Chile’s President Gabriel Boric and the chief executive of Teck Resources (TSX: TECK.A | TECK.B) (NYSE: TECK), Don Lindsay, met in the capital Santiago to discuss the Canadian miner’s projects in the country, including its biggest ever: the Quebrada Blanca phase 2 (QB2) expansion.

The US$5.2 billion QB2 expansion project has the objective of extending the open pit mine’s life by 28 years, boosting production to 316,000 tonnes of copper annually during the first five years of operation.

First copper production is planned for later this year, but could be delayed to January 2023 if Covid-19 related inefficiencies continue in the fourth quarter, the company has said.

The mining giant is already studying a Phase 3 expansion for the mine, which will double its capacity to 600,000 tonnes of copper per year. The potential extension will make the mine Chile’s second-largest copper operation, after Escondida. It will also situate Quebrada Blanca among the world’s top five copper mines.

Tougher environmental regulations in the world’s largest copper producing country were also addressed as QB2, Teck’s most important growth project, has experienced setbacks in recent months.

In April this year, the company faced eight charges filed by Chile’s environmental regulator SMA based on audits carried out in 2019, 2020 and 2021.

Shortly after the claimed transgressions were announced, the company agreed to the terms outlined in its environmental permit to protect local species and control emissions.

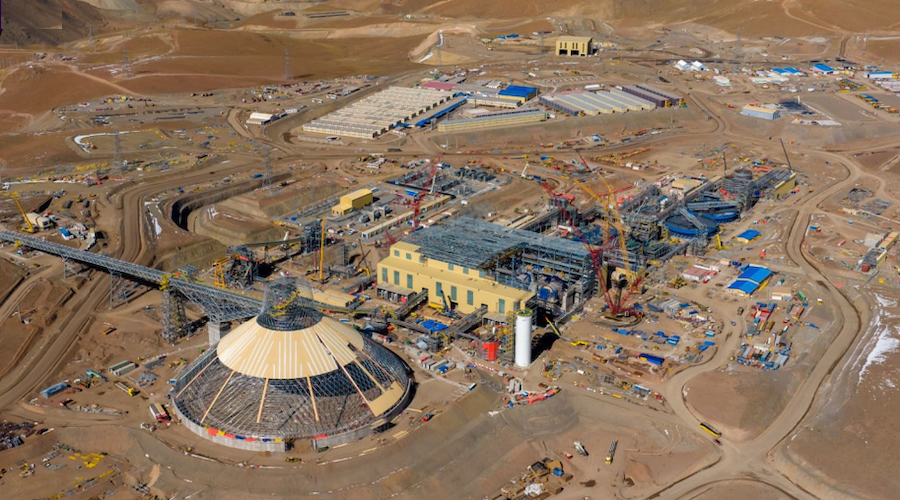

Concentrator area overview as of June 2022. Credit: Teck Resources.

The process against Teck was halted in July, after the company presented an investment plan aimed at correcting the deficiencies found.

SMA had fined the Canadian miner $1.2 million in 2019 for violations related to the handling of mining waste and internal environmental controls at the mine.

Teck is not the only company to experience stricter scrutiny in Chile. In May, the SMA rejected a major expansion at Anglo American’s (LSE: AAL) Los Bronces mines in the mountains above Santiago, while a proposed constitutional rewrite would afford greater protections for glacial and other sensitive areas.

New royalty

Boric and Lindsay also discussed Chile’s proposed tax reform, which includes the country’s first wealth tax and a new mining royalty.

Teck highlighted that it has stability agreements for QB2, which protects it against changes in tax laws for 15 years from the start of production. The company noted it was still evaluating the impacts of the tax reform on other projects and operations in the country, including the Carmen de Andacollo copper-gold mine in central Chile.

Since Boric first introduced the idea of a new royalty, the mining industry has been up in arms. It argues that the reforms would add uncertainty to investment decisions needed to help fill a global supply gap as demand rises in the clean energy transition.

The bill includes a 1% to 2% tax on sales for companies that produce 50,000 to 200,000 tonnes of copper a year, and 1% to 4% for those that produce more than 200,000 tonnes.

A second component is a sliding scale of between 2% and 32% on profits, which depends on copper prices. If approved, the changes would come into force partially in 2024 once tax stability contracts expire.

“We are monitoring the royalty bill closely, and we believe that the discourse in Chile will reach a reasonable outcome that will allow for continued sustainable resource development,” Lindsay said in May.

Teck Resources owns a 60% interest in Teck Quebrada Blanca SA (QBSA), which is the mine’s owner. Japan’s Sumitomo Metal Mining and Sumitomo Corporation have a collective interest of 30% in QBSA, while Chilean state company Enami has a 10% non-financial interest in the project.

Be the first to comment on "Teck CEO meets with Chile’s President Boric to discuss investments, royalties"