On the surface,

“The price of gold today is C$535 per ounce, and when we opened the mine [in 1996], it was $525,” says River Gold President Murray Pollitt, who is careful to avoid expressing the gold price in conventional, and much more encouraging, U.S. dollar terms. “Since then, workers’ compensation has tripled, fuel prices have doubled, wages have gone up, and the general level of government harassment and bureaucratic intervention has skyrocketed.”

By contrast, the U.S. dollar gold price flirted with 8-year highs in 2003, closing the year at US$415.85 per oz. So although costs are rising universally, U.S. gold operations are blessed with a much higher price than their counterparts in countries with appreciating currencies, such as Canada.

River Gold operates two gold mines in northern Ontario: the flagship Eagle River mine near Wawa, Ont., and the nearby Mishi mine. Last year, the company produced 74,000 oz. gold at a cash cost of US$294 per oz., compared with 78,800 oz. at US$229 per oz. in 2002. Hardly a stellar performance, yet the tiny producer has caught the eye of John Embry, manager of the Sprott Gold & Precious Minerals Fund, and a tireless gold bug. If, as Embry anticipates, gold finally begins to move skyward in Canadian-dollar terms, domestic producers such as River Gold will look cheap.

The stock currently trades at about $3 in a 52-week range of $2.10 to $4.70.

“Gold has been the inverse of the U.S. dollar,” says Embry. “If you were holding gold bullion in euros or Canadian dollars or South African rand, or any number of currencies, you haven’t made much money. I think these companies are taking a discount because of that. I’m more encouraged to buy them, because I think people will be surprised at the degree to which this changes.”

Embry also likes the reserve potential on River Gold’s extensive land package along the Mishibishu belt. Last year, exploration and development at Eagle River yielded two discoveries close to existing workings, adding 325,000 tonnes of proven and probable reserves grading 12 grams gold per tonne.

“I like a number of the underground situations that are evolving,” says Embry. “Underground mines don’t prove their reserves up, except as they need them, whereas with open pits, they just drill the whole thing off, and what you see is what you get.”

One of the new discoveries at Eagle River, the 650 zone, has been traced for a strike length of 100 metres and a vertical distance of 300 metres and remains open to the east and at depth. The highlight of a recent drilling campaign was a true-width intersection of 3 metres grading 146 grams gold per tonne.

The new zone is typical of the steeply dipping, east-west-striking, shear-zone-hosted quartz veins that make up most of the known reserves at Eagle River. Geologists have identified several similar showings along a 16.5-km strike length.

Eagle River is one of three known gold deposits along the Mishibishu greenstone belt, which became the focus of a fevered gold rush in the late 1980s after the Hemlo gold camp was discovered nearby.

Convinced that another mining camp could evolve along the belt, Noranda subsidiary Hemlo Gold Mines staked most of the prospective ground or joint ventured with juniors who held claims there. John Harvey, head of Noranda Exploration at the time, called Mishibishu the “cornerstone” of Hemlo’s future (T.N.M., June 5/1989).

Fueled by cheap financing in the form of flow-through dollars, the camp’s main players found three major gold deposits: Mishi, Magnacon and Eagle River. But sloppy reserve calculations at Magnacon and a drop in the gold price below US$360 put a lid on exploration and development in the area.

Eagle River was shelved by Hemlo, even though a feasibility study suggested the mine could provide an 18% return at a gold price of US$375 per oz. Millions of dollars of investment in the camp were simply written off.

In 1994, Noranda decided to divest of some of its smaller gold deposits, including Brewery Creek in the Yukon and Eagle River. Pollitt and partner Conrad Hach, then-president of

“Our spies, who were ex-Noranda guys, were sure there were more reserves,” says the colourful Pollitt.

The partners formed River Gold to consolidate ownership of the property, inheriting $32 million in exploration and development expenditures that have yet to be claimed, and raised $17.3 million to put the mine into production. Later, the company bought the nearby Mishi and Magnacon properties and sunk a $60-million, 500-metre shaft at Eagle River.

The past five years have been tough slogging, but Pollitt, who became president after Hach died, believes the company may finally be emerging from a low gold-price era he calls “the deep, dark days.”

Reserves unchanged

After nearly a decade of mining, Eagle River has the same reserves it had when River Gold assumed ownership: 1.3 million tonnes grading 10 grams gold per tonne, or roughly 407,000 oz. The surrounding land package also looks promising.

“We’ve mopped up the entire camp back to Magnacon,” says Pollitt. “We’re doing a lot of drilling and finding new zones. We’re optimistic the reserve picture is growing.”

Eventually, the company would like to deepen the shaft and switch from trackless to track mining at Eagle River in order to save on ventilation, fuel and maintenance costs.

“Trackless mining is an easy way to get started,” says Pollitt. “But looking back, it would have been better to raise $40 million, sink a thousand-metre shaft and [track] mine from the bottom up.”

Pollitt also envisions a shift from long-hole to shrinkage stoping in order to reduce dilution. “The ideal resolution would be to shrink most of these zones, but it takes time and ties up a lot of working capital,” he says.

Finally, Pollitt would like to source more ore from the Mishi-Magnacon complex, a land package covering a 10-km strike length of sheared and altered volcano-sedimentary rocks that host known gold occurrences. For example, beneath the existing Mishi pit is an indicated resource of 1 million tonnes grading 5.1 grams per tonne.

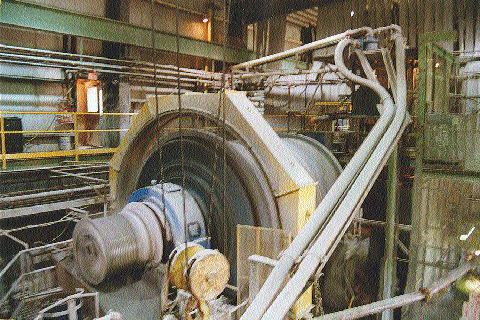

In the centre of Mishi-Magnacon, about 17 km by road, from the Eagle River mine, lies the River mill. The mill operates at an average rate of 850 tonnes per day with a recovery rate of 96.5%.

River Gold’s goal is to feed the mill 300-400 tonnes at a grade of about 5 grams per tonne from the Mishi-Magnacon complex per day, says Pollitt. To this end, the company is using cash flow from Eagle River to drive a 1.3-km exploration drift between Mishi and Magnacon and will delineate more reserves with underground drilling.

“The secret, I have discovered, is to just choke the mill with ore,” says Pollitt. “A hungry mill may be a way of life in this business, but you don’t want that.”

With some co-operation from the Bank of Canada, the River mill may be choking for some time to come.

— The author is a Toronto-based geologist and freelance writer specializing in mining and the environment.

Be the first to comment on "River Gold eyes higher gold price in Canadian dollars"