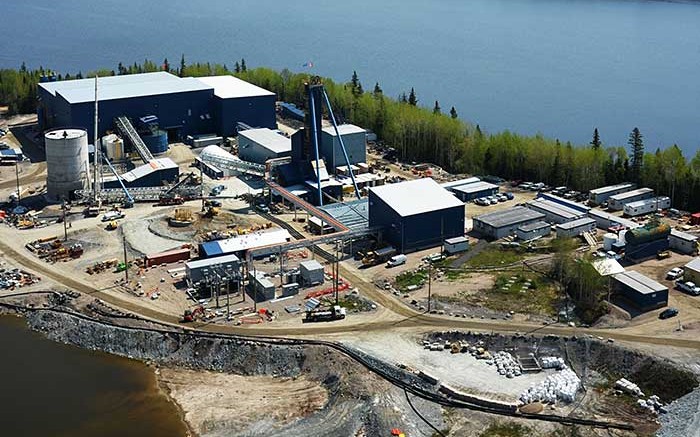

Rubicon Minerals (TSX: RMX; NYSE-MKT: RBY) has poured the first gold at its Phoenix gold project in Red Lake, Ont., and expects to complete the commissioning phase of the mill in early July.

At the same time, the company is demonstrating that there’s significant exploration upside north of the project’s main F2 deposit.

Assay results from a 9,553-metre surface drill program — 1 km north of Rubicon’s underground mine development — returned intercepts of 8.48 grams gold per tonne over 3.3 metres, including 11.1 grams gold over 2.3 metres in drill hole 15-16, 8.43 grams gold over 1.1 metres in drill hole 15-19 and 7.84 grams gold over 1.5 metres in drill hole 15-09.

The exploration results underscore the exploration opportunities surrounding the Phoenix project, Andrew Kaip of BMO Nesbitt Burns says.

The drilling “highlighted near-surface (less than 100 metres) exploration potential at the previously discovered Carbonate zone,” the mining analyst writes in a research note. “The drilling results reported weighted average grade of 2.8 grams gold per tonne at an average thickness of 2.7 metres.”

Drilling the gold system north of F2 is warranted, Rubicon says, but it won’t begin that until the underground mine generates positive cash flow.

At that point, exploration programs will include infill drilling high-grade gold intersections; testing the down-plunge continuity of the Carbonate zone, which remains open at depth; and testing high-interest areas within the F2 gold system regional trend.

The F2 system is made up of a northeast-trending, west-dipping sequence of ultramafic to mafic volcanics, felsic intrusives and metasedimentary rock types, which include the McFinley gold deposit banded iron formation sequence within the East Bay deformation trend.

Red Lake is known for deep, high-grade, long-life mines, and Rubicon controls over 259 sq. km of prime exploration ground in the prolific gold district.

Phoenix is fully permitted for initial production of up to 1,250 tonnes per day.

Once in production, the Phoenix mine could produce 2.19 million oz. gold over a 13.3-year mine life, or 165,300 oz. gold annually. Cash-operating costs are estimated at US$599 per oz., with all-in-sustaining costs of US$845 per oz.

Average life-of-mine throughput rates will be 1,900 tonnes per day. Ninety percent of the mining will be done by long-hole stoping and 10% by cut-and-fill mining. The average mill feed grade will be 8.1 grams gold per tonne, and the company expects 92.5% gold recoveries.

According to a recent corporate presentation, Phoenix generates a 19.9% after-tax internal rate of return and a $423.1-million after-tax net present value at a 5% discount rate, and US$1,200 per oz. gold price.

Phoenix has an indicated resource of 4.1 million tonnes grading 8.52 grams gold per tonne for 1.13 million contained oz. gold, and inferred resources of 7.5 million tonnes averaging 9.26 grams gold for 2.22 million contained oz. gold. The resource estimate was calculated using a 4-gram-gold-per-tonne cut-off grade.

In May, Rubicon was accepted into the Industrial Electricity Incentive Stream 3 program from the Independent Electricity System Operator. As part of its nine-year contract, Rubicon expects to save $4 million per year on its electricity bill.

Rubicon also entered into a financing agreement with Canada Pension Plan Investment Board (CPPIB) subsidiary Credit Investments for a US$50-million secured loan facility that will help develop the Phoenix project. The loan, announced in May, has a five-year term that will mature on May 12, 2020. It bears a 7.5% annual cash interest rate, compounded quarterly. As part of the agreement, Rubicon issued 10 million warrants to CPPIB. Each warrant entitles CPPIB to one common share of Rubicon for five years at $1.72 per share.

At press time Rubicon’s shares traded at $1.39, within a 52-week trading range of 90¢ to $1.83 per share.

Be the first to comment on "Rubicon Minerals advances Phoenix on two fronts"