Battery metals are crucial in the world economy today and their importance will only grow over time as the climate warms and greener energy comes to the fore. Here are eight companies with projects to keep an eye on.

American Lithium

American Lithium (TSXV: LI; US-OTC: AMLIF) is focused on producing battery-grade lithium carbonate at its TLC claystone project in Nevada and its Falchani hard rock project in southern Peru.

An updated preliminary economic assessment (PEA) in January 2024 for an open-pit operation at Falchani considered two scenarios: the first producing lithium carbonate equivalent (LCE) and the second adding sulphate of potash (SOP) fertilizer and cesium sulphate (Cs2SO4) by-products starting in year six of the project’s 43-year-mine life.

The base case outlined life-of-mine production of 2.64 million tonnes of LCE delivering an after-tax net present value (at an 8% discount rate) of $5.11 billion (C$7.3 billion) and internal rate of return (IRR) of 32%. At $22,500 per tonne LCE, initial capex of $681 million could be repaid after-tax in three years.

In the second scenario, Falchani would produce the same amount of LCE along with 3.1 million tonnes of SOP and 144,247 tonnes of (Cs2SO4). The NPV was pegged at about $5.6 billion and IRR at 29.9%. Initial capex remained the same with a three-year payback.

The company is awaiting approval of Falchani’s environmental impact assessment, which it submitted in November 2023.

In Nevada, a PEA of the open-pit TLC project outside Tonopah envisioned production of 1.46 million tonnes LCE over 40 years or about 38,000 tonnes LCE annually. The 2023 study estimated an after-tax NPV (at an 8% discount rate) of $3.26 billion and IRR of 27.5% based on $20,000 per tonne LCE. Initial capex of $819 million could be repaid after-tax in 3.8 years.

The PEA also evaluated producing the identical amount of LCE along with 1.68 million tonnes per year of magnesium sulphate (MgSO4). The NPV rose to $5.16 billion and the IRR to 36%. Capex of $827 million could be repaid in 3.7 years.

At a cut-off grade of 500 parts per million (ppm), TLC contains 2,052 million measured and indicated tonnes grading 809 ppm lithium for 8.8 million tonnes LCE. Inferred resources add 486 million tonnes grading 713 ppm lithium for 1.86 million tonnes LCE.

Environmental baseline study work is underway as the company prepares to start the permitting process for its mine plan.

The company also owns the Macusani uranium deposit in Peru.

American Lithium has a market cap of about $108 million.

Critical Metals

Critical Metals Corp. (NASDAQ: CRML) plans to become Europe’s first lithium concentrate producer in 2026-2027 with lithium mined at its Wolfsberg project in Austria, about 270 km southwest of Vienna. An updated definitive feasibility study for the mine and lithium concentrate converter is expected in the first quarter of this year.

Last year Critical Metals and Saudi Arabia’s Obeikan Group agreed to create a 50:50 joint-venture company that will build a processing plant to convert Wolfsberg’s lithium spodumene concentrate into lithium hydroxide. The refinery will be built in Saudi Arabia and Critical Metals estimates the plant could produce up to 20,000 tonnes of battery-grade lithium hydroxide a year.

Last December the state government of Carinthia ruled Wolfsberg, which already has a mining licence, did not require an environmental impact assessment.

Wolfsberg contains an S-K 1300 compliant resource estimate of 9.7 million measured and indicated tonnes grading 1.03% lithium oxide (Li20) and another 3.1 million inferred tonnes grading 0.9% Li20.

Critical Metals signed an offtake agreement with BMW in December 2022 giving the carmaker the first right to purchase 100% of its lithium hydroxide. Under the deal, BMW contributed a prepayment of US$15 million to develop Wolfsberg, to be repaid through equal set offs against the lithium hydroxide delivered.

Critical Metals is also advancing its Tanbreez rare earths project in southern Greenland. Tanbreez contains 28.2 million tonnes of total rare earth oxides (TREO) contained within 4.7 billion tonnes of material, making it the largest rare-earth deposit in the world by total resource count.

After acquiring the project last June, the company kicked off a 14-hole (2,200 metre) drill program last September to upgrade the resource to U.S. Securities and Exchange Commission standards.

Results from the first hole were reported last December and the highlight was a 40-metre intercept averaging 1.82% zirconium oxide (ZrO2), 4,722.51 ppm TREO, 130.92 ppm tantalum pentoxide (Ta205), 1,852.22 ppm niobium pentoxide (Nb205), 393.68 ppm hafnium oxide (Hf02) and 101.67 ppm gallium (Ga203).

In October, the company identified two high-grade areas that it had not previously factored into its development strategy: Horizon Zero, where limited testing returned about 5% zirconium dioxide (ZrO2), and EALS, located above the unit designed for mining.

Critical Metals has a market cap of about $728 million.

Element 25

Element 25 (ASX: E25; US-OTC: ELMTF) started mining and manganese concentrate processing operations at its 100%-owned Butcherbird manganese deposits in Western Australia in early 2021 and has exported 12 shipments of manganese concentrate to customers in Asia.

In January, an updated feasibility study evaluated expanding open pit mining at Butcherbird to 1.1 million tonnes of manganese lump concentrate a year. It envisions a mine life of 18.3 years with a modified primary comminution circuit and a dense media separation solution to optimize grade and recoveries.

Capex was pegged at A$64.8 million (US$41 million), with a post-tax NPV (at an 8% discount rate) of $379.7 million and pre-tax internal rate of return of 96%.

The feasibility study was based on an updated resource estimate completed last October, which boosted measured and indicated resources by 142% to 130 million tonnes grading 10.23% manganese.

The project in the Pilbara region, 130 km south of Newman and 1,050 km north of Perth, now contains 14 million measured tonnes grading 11.3% manganese, 116 million indicated tonnes averaging 10.1% manganese and 144 million inferred tonnes of 9.8% manganese.

The JORC-compliant resource update of four deposits—Yanneri Ridge, Coodamudgi, Mundawindi, Richies Find—used a 7% manganese cut-off grade and was based on 717 drillholes for 25,493 metres.

Element 25 is also commercializing proprietary technology to produce battery grade high-purity manganese sulphate monohydrate (HPMSM) in the United States. The company plans to build its first HPMSM refinery in Louisiana to produce raw materials for the electric vehicle battery market, in partnership with General Motors and Stellantis.

Element 25 has a market cap of $64 million.

Euro Manganese

In January Euro Manganese (TSXV, ASX: EMN; US-OTC: EUMNF) received a mining licence permit to extract manganese from old tailings from a decommissioned mine that operated between 1951 and 1975 in the Czech Republic.

Manganese recycled from the tailings at the Chvaletice project, 90 km east of Prague could provide up to 20% of projected 2030 European demand for high-purity manganese, which is essential to the battery supply chain, the company says.

A feasibility study in 2022 outlined a 25-year project life producing about 1.2 million tonnes of high-purity electrolytic manganese metal (HPEMM), about two-thirds of which is expected to be converted into HPMSM on site.

Saleable product includes 2.5 million tonnes of HPMSM (32.34% manganese) and 372,300 tonnes of HPEMM (99.9% manganese) over the project life, averaging 98,600 tonnes HPMSM and 14,890 tonnes of HPEMM a year, focused primarily on Europe’s rapidly growing EV battery industry.

The study forecast an after-tax NPV (at an 8% discount rate) of $1.34 billion (C$1.92 million) and an ungeared after-tax (IRR) of 22%. Initial capex was pegged at US$757.3 million, including contingencies of $103.2 million.

Chvaletice contains 26.9 million measured and indicated tonnes grading 7.33% total manganese.

Last October the company announced that its demonstration plant had successfully completed a five-day continuous operation program of HPEMM, producing 172 kg of metal and exceeding the target by 30%. The plant has six of the main process stages of the project’s metallurgical flowsheet.

The company applied last August to have Chvaletice designated as a strategic project under the European Union’s Critical Raw Materials Act.

In November 2023, Orion Resource Partners agreed to a $100-million financing package for Chvaletice. In connection with the financing, Orion has an off-take option of 20-22.5% of the project’s total manganese production for a 10-year period.

The company is also exploring an opportunity to produce battery-grade manganese products in Bécancour, Que. A scoping study completed in March 2023 evaluated developing an HPEMM dissolution plant to produce HPMSM.

The early-stage study envisioned annual production of 48,500 tonnes per year of HPMSM with an initial capex of $110 million (C$162.6 million), including $15 million of contingencies) and a four-year payback. The project’s after-tax NPV (at an 8% discount rate) was pegged at $190 million, with a post-tax ungeared IRR of 26%.

A feasibility study on Bécancour is on hold and subject to financing.

Euro Manganese has a Toronto market cap of about $18.1 million.

Greenland Resources

Greenland Resources (CBOE CA: Moly-NE) is advancing its Malmbjerg molybdenum project in central-east Greenland, which it says will eventually supply 25% of the European Union’s molybdenum demand. The EU is the world’s second-largest molybdenum consumer and has no domestic production of its own.

The project, 30 km from tidewater and about 190 km from the nearest village of Ittoqqortoormiit, contains proven and probable reserves of 245 million tonnes grading 0.18% molybdenum disulphide (MOS2) for 571 million lb. of contained molybdenum metal.

A 2022 feasibility study envisioned an open pit mine producing an average of 24.1 million lb. molybdenum metal a year over a 20-year mine life at $6.38 per lb. molybdenum.

The pit’s highest-grade molybdenum would be mined in the first 10 years, with production of 32.8 million lb. molybdenum metal a year at an average grade of 0.23% molybdenum disulfide (MOS2).

The study outlined an after-tax NPV (at a 6% discount rate) of $1.2 billion and an IRR of 22.4%. Initial capex was pegged at $820 million.

Greenland Resources notes that capex would have been US$80 million lower if it had chosen to use diesel-powered mining trucks. Instead, it will haul ore with a rope conveyor that produces no carbon dioxide. The company also plans to use salt water in its process plant, with very low reagent concentrations.

Under the proposed plan, 35,000 tonnes per day of molybdenum ore will be mined for processing in a conventional base metal sulphide concentrator. Based on current reserves, the concentrator will be fed directly from the pit for an 11-year period and will then process stockpiled ore for the remaining nine years.

The company received a draft exploitation licence for the project in January under the country’s new Mining Act. It replaces an exploration licence the company has held since 2009.

Greenland Resources has a Canadian market cap of $110 million.

Lithium Americas

Lithium Americas (TSX, NYSE: LAC) is focused on building the Thacker Pass lithium project in northern Nevada, which has the largest known lithium resources and reserves in the U.S.

Last December Lithium Americas and General Motors closed a joint venture deal that gave the carmaker a 38% stake in the project for $625 million (C$1.18 billion) in cash and letters of credit. The funds will support construction of the first phase, which targets production of 40,000 tonnes of lithium carbonate equivalent a year at an initial capex of $2.93 billion. Lithium Americas now holds a 62% stake and is the project operator.

Lithium Americas also closed a $2.26 billion loan from the U.S. Department of Energy’s loans program office last October to finance construction of the processing facilities at Thacker Pass.

The company is targeting first production in 2027 and based on a corporate presentation in February, excavation of the process plant is 75% complete; the top seven pieces of long lead equipment have been awarded; and about 50% of the detailed engineering design has been completed.

In an update in January, Lithium Americas increased the project’s measured and indicated resources by 177% (compared to a November 2022 feasibility study) to 44.5 million tonnes LCE grading 2,230 ppm lithium. Proven and probable reserves grew by 286% over the same period to 14.3 million tonnes LCE at an average grade of 2,450 ppm lithium.

The reserves support an 85-year mine life with up to five production phases. Production capacity in each of the first four phases will average 40,000 tonnes LCE per year.

Lithium Americas has a TSX market cap of about $929 million.

Renascor

Renascor (ASX: RNU) intends to use graphite concentrate from its Siviour graphite deposit near Arno Bay in South Australia as feedstock to produce purified spherical graphite (PSG) in the first integrated in-country mine and battery anode material operation outside of China. The commercial facility, which it secured in January is to be built in Bolivar, a suburb of Adelaide.

Last September the company completed a 730-tonne bulk sample of graphite ore from its 100%-owned Siviour graphite deposit on the Eyre Peninsula, about 120 km northeast of Port Lincoln. The sample will be used to produce graphite concentrate at a commercial graphite facility in China using Renascor’s flowsheet.

The concentrate will then be processed into PSG at a demonstration plant Renascor is building near Bolivar. Commissioning the demonstration plant is expected to begin in the third quarter of this year.

Last April, the Australian government approved a $185 million (US$116 million) loan to fund development of the Siviour graphite operation under its $4-billion Critical Minerals Facility. The loan will assist in the development of a graphite concentrate operation and a downstream PSG facility.

Siviour is the second-largest proven graphite reserve in the world and the largest outside Africa. Reserves will support a 40-year open pit mine life producing up to 150,000 tonnes of graphite concentrates per year.

The deposit contains 16.9 million measured tonnes grading 8.6% total graphitic carbon (TGC) for 1.4 million tonnes of contained graphite and 56.2 million indicated tonnes averaging 6.7% TGC for 3.8 million tonnes of contained graphite. Inferred resources add 50.5 million tonnes grading 6.9% TGC for 8.5 million tonnes of contained graphite.

Renascor has a market cap of about A$126 million (US$79 million).

Zijin Mining

Zijin Mining plans to become one of the world’s top lithium producers with production capacity of 250,000 to 300,000 tonnes lithium carbonate equivalent by 2028.

In January the Chinese miner completed a RMB13.7-billion (US$1.9-billion) investment for a 25% interest in Zangge Mining. In addition to copper and potash, Zangge has significant lithium assets with an annual production capacity of 10,000 tonnes of battery-grade lithium carbonate.

Additional lithium output is expected to come from Zangge’s three salars in Xizang, also known as Tibet: Mami Tso, which is currently under construction and adjacent to Zijin’s Lakkor Tso Salar, and the Longmu Tso and Kyetse Tsakha Salars. Mami Tso contains an estimated 2.18 million tonnes of LCE, Longmu Tso 1.89 million tonnes LCE and Kyetse Tsakha 2.01 million tonnes LCE.

Zangge holds a 24% stake in the Mami Tso Salar and a 21% stake in each of the Longmu Tso and Kyetse Tsakha salars.

Zijin, which has traditionally mined copper, gold, zinc, silver and molybdenum, expanded into lithium in 2021. In 2022 it acquired a 70% stake in the Lakkor Tso Salar in Tibet, which contains an estimated 2.16 million tonnes LCE. It also bought 100% of the Xiangyuan lithium-containing polymetallic mine in Hunan province in 2022-2023. Xiangyuan contains an estimated 830,000 tonnes LCE and the mine produced 2,903 tonnes LCE in 2023.

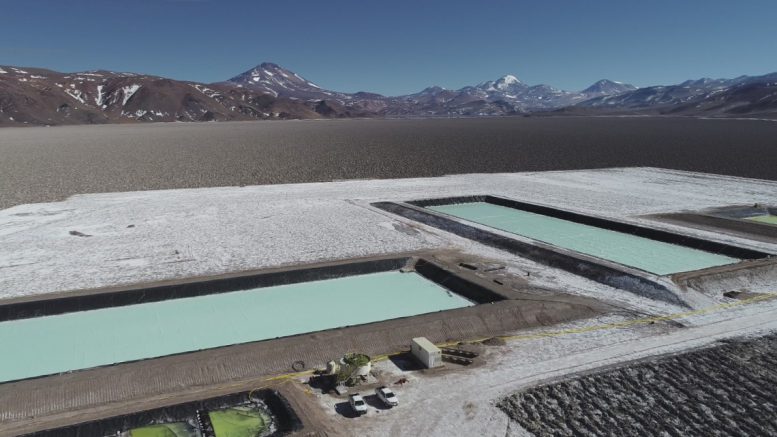

Outside China, Zijin owns 100% of the Tres Quebradas Salar project under construction in Argentina’s Catamarca state. Zijin estimates the project contains 8.54 million tonnes LCE. Construction of the project’s first stage (20,000 tonnes LEC a year) has been completed, and stage two (30,000 tonnes LCE a year) is under construction. After the stages reach nameplate capacity, the project’s annual capacity will grow to 40,000-60,000 tonnes LCE a year, according to Zijin.

In Africa, Zijin is leading exploration and development of the northeastern section of the greenfield Manono lithium pegmatite project in the Democratic Republic of Congo. Zijin has a 61% stake in the exploration licence and COMINIERE, a state-owned enterprise, owns the remaining 39%.

Zijin’s Hong Kong listed shares have a market cap of about HK$479 billion (US$62 billion).

Be the first to comment on "Spotlight: Global battery metals "