $188 per ton.

She notes the company’s cash cost projections adjusted to US$102-US$108 per ton from the previous range of US$97-US$103 per ton.

Rare earths venture

Central to Ramaco’s growth strategy is the development of new mines.

The company’s board has given the green light for initial development of the Brook Mine in Sheridan, Wyo. to begin in the fall, and earmarking an investment of US$2.5 million. This would make it the first new rare earths mine in the U.S. since 1952 when the Molybdenum Corporation of America opened the Mountain Pass mine in California

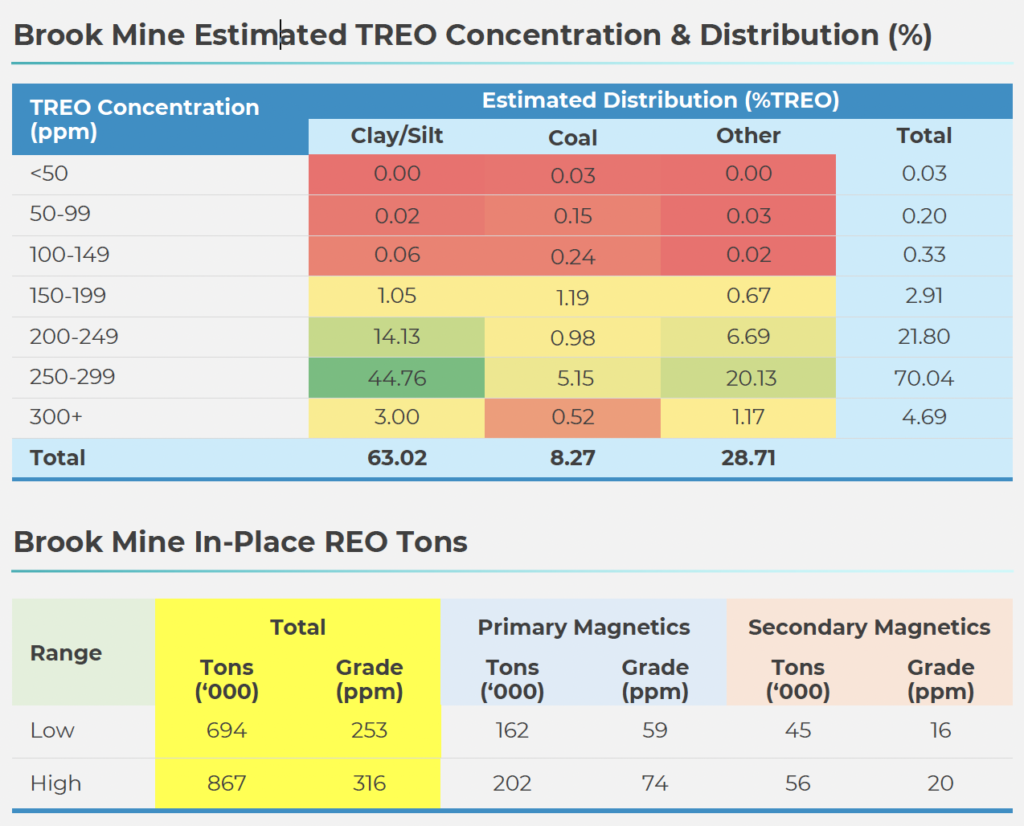

The Brook deposit contains many primary and secondary magnetic rare earth oxides, such as neodymium, praseodymium, dysprosium, and terbium. This assessment was conducted on just a portion of the mine’s area.

Based on additional coring and chemical analysis, Weir International has also determined that the size of the company’s rare earth elements (REE) exploration target has increased almost 50% to 900,000-1.2 million tons of total rare earth oxides (TREOs) from its initial target in May of 0.6-0.8 million tons. For perspective, the U.S. has had an average annual domestic consumption rate of about 10,000 tons of REEs over the last 10 years, according to Ramaco.

The current exploration target encompasses roughly 636,000 and 795,000 in-place tons of 100% TREO with all concentration grades. Core drilling and chemical test analysis will continue on an ongoing basis to further delineate the deposit.

Based on additional drilling and chemical analysis, the unconventional REE deposits at Brook are nearly 50% larger than initially estimated in May.

Ramaco has engaged experts in rare earth mining, metallurgy, mineralogy and economics, as well as SRK Consulting to conduct and studies related to the rare earth deposit’s development.

Ramaco has collaborated with the Department of Energy’s Oak Ridge National Laboratory (ORNL) to develop technologies that use coal as a primary feedstock for creating valuable carbon products. These include activated carbon fibre for capturing CO2 and low-cost synthetic graphite for electric vehicle batteries.

The Brook mine has all permits in place and is ‘shovel ready.’

At mid-day in New York Wednesday, Ramaco shares were trading nearly a dollar below its closing price Tuesday at US$8.35, having touched US$7.26 and US$12.81 during the period. It has a market capitalization of US$485 million.

Be the first to comment on "Ramaco shares dive as coal outlook softens, board okays rare earths buildout"