VANCOUVER — Good relationships in Spain have paid off for B.C.-based explorer Solid Resources (TSXV: SRW; US-OTC: SLDRF).

The company’s operational history in the country allowed it to jump on a past-producing iron-ore mine in the autonomous community of Murcia. And that asset subsequently attracted the attention of Glencore Xstrata (LSE: GLEN).

Solid first entered Spain 12 years ago when management flagged tantalum as an emerging strategic metal, and began scouring the globe for projects. The company ended up in the autonomous community of Galicia — 25 km east of the port city Pontevedra — with its wholly owned Alberta 1 tantalum-tin-lithium property, which is now approaching the permitting stages.

According to director and COO Rick Gliege, it was during Solid’s work at Alberta 1 that the company forged strong business ties in Spain, which created the opportunity to acquire a 100% interest in 62 iron-ore concessions in the region of Cehegin, 100 km from the deep-sea port of Cartagena.

The concessions were formerly owned by Spanish ironworks outfit Altos Hornos de Vizcaya, which was the largest industrial company in Spain for much of the twentieth century. The vertically integrated steel producer pulled around 4 million tonnes of magnetite from three pits during operations that ran from the late 1970s to early 1980s.

“It came into our possession largely because we’ve been working in Spain for so long. We have a good reputation in the country, as well as a strong technical team,” says Gliege during a phone interview, citing the influence of Alfonso Garcia Plaza, who received his doctorate in economic geology from the University of Salamanca outside of Madrid.

“There is a tremendous amount of historic drilling on the property, as well as a lot of historic production data. It’s been extremely valuable as we’ve gone through our due diligence. We can show that the project produced a high-grade iron ore with low impurities. So from a marketing basis this is something that would be attractive to European industry,” he says, adding that Solid has determined production grades averaging from 65–68% iron.

Solid’s Cehegin concessions came with a database that includes 38,000 metres of drilling, which was largely shallow and collared around its producing pits.

The project also hosts a pair of non-National Instrumetn 43-101 compliant resources, which include 13.5 measured tonnes grading 35% iron and 62.5 million inferred tonnes at 40% iron.

And it was the turn-key nature at Cehegin that attracted Glencore. Solid announced its acquisition in October 2012, and Gliege says negotiations with the large-cap miner began just four months later when he met with Glencore’s representatives in Vancouver to review the historic data.

The companies signed a co-operation agreement in late October that lays the foundation for a potential joint venture.

“They were taken with it right away,” Gliege says. “We’ve mentioned getting this thing into production within the next two years, though that might be ambitious. We’ve got a lot of talent at the table now, with Glencore offering their mine-development expertise, as well as marketing and logistic support. One of the first things we noted were these truly world-class logistics. Quite frankly, Glencore said to us they hadn’t seen a better situation logistically than this project.”

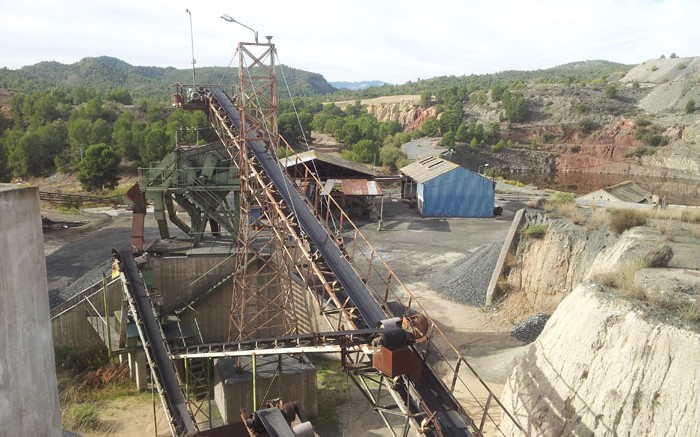

Cehegin is accessible by a toll-free road, and provides access to rail and sea transportation due to the nearby port. Gliege points to an on-site mill, which could provide the companies an opportunity to run a pilot operation prior to full production.

Under the agreement, the companies will conduct due diligence at Cehegin, which could transition into an 80–20 joint venture with Solid as the majority stakeholder.

Solid also issued Glencore 12 million warrants, with an initial strike price of 19¢ through October 2014, which rises to 26¢ through October 2015.

Glencore would buy all iron-ore production from the project, and can increase its equity stake at Solid’s discretion.

Once due diligence is complete, the companies will conduct a scoping study to upgrade resources to NI 43-101 compliancy, and assess a potential operation running at 1 million tonnes of iron concentrate per year.

Gliege says the scoping study is budgeted at US$3 million, with Solid’s share pegged at US$2.4 million.

Solid will be in fundraising mode moving forward, as it reported only a US$84,800 cash position at the end of June.

Gliege reckons that between Cehegin and Alberta 1, the company will need US$6 million over the next year.

Solid maintains 128 million shares outstanding, and shares have traded within a 52-week window of 4¢ to 22¢.

Shares closed at 16¢ per share at press time for a $20.4-million market capitalization.

Be the first to comment on "Solid Resources teams with Glencore in Spain"