BHP (NYSE, LSE, ASX: BHP) appears to be discarding its long-running interest in Anglo American (LSE: AAL) and pivoting to spend billions instead on expanding its own assets.

Over the weekend, the Financial Times reported that Melbourne-based BHP was abandoning plans to bid for Anglo due to the recent run-up in the target’s stock price. Whether BHP has the pockets or the stomach for a much more expensive acquisition than the US$49-billion deal that Anglo rejected last year remains to be seen.

Meanwhile, although talks between Glencore (LSE: GLEN) and Rio Tinto (NYSE, LSE, RIO, ASX: RIO) – held late last year and revealed this month – seem to have stalled, the impetus for mega-mergers at the top of the mining food chain is alive and well. And if even large-scale transactions fail to materialize, smaller players are ready to pick up the slack and acquire copper assets on their own.

Since BHP’s unsolicited aproach was officially declared dead, London-based Anglo has been busy getting in the right shape should its suitor have another go – which cannot be ruled out entirely, given the company’s careful wording around the issue.

De Beers out

Anglo is ditching its Southern African diamond and platinum, Australian coal and Brazilian nickel assets. This restructuring, which is along the lines of what BHP demanded in its first approach, would result in copper accounting for 60% of Anglo’s portfolio.

For its part, BHP is now pivoting to organic growth. Up to $10 billion is being spent on Escondida, the world’s largest copper mine, in which Rio Tinto has a 30% stake.

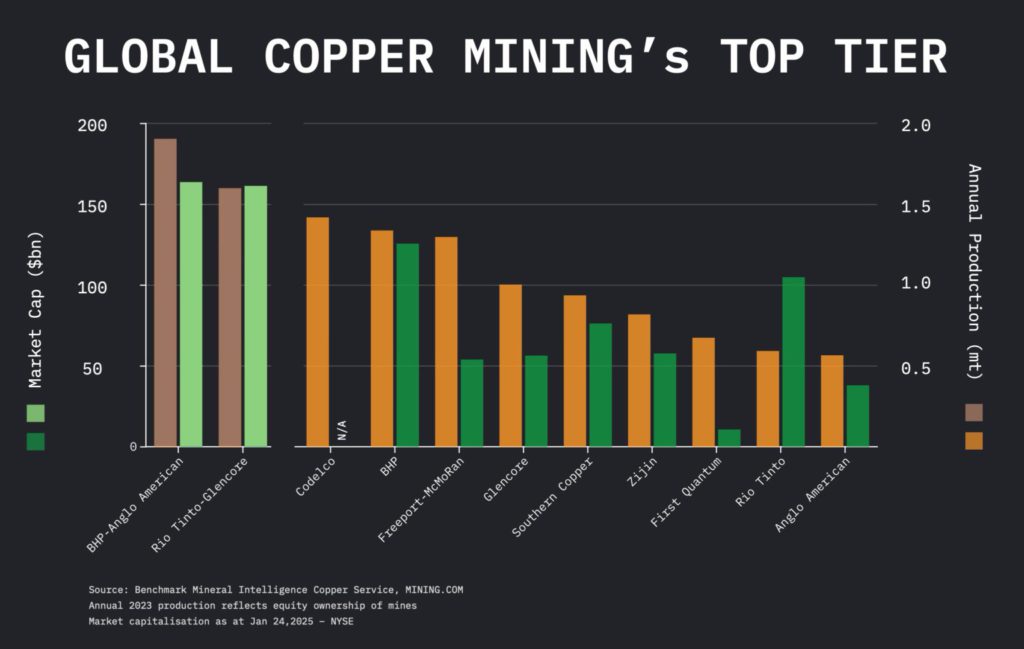

What would the copper landscape look like if BHP revived its interest in Anglo while Glencore and Rio Tinto decided to tie the knot? Based on today’s market valuation, a BHP-Anglo combination would be worth some US$160 billion, just about on par with that of a merged Glencore and Rio Tinto.

Together, BHP and Anglo would produce about 1.9 million tonnes of copper on attributable basis, topping the 1.6 million tonne output of a merged Glencore-Rio Tinto.

Should these combinations happen, only two companies would control 16% of global copper production. As it stands the companies listed in the accompanying graph represent nearly 40% of the global total.

Production growth

Benchmark Mineral Intelligence’s copper service says that under a Glencore-Rio Tinto merger, the potential for copper production growth would be substantial – primarily driven by the latter’s assets.

Should Rio Tinto’s Resolution project in Arizona somehow be resurrected – and with President Donald Trump back in office those chances have improved – the ranking of top producers would not change much, however. Rio Tinto has a 55% stake and BHP owns the remainder of what could be a 450,000 tonne-per-year mine.

Benchmark points out that Oyu Tolgoi in Mongolia, which Rio Tinto partly owns, is on track to achieve production of 500,000 tonnes a year of copper by the end of the decade as an underground expansion makes steady progress. Escondida, which is projected to reach peak production of 1.3 million tonnes of copper in 2025, also offers significant brownfield expansion opportunities.

Glencore also brings tonnes to the table. The company’s standout asset is its 44% stake in Collahuasi, a mine with a 76-year lifespan and considerable expansion potential, Benchmark says.

Africa

Two large mines with cobalt by-products and crucial operating experience in the Democratic Republic of Congo also count in Glencore’s favour, particularly now that Western governments are belatedly rediscovering Africa as a potential supplier of critical minerals and global trade is fast going back to its mercantilist roots.

The DRC has been the number one source of additional copper tonnes coming on stream for four out of the last five years. What’s more, the central African nation is likely to add another 200,000-plus tonnes to yearly mined copper in 2025.

Glencore also owns an extensive greenfield portfolio in Latin America with projects such as West Wall, El Pachón, and MARA each having the potential to develop into major copper mines in the decade to come, says Benchmark.

Switzerland-based Glencore is always looking for deals.

Under former CEO Ivan Glasenberg, Glencore made its first attempt to merge with Rio Tinto in 2014 – barely two years after gobbling up Xstrata for US$90 billion to add a vast mining portfolio to its then high-flying trading business.

Trader weight

That approach was a non-starter in Melbourne, but with ever more fraught geopolitics, Glencore’s skills at navigating the global commodities trade may represent more of an asset this time around. At US$228 billion a year, Glencore’s revenues dwarf those of its peers, and the company has never been afraid to throw its weight around.

Glencore made an unsuccessful US$23-billion bid for Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) in 2023 but did end up with the Vancouver-based company’s coal assets.

Despite pressure from shareholders, Glencore is clinging onto its very profitable coal mining and trading business. Following Rio Tinto’s well publicized exit from the industry, however, the fossil fuel may well prove to be an insurmountable merger obstacle for its green-conscious shareholders.

Teck is itself on an aggressive copper growth path, vowing to boost production to 800,000 tonnes. Even on an owned basis, that would place the company firmly among the top 10 producers.

Another dark horse in copper M&A is First Quantum Minerals (TSX: FM). Last week, the Vancouver-based company disappointed markets with a cut to its 2025 production guidance.

First Quantum is targeting 400,000 tonnes this year, but if – and when – its Cobre Panama mine is restarted, the company’s contribution to global copper production could exceed that of Anglo. Consensus seems to be that the restart will occur either late this year or in the first half of 2026.

Be the first to comment on "The future of copper mining’s top tier?"