Vehicle and battery makers are “likely to confront persistent long-term challenges” in keeping up with demand by the end of the decade, according to a new report by McKinsey & Co.

Ensuring a reliable supply of critical battery raw materials will be crucial to the global push to net-zero, especially with demand for battery electric vehicles (BEV) picking up within five years, the consultantcy says.

Worldwide demand for BEV passenger cars is to grow sixfold from 2021 through 2030, with annual unit sales increasing to roughly 28 million from 4.5 million during that period, McKinsey estimates. Demand will outpace base-case supply for certain materials, requiring additional investment and threatening shortages and price volatility among other challenges, it said.

In particular, its report highlights that automotive original equipment manufacturers are giving more attention to reducing Scope 3 emissions (greenhouse gases released outside of an organization’s direct control, but that the organization indirectly affects) from material usage. They contribute a large portion of what batteries emit, so battery materials sourcing has become ever more important for battery producers.

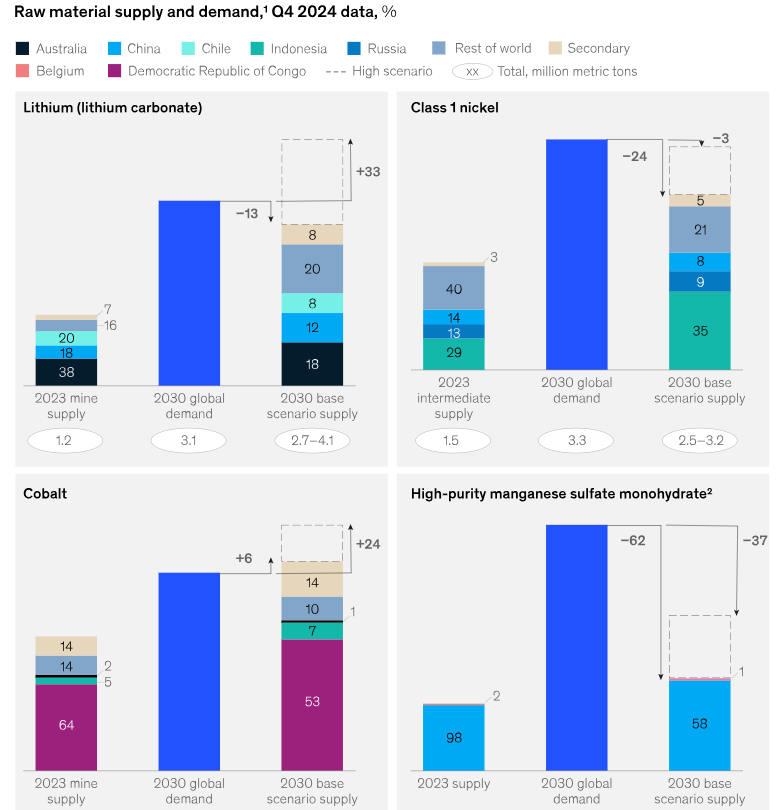

Deficits

Based on the current market, battery manufacturers can expect challenges securing the supply of several essential battery raw materials such as lithium, high-grade nickel, cobalt and manganese.

Battery makers use more than 80% of all lithium that is mined today, and that share could grow to 95% by 2030. With technological advancements shifting in favor of lithium-heavy batteries, lithium mining will need to increase substantially to meet 2030 demand, McKinsey says.

For nickel, fears of a shortage prompted by the shift to BEVs have already triggered significant investments in new mines, particularly in Southeast Asia, but even more supply will need to be brought online. McKinsey’s report suggests the possibility of a slight shortage in 2030 as the battery sector continues to vie with steel and other sectors for Class 1 nickel.

While the share of cobalt in battery chemistry mix is expected to decrease, the absolute demand for cobalt for all applications could rise by 7.5% a year from 2023 and 2030, McKinsey estimates, adding that shortages of cobalt are unlikely, but its supply will be driven by nickel and copper since it is largely a byproduct of their production.

Meanwhile, the supply of manganese is projected to grow moderately through 2030, but an increasing demand for battery-grade material is likely to outpace supply, requiring the development of new refineries.

Two outlooks

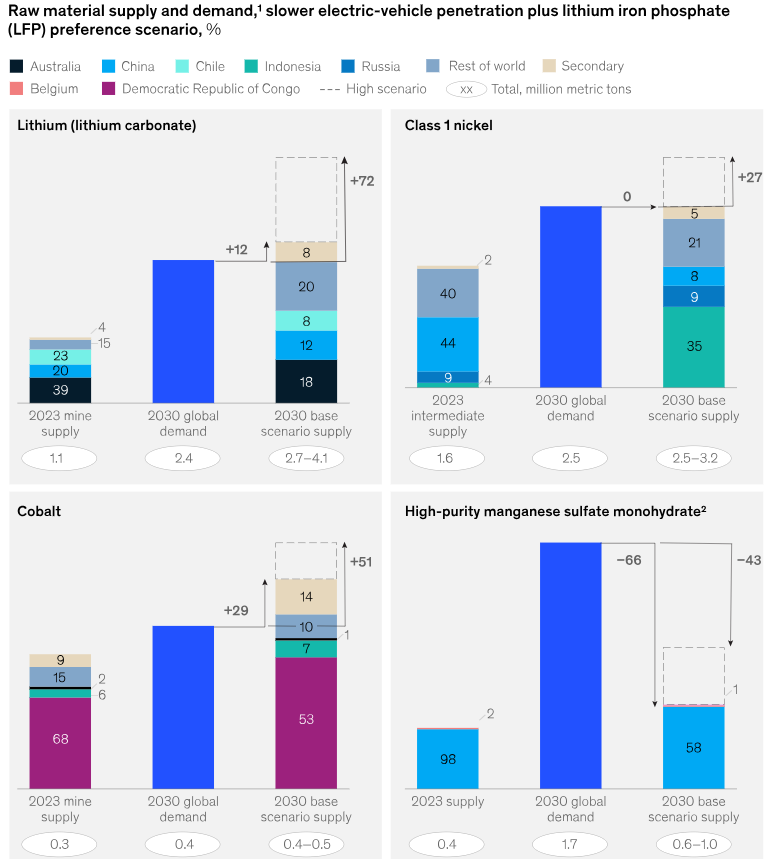

To account for a rapid adoption of LFP (lithium iron phosphate) technology, McKinsey’s study models the 2030 supply and demand balances with two scenarios.

In a world where the rapid adoption of LFP technology is coupled with a lower growth in EV production, the demand of battery materials could look different: there would be enough lithium, high-grade nickel and cobalt, but manganese would still be in short supply.

Under the base case, only about 20% of the HPMSM (high-purity manganese sulfate monohydrate) supply will meet the requirements of battery applications (30% if all announced projects are realized), which themselves will account for only about 5% of total demand for manganese.

Global trends

Although overall demand for batteries and raw materials is increasing rapidly, supply is — and will remain — largely concentrated in a few naturally endowed countries, including Indonesia for nickel; Argentina, Bolivia, and Chile for lithium; and the Democratic Republic of Congo for cobalt, McKinsey says.

Meanwhile, the refining typically takes place elsewhere, often in China (for cobalt and lithium), Indonesia (nickel), and Brazil (niobium).

This value chain setup, according to McKinsey, poses additional considerations for regions such as the European Union and the United States, both of which have high demand for imported materials and often rely heavily on single-country sources.

For example, the EU imports 68% of its cobalt from the DRC, 24% of its nickel from Canada, and 79% of its refined lithium from Chile.

Supply chain transparency

Moreover, although supply concentration for materials such as refined nickel, cobalt and lithium are knowable, complete visibility into the origin of raw materials is sometimes unattainable.

This is the case with high-purity manganese, of which more than 95% is produced in China and minor volumes come from Belgium and Japan; graphite, of which almost all is refined in China; and anode production, on which China has a near monopoly.

Limited transparency into the origins of battery raw materials supply also poses broader environmental, social and governmental (ESG) concerns and attention. For instance, EU batteries regulation aims to make them sustainable throughout their entire life cycle, from material sourcing to battery collection, recycling and repurposing. As a result, McKinsey believes the pressure to address ESG concerns will likely increase.

Recent supply chain disruptions, such as those affecting magnesium, silicon and semiconductors from 2021 to 2023, have increased buyers’ needs to boost supply chain resilience for critical battery raw materials.

Buyers’ risks of import dependency are further heightened by recent trade restrictions introduced by exporters, including China’s limits on some materials (such as synthetic graphite and natural flake graphite products used in BEVs) and Indonesia’s ban on nickel ore exports.

Be the first to comment on "Supply shortage looms for critical battery raw materials by 2030: McKinsey"