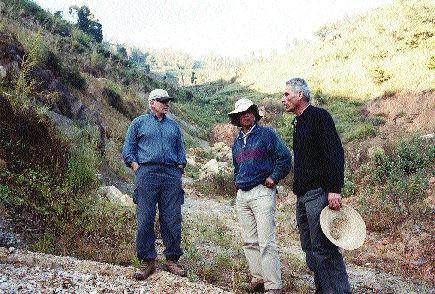

Mangshi City, Yunnan Province, China — Two years of successful grassroots exploration by

Sparton’s 250-sq.-km Luxi gold property (pronounced “Loo-shee”) covers almost all of the 40-km-long, northeast-trending Luxi gold belt, situated in Luxi Cty., a few kilometres north of the border with Myanmar.

The regional centre of Mangshi City (population 335,000) is 25 km to the northeast and the provincial capital Kunming is 500 km to the east.

The topography is hilly and the climate subtropical, with a rainy season lasting from May to October. A paved highway passes close to the project, and secondary roads allow access to most areas of the property. The nearest Chinese railroad, though, is 400 km east.

At the belt’s northeastern end is the small, operating Guanlingpo (or Luxi) open-pit, heap-leach gold mine, which sits on a 53-hectare mining licence.

The four shallow, oxide-gold deposits that have been exploited at Guanlingpo were discovered in 1988 by the Yunnan Nuclear Geological Exploration Brigade 201, which is based in Kunming and owned by the Yunnan provincial government.

Today, the Brigade operates the mine and holds a 35% interest in it, with the remainder held by the municipality of Luxi (35%) and the Yunnan Gold Bureau (30%).

Guanlingpo is now profitably producing about 5,000 oz. gold per year. However, remaining oxide resources are enough for only another six years of mining, and mined grades are just 1.5 grams gold per tonne, and slipping each year. (For a feature report on the Guanlingpo mine, see T.N.M., Sept. 2-8/05.)

Most gold mineralization in the Luxi gold belt is considered “Carlin-style,” and controlled by steeply dipping faults that cut through favourable stratigraphic units, such as carbonaceous limy shales and impure silty-carbonaceous limestones or dolomites, in the upper part of a Jurassic clastic sequence, or in the lower part of a Permian carbonate stratigraphy.

In the Guanlingpo portion of the Luxi belt, the dominant mineralized structural feature is the northeast-striking, west-dipping Shangmangyang fault, which Sparton has now traced for 3 km. Most gold at the mine is hosted in middle Jurassic sediments, which consist of a silicified, carbonaceous, pyrite-rich siltstone unit, interbedded with limestone.

Just east of the fault, quartz-porphyry dykes and other felsic-to-intermediate intrusive bodies intrude sedimentary sequences along various fault structures and fracture zones.

Sparton management first visited the Luxi property in May 2003, and signed an acquisition agreement in September of that year.

To pay for the acquisition and subsequent exploration, Sparton raised $3.6 million in 2003 and moved from near-dormancy to Tier 2 status on the TSX Venture Exchange in January 2004.

In February 2004, Sparton received a business licence for its new, 80%-owned Chinese subsidiary, named Yunnan Sparton Minerals Co. — the remainder of which is held by the Brigade. Now responsible for 20% of the project’s ongoing costs, the Brigade can also opt to be diluted to a 10% net-profits interest.

The Brigade currently receives about half its funding from the central government, receives a fee for operating the Guanlingpo mine, and is involved in various side businesses such as real estate and restaurants.

“Having a partner like the Brigade, one that’s willing to work really hard to push things through the system, is very important,” says Sparton president and CEO Lee Barker.

In addition to Barker, Sparton’s board of directors is composed of Canadian mining veterans Edward G. Thompson (chairman), John H. Paterson, MacKenzie Watson, James McCartney and Glenn R. Brown, as well as Chinese lawyer and businessman Charles Ge. Another Chinese resident, Kenneth Wang, serves as a technical consultant.

Early in 2004, Sparton set up an exploration office in Mangshi City (also called Luxi) and a substantial business office occupying one floor of the Brigade’s headquarters in Kunming. Sparton also has access to office facilities in Beijing through Charles Ge, who lives there.

In June 2004, Yunnan Sparton signed an agreement to buy 75% of the Guanlingpo mining licence as well as the deep exploration rights beneath the Guanlingpo licence area. The deal essentially will give Yunnan Sparton control over 90% of the Luxi gold belt.

At the Guanlingpo mine licence, Yunnan Sparton can now explore anywhere beneath an elevation of 1,180 metres above sea level under the existing Guanlingpo mines. This translates into more or less anywhere below the licence’s oxide-sulphide boundary.

Yunnan Sparton can acquire its 75% stake by spending US$1.5 million and delivering a positive feasibility study to Guanlingpo Gold Mines for development of any primary, non-oxide mineral resources found in these areas.

Friedland connection

Also in mid-2004, as a consequence of the above agreement, Sparton issued 300,000 shares to Cana Trimax Investment, the original vendor of the Luxi project properties, and made a US$50,000 payment to the Brigade.

Sparton had already issued 1.5 million shares and paid US$50,000 to Cana Trimax, and is due to issue another 200,000 shares to complete its obligations to Cana Trimax.

The vendor, Cana Trimax, traces its roots to Eric and Robert Friedland’s DiamondWorks (now

At that time, geologist Charles Forster, who is now

“Charlie Forster compiled everything and his recommendations were right on the bit in his geological interpretations, so we set out to test those in the beginning,” recalls Barker.

In early 2004, Sparton brought 49 tonnes of its own auger and core drilling equipment from North America to China by air, and soon had most of it on-site.

At the Guanlingpo mine, Sparton rented and then upgraded the mine’s analytical laboratory, and had it audited by SGS Lakefield. Analytical results from Sparton’s exploration drilling now come back in just a few days, and better guide further exploration. These results are periodically double-checked at SGS Lakefield in Canada.

“I’m kind of an independent person and like to be able to do things myself,” comments Barker. “I like to be able to control what other people are doing for me so that things don’t get screwed up, money doesn’t get wasted and time is used efficiently.”

Sparton began core drilling in the Guanlingpo mine area in June 2004. Things started off with a bang, with the first two drill holes returning 33 metres of 2.85 grams gold per tonne and 59 metres of 2.6 grams gold, respectively, in Carlin-style gold mineralization at a shallow depth under Guanlingpo’s pit no. 1, which has produced 80% of the mine’s gold.

By October, Sparton was reporting excellent surface-sampling results from pit no. 1, including 18 metres of 8.2 grams and 10 metres of 5 grams.

For all of 2004, Sparton drilled 3,500 metres in 28 separate holes along a strike length of 825 metres. The work defined two separate zones of mineralization: the South zone, containing pit no. 1; and the North zone, which wends its way between pits no. 2, 3 and 4. Both zones are open at depth and along strike.

“We had to reinterpret the geology based on the results,” says Barker. “They were drilling all these holes thinking the zones dip forty degrees. But they dip more like sixty or sixty-five degrees, and it looks like all the mineralization is within forty metres of the fault.”

While Sparton has not yet produced a resource estimate compliant with National Instrument 43-101, the com

pany says it identified along this 825-metre strike length a “significant exploration target with potential primary gold content at least equal to the historical gold production from the oxide deposits in the mine area” — about 210,000 oz. gold to date.

In July 2005, using data from 34 drill holes and chip samples, Sparton calculated an in-house, non-NI 43-101-compliant, oxide resource of 4.2 million tonnes grading 1.5 grams gold (or 210,000 contained ounces gold), using a cutoff grade of 1 gram gold. Lowering the cutoff to 0.50 gram gold boosts the tonnage to 7.6 million tonnes but drops the grade to 1.2 grams gold (320,000 contained ounces).

“The drilling conditions were difficult,” concedes Barker. “We were drilling in an environment that, in North America, you’d normally drill with a reverse-circulation percussion drill rather than a core drill, but you couldn’t get these kinds of machines in China last year. Plus, the drillers aren’t used to working twelve-hour shifts, seven days a week; they work eight-hour shifts.”

One of the first geophysical surveys Sparton wanted to do at Luxi was an airborne magnetic survey to try to find intrusions buried under the hydrothermal systems that seem to be feeding the belt’s gold mineralization. However, for national security reasons, the contractors were not able to obtain permits to fly within 10 km of the border with Myanmar.

Earth-bound induced-polarization (IP) surveys are still OK, and early this year Sparton completed extensive IP surveying at Luxi.

These IP surveys show very high correlation between zones of high chargeability and gold mineralization found by auger and core drilling, and other geological sampling.

Enticingly, Sparton has discovered significant IP anomalies to the north of the Guanlingpo mine in an area now covered by Jurassic siltstones and separated geologically from the mine by an unconformity. These virgin targets will be drilled later in the program.

In April 2005, initial tests by Reno, Nev.-based consultants Kappes Cassidy & Associates indicated 77% cyanide-soluble gold from crushed drill core. Bottle roll and carbon-in-leach (CIL) tests were to follow.

States Sparton: “These results are an extremely positive development for the Luxi project as there appears to have been a general perception amongst some investors and the resource financial community that the Luxi-area gold deposits were refractory in nature, which is not the case.”

In July, after a half-year pause, Sparton started another 5,000-metre drilling campaign aimed at extending the South zone northwards.

“Our objective here right now is to build up a resource of oxide ore — three to four hundred thousand ounces of reserve — that we can put into a National Instrument 43-101 category, do a prefeasibility evaluation, and see if we can start a small heap-leach operation,” says Barker.

The pace of drilling will be stepped up this fall with the introduction of a contractor’s reverse-circulation drill that will be earmarked for infill drilling, freeing up the core drill to test other anomalies on the Luxi gold belt.

The other targets that will be tested in more detail are: Yangshishan, immediately southwest of Guanlingpo, where a small oxide gold deposit was previously mined and where a gold-mineralized lamprophyre dyke is exposed; Mabozi, a high-level epithermal system just south of Guanlingpo; Guanming, 30 km to the southwest; Hebienzhai, 2 km southwest of Guanming; and Bajowa, another small mine site 35 km southwest of Guanlingpo. All these targets show strong IP anomalies.

“We need another hit in another area to show that we have more than the one Guanlingpo target,” says Barker. “We’ve only just scratched the surface by starting work in the known areas around the mine.”

He adds: “But we’ve come a long way here: about ninety per cent of everything we’ve set out to do, we’ve been able to do — and I don’t know how many foreign companies operating in China can say that.”

Barker says that Yunnan, apart from its geological potential, remains one of the best provinces in China for mineral exploration because the central government has granted to the Yunnan government a right to independently negotiate foreign investments in various mineral projects, including precious metals. For foreigners, that means deals can be struck more quickly.

Still, cautions Barker, “a lot of the Chinese bureaucracy is operating in the 1950s, whereas the Chinese government is thinking in the 21st century. There’s always a lag between government policy and the local implementation of this policy by bureaucrats who aren’t plugged into the perspective of the whole country’s development internationally. But it’s not a problem that’s insurmountable.

“The country has a history of being so tightly controlled at all levels, that when you go in there as a foreigner, you have to understand the background of the people you’re dealing with,” he says. “Unless you can think of how they would react based on certain input from you, based on their cultural, political and social framework that they’ve been brought up in, the response may be something you don’t like, but at least if you understand it, you can try to manipulate around it and come back with something that could be workable.”

Other assets

While Luxi remains Sparton’s primary focus, it does have more assets in Mexico and Canada.

In the northernmost portion of Mexico’s Sinaloa state, Sparton has a joint-venture agreement with

Sparton can earn a 51% interest in the 500-hectare claim group, which is situated 25 km northeast of the town of Choix and 40 km east of the town of Alamos, by paying Northair $130,000 in cash, issuing 275,000 shares and spending $800,000 on exploration within four years.

In late 2004 and early 2005, Sparton carried out grassroots exploration at Sierra Rosario that confirmed, and expanded upon International Northair’s work. Sparton collected over 1,000 soil, stream-sediment and rock samples at the site, which includes abandoned workings of the San Rafael mine.

In April 2005, Sparton reported high-grade gold and silver mineralization within three distinct zones at Sierra Rosario, named Josca, San Rafael and Las Tahunas.

Sparton completed more sampling and geophysical work in mid-2005. The results were again encouraging, prompting the joint-venture partners to expand their claim holdings. The company plans to resume drilling in the new year.

In Canada, Sparton has an intriguing sleeper asset: a 12.5% working interest in licence no. 2286 of the offshore Chebucto K-90 natural gas field, situated 40 km southeast of Nova Scotia’s Sable Island and 300 km southeast of Halifax.

In fact, Sparton is the only public junior exploration company in Canada that owns a percentage of a major, undeveloped natural gas reserve in the offshore Nova Scotia gas-producing region.

“We don’t know what Exxon Mobil is going to do,” says Barker. “If we ever got a letter from Exxon Mobil with a proposal, the stock would go to a buck right away, because it wouldn’t be hard to raise the $4-5 million that you’d need to participate.”

Adds Barker, “It’s like an insurance policy, and we get no value for it in the market.”

In British Columbia, Sparton is involved in the Blizzard uranium deposit again, after its predecessor company first staked it in 1977.

With B.C. converting over to an online staking system at the start of this year, a private individual seems to have accidentally let his claim on the deposit become open for five days, allowing another, unrelated individual to step in, stake it and

deal it to

The original claim holder has responded with litigation against the government and the two companies.

This summer, Sparton decided to consolidate Blizzard back into Santoy. Explains Barker: “What we’re trying to do is settle with this fellow who’s instituted the lawsuit and give him a piece of equity in the project going forward, and make all his litigation go away.”

That way, says Barker, they can then just “drive on with all the technical evaluation, and trying to massage the environmentalists and the B.C. government into recognizing that the thing likely can be exploited with a non-polluting, non-invasive method, and all we’re trying to do is see if it’ll work or not.”

In terms of finances, Sparton spent $400,000 exploring Luxi in 2003. Last year, Sparton spent another $1.1 million buying and shipping two drills and related equipment to China, and spent $1.3 million on exploration expenses at Luxi.

Today, Sparton is still living off its 2003 financings, and thanks to Barker’s tight-fisted approach to spending, the company has enough money to last another year.

“I’d like to raise some more money if the market gets stronger, but I’m not desperate,” says Barker. “We have the ability to generate some good news here.”

In late November, Santoy announced it was taking down a $300,000 private placement in Sparton, with the money earmarked for the vendor of the Blizzard property.

Including this latest placement, Sparton will have 42.4 million issued shares. Shares last traded at 12, and various warrants originating from the 2003 financings have been expiring this October and November, well out of the money at strike points of 40-87.

T.N.M. SNAPSHOT LUXI PROJECT

WHO: Toronto-based Sparton Resources (sri-v), led by president and CEO Lee Barker.

WHERE: 500 km west of Kunming in China’s Yunnan province, near Myanmar.

ASSET: 250-sq.-km Luxi property covers almost all of the 40-km-long Luxi gold belt, and surrounds small operating Guanlingpo heap-leach gold mine.

OWNERSHIP: Sparton is operating in China through an 80%-owned subsidiary that can acquire a 75% stake in the Guanlingpo licence area.

GOLD: Carlin-style mineralization. Oxide resource near Guanlingpo calculated in-house at 4.2 million tonnes at 1.5 grams gold per tonne.

OBJECTIVE: Prove up enough NI-43-101-compliant oxide reserves to justify building heap-leach mine. Continue regional exploration along 40-km structural trend, which is little explored.

Be the first to comment on "Sparton explores Yunnan’s Luxi belt"