Roughly two weeks after a group of workers at Latin America’s biggest mine returned to work, miners at Peru’s Yanacocha gold mine are threatening to walk off the site again.

“We’ve broken off talks and we’ll hold a fresh, indefinite strike in two weeks,” union leader Guillermo Nina told Reuters. “It will be a more forceful strike.”

The initial strike lasted only days, starting April 15 and ending April 17. The company claimed 100 of 660 workers walked off, and that the mine was able to continue operations.

The strike was deemed “illegitimate” by Peru’s Ministry of Labour, because it lacked the necessary number of signatures. A union official, however, claimed the number of striking workers totalled 1,000.

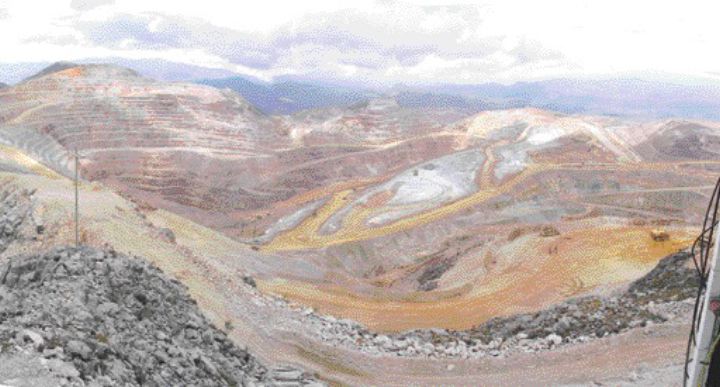

Denver, Colo.-based Newmont Mining (NMC-T, NEM-N) controls Yanacocha with just over a 51% stake. Peru-based Compania de Minas Buenaventura (bvn-n) holds roughly a 44% stake in the mine and the World Bank owns the rest.

The mine produced about 3.3 million oz. gold last year and is expected to produce 2.6 million oz. this year, according to Buenaventura.

Management and workers had been in negotiations since workers returned from the previous strike. Workers are demanding better health, education and living standards.

At the time, there was speculation that news of the initial walkoff contributed to a spike in the gold price in mid-April.

“That’s a bit of a stretch,” says RBC Capital Markets analyst Stephen Walker. “It’s a relatively small component to the overall supply picture for gold.”

Both Walker and HSBC analyst Victor Flores say today’s news didn’t play a part in gold’s gains.

The spot price for New York gold was up 3% or US$17.70 to US$651.50 on April 28.

With the up-tick in the gold price and strong first-quarter results for Buenaventura, the companies made gains on the market.

In New York on April 28, Buenaventura’s shares were up roughly 9.7% or US3 to US$30.24 on roughly 1.4 million shares traded.

The company beat forecasts for the quarter by announcing a net income gain of 89% to roughly US$125 million, compared with the same period in 2005. Buenaventura credited the large spike in operating income to higher silver production and higher prices for silver, zinc and lead.

In Toronto on April 28, Newmont’s shares were up 1.68% or roughly $1 to $64.85 on 211,000 shares traded.

Still, analysts say if negotiations break down further and the mine experiences a prolonged shutdown, the impact on both companies would be significant.

“It’s two weeks before the official date. A lot can happen in that time,” Walker says. He adds that the significance of an asset like Yanacocha to Newmont means it will likely meet union demands to ensure operations run smoothly.

But word out of Yanacocha is that the company is holding fast to the existing agreement signed by the two parties in mid-April. A spokesman for Newmont says even the union has acknowledged that another strike would not be permitted under the terms of the collective agreement.

The collective bargaining agreement doesn’t expire until February 2007, but poor water, medical and educational facilities in the areas around Yanacocha are said to be fuelling the union’s demands.

Be the first to comment on "Strike looms over Yanacocha (May 08, 2006)"