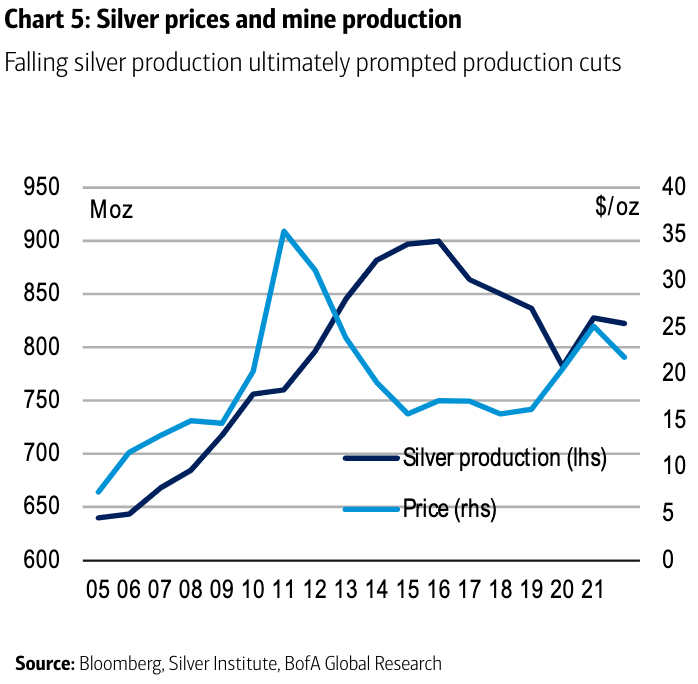

Global mined silver production has fallen 10% below the record highs of the past decade and underpins the recent price rally and potential further gains, new Bank of America analysis suggests.

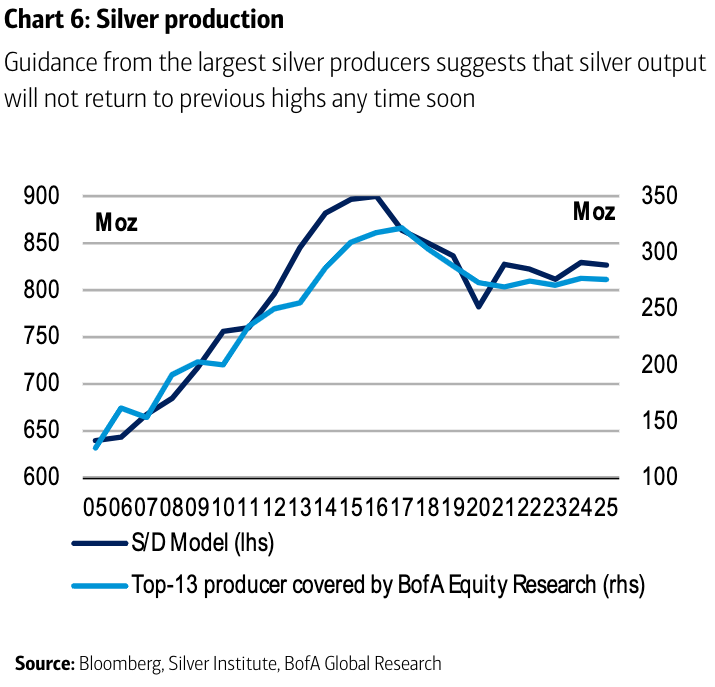

Silver miners cut production after a drawn-out bear market in the past decade, and guidance from the largest silver producers suggests that silver output will not return to previous highs soon, the bank says in its May 11 Global Metals Weekly report.

“Factoring in guidance from the largest silver miners covered by the bank’s equities research team, we believe supply will remain capped going forward,” Global Commodity Research team lead and report co-author Michael Widmer said.

Silver prices have leapt 21% yearly to US$25.7 per oz. early last month and then achieved US$26.05 per oz. on May 4.

The bank flags tightness on the physical market as compounding the already constrained primary supply situation. The bank’s data demonstrates that the volume of metal stored at the Chicago Mercantile Exchange warehouses and the London Bullion Market Association vaults has fallen steadily.

This has helped to offset weakness in traditional industrial demand, with metal imports from Japan and the U.S. weakening. China remains a net exporter of refined silver, while India, which imported record volumes last summer, has now seen demand return to more normal levels.

The bank is bullish on rising offtake from green sectors but notes investors have thus far mainly taken a wait-and-see approach. It expects demand from green technologies, including solar and electric vehicles, to increase steadily.

“This should help keep the market undersupplied,” notes Widmer.

Widmer says investors are often the marginal price drivers. Still, confidence in the white metal had taken a hit in recent years when bullish pitches around ‘promising’ applications, like silver usage in bandages, didn’t deliver.

While U.S. coin sales are not very high, coin premia are trading at about US$1 per oz. above the levels seen in the past decade, the bank notes.

Given the miners’ production cuts, along with increased demand from EVs and solar panels, have rebalanced the silver market, and prices are now finding support, even without much non-commercial demand, Widmer argues.

To that point, investment assets under management at physically backed exchange-traded funds have fallen since last year’s third quarter, even as silver prices have rallied. “Yet, with fundamentals strengthening, there is scope for increased investor buying, which may provide additional momentum to silver prices.

The bank forecasts silver to average US$24.55 this year and US$25.75 per oz in 2024.

Be the first to comment on "Silver price surge set to continue on lower mine supplies, growing green demand"