Ecuador-focused SolGold (TSX: SOLG; LSE: SOLG) is merging with Canadian junior Cornerstone Capital Resources (TSXV: CGP) to secure a 100% ownership of the Cascabel copper-gold project in the South American country.

The friendly deal, SolGold’s third official attempt to take over the Ontario-based junior, values it at £96.7 million (US$107.9 million).

Under the terms of the agreement, Cornerstone shares will be exchanged for SolGold’s on the basis of 15 SolGold shares for every Cornerstone share. SolGold has the option to pay up to 20% of the deal in cash. If it chooses not to do so, its shareholders will hold 80% of the new enlarged firm.

The firm noted the 80/20 split is consistent with the current effective exposure both companies have to the Cascabel project.

Cornerstone’s shares skyrocketed on the news, climbing as much as 35% in Toronto to $3.69 each in early morning. SolGold’s shares closed down 1.37% in London on Friday at 17.22 pence, but were almost 17% higher in Toronto on the news, leaving the company with market capitalization of almost £388 million (US$431 million).

SolGold said the merger will consolidate ownership of Cascabel, in which it currently holds an 85% stake, along with a strong portfolio of other projects.

The miner also said it is undertaking a strategic review which may include evaluating financing alternatives and a spinout of assets other than the Cascabel project.

“This merger transaction makes sense for both sets of shareholders. The merger allows our shareholders to maintain exposure to the world class Cascabel project and is a step towards maximizing value,” Cornerstone president and CEO, Brooke Macdonald, added.

SolGold had tried and failed to take over Cornerstone in 2017 and 2018. And in 2019, it made its first disclosed attempt, which was followed by another offer in 2020.

The parties ended the two-year standoff that cost SolGold’s chief executive his post in June last year, agreeing to jointly advance the copper-gold project in Ecuador.

In August, the miner announced a round of management changes, which included newly appointed chief financial officer Ayten Saridas stepping down after only six weeks in the job, after an unsuccessful equity rise.

In top 20 copper mines

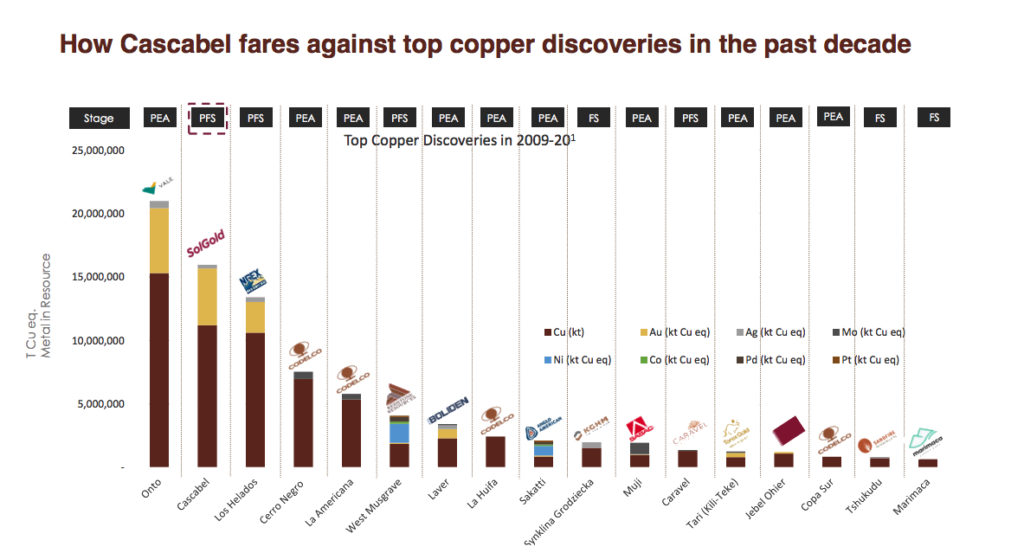

The Cascabel project, located in the Imbabura province of northwest Ecuador, is one of the most ambitious mining projects in a country that is keen to develop mineral resources to boost its sluggish economy.

According to the pre-feasibility study published in April, annual production will average 132,000 tonnes of copper, 358,000 ounces of gold and 1 million ounces of silver during Cascabel’s 55-year mine life.

This means the asset has the potential to become one of the 20 largest copper-gold mines in South America.

Alpala, the largest deposit found at Cascabel so far, has measured and indicated resources of 2.7 billion tonnes grading 0.53% copper-equivalent (0.37% copper, 0.25 gram gold per tonne, and 1.08 parts per million silver) for 9.9 million tonnes of contained copper, 21.7 million oz. gold and 92.2 million oz. of silver.

During the first 25 years of mining, Cascabel is expected to have an average annual production of 207,000 tonnes of copper, 438,000 oz. of gold and 1.4 million oz. of silver.

Over the last two years, Ecuador has attracted a flurry of interest from big miners looking to increase their exposure to copper. The highly conductive metal is in demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

It’s estimated that the global copper industry needs to spend more than $100 billion to build mines able to close what could be an annual supply deficit of 4.7 million tonnes by 2030.

Be the first to comment on "SolGold becomes sole owner of Cascabel with Cornerstone buy"