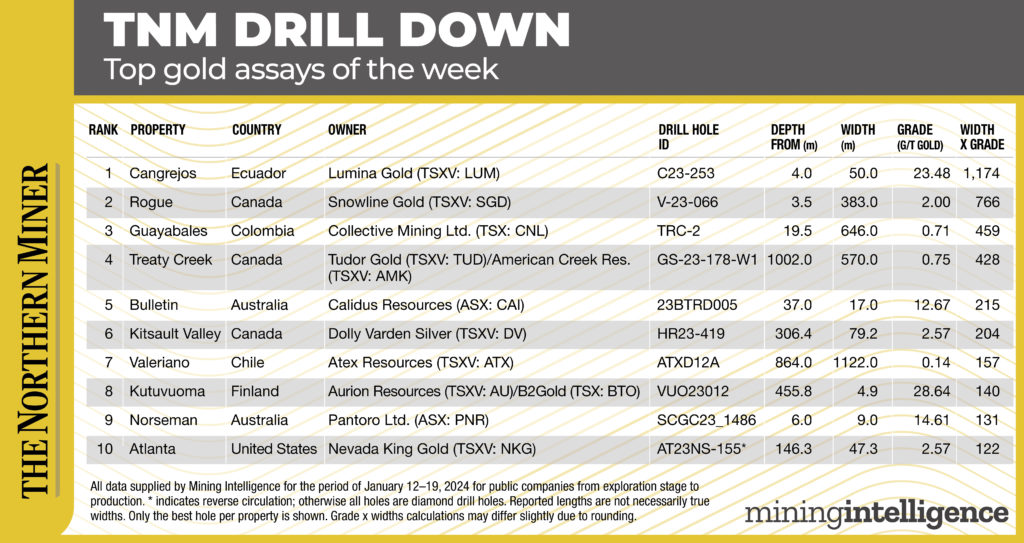

Our TNM Drill Down features highlights of the top gold assays from Jan. 12-19. Drill holes are ranked by gold grade x width, as identified by data provider Mining Intelligence.

Lumina Gold at Cangrejos

Lumina Gold’s (TSXV: LUM) feasibility-stage Cangrejos project in southern Ecuador returned the week’s top result, with a standout width x grade of 1,174. Hole C23-253 cut 50 metres of 23.48 grams gold from a depth of 4 metres, including a 2-metre section of 580 grams gold per tonne — the highest-grade interval yet from the project.

It was one of 91 resource conversion drill holes totalling 7,800 metres drilling. Lumina also completed drilling to collect geotechnical, metallurgical and hydrogeological data. A prefeasibility study for the project released last April outlined a US$925-million capex for an open pit mine that would operate for 26 years. Average annual production was estimated at 371,000 oz. gold and 42 million lb. copper.

Lumina expects to release a feasibility study for the project in the first half of 2025.

Snowline Gold at Rogue

Snowline Gold’s (TSXV: SGD) Hole V23-066, from the Valley zone at its Rogue project in eastern Yukon, ranked second this week. The hole cut 383 metres of 2 grams gold from 3.5 metres down-hole for an overall grade x width of 766. The strongest mineralization was above 277 metres down-hole, where the hole intersected the second of two faults.

“Today’s results highlight the strength and scale of mineralization near the open, eastern edge of the well-mineralized, near surface corridor at our Valley target,” said Scott Berdahl, CEO of Snowline in a release. “V-23-066 is drilled through a gap in the east-central part of the target, carrying an average grade of almost 4 grams gold per tonne over a 107.5 metre downhole interval, within a broad interval of consistent, multi-gram gold starting from surface. Such grades are highly atypical of a reduced-intrusion related gold system.

The company followed the hole with an even better one reported on Monday: Hole V23-070 cut 382.4 metres of 2.12 grams gold from 3.7 metres depth, including 113.4 metres of 3.51 grams. The hole was drilled perpendicular to previous holes, showing continuity of strong mineralization between them. True widths are not yet known.

Berdahl said the hole, which was drilled along strike of the system, added a new dimension to the company’s understanding of the Valley deposit and showed that its strong grades are independent of drilling direction.

Snowline says the intrusion-related gold deposit hosts mineralization in sheeted quartz vein arrays within and along the margin of the intrusion. It drilled 16,000 metres at the project last year and is preparing for a drill campaign this year armed with $35 million in cash.

The company also plans advanced metallurgical tests in the current quarter.

Collective Mining at Guayabales

Last week’s No. 1 entry was from Collective Mining’s (TSXV: CNL) Guayabales project in central Colombia. The project made a return in this week’s list, landing at spot No. 3. Hole TRC-2 cut 646 metres of 0.71 gram gold (0.81 gram gold equivalent) from 19.5 metres depth for a grade x width of 459.

The hole, which was only the second drilled at the Trap target, included 301.5 metres of 0.84 gram gold (1.01 grams gold equivalent) and ended in mineralization (11.1 metres at 0.98 gram gold equivalent). Trap marks a new discovery for Collective, and is located just 3.5 km from its Apollo porphyry discovery at Guayabales.

This article has been edited. While the table data was accurate, Collective Mining’s 646 metres of 0.71 gram gold per tonne assay from Hole TRC-2 was previously mistakenly reported in the text as gold-equivalent. We regret the error.

Be the first to comment on "TNM Drill Down: Ecuador, Yukon and Colombia yield week’s top gold assays"