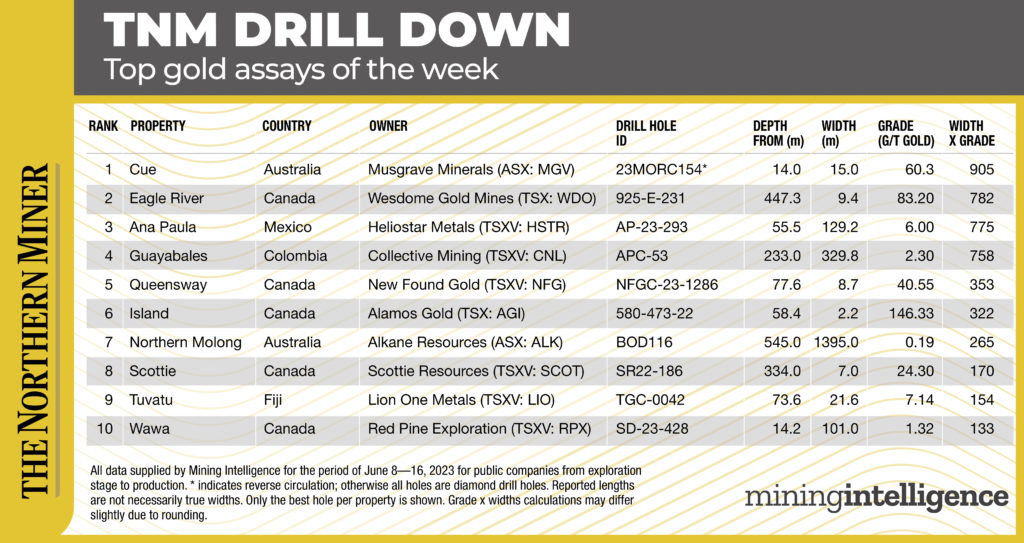

Our TNM Drill Down features highlights of the top gold assays of the week (June 9-16). Drill holes are ranked by gold grade x width, as identified by our data provider Mining Intelligence.

The top gold drill result of the week came from Musgrave Minerals’ (ASX: MGV) Cue project in Western Australia’s Murchison province on June 13. Reverse-circulation hole 23MORC154 cut 15 metres of 60.3 grams gold per tonne starting from 14 metres for a grade x width value of 905. (True widths are estimated at 45-70% of apparent widths.) The resource conversion drilling, at the Break of Day deposit, returned multiple intercepts above the average resource grade of 10.2 grams gold from within the project’s planned open pit. The Break of Day and White Heat deposits host a global resource of 982,000 tonnes grading 10.4 grams gold for 327,000 oz., with 70% of the total falling in the indicated category. Total resources at Cue stand at 12.3 million tonnes grading 2.3 grams gold for 927,000 oz.

Musgrave reported receiving an unsolicited, all-share takeover bid by Westgold Resources (ASX: WGX) on June 6. The offer of one Westgold share per 5.37 Musgrave shares implied a value of A30¢ per Musgrave share. The board has advised shareholders not to take action until it can fully evaluate the offer.In April, Musgrave released a prefeasibility study for a first phase of mining at Cue outlining a five-year operation producing 337,000 oz. gold at an all-in sustaining cost of A$1,315 per ounce. The company is working on a prefeasbility for a second stage of mining, expected in next year’s first quarter.

Wesdome Gold Mines’ (TSX: WDO) producing Eagle River mine in Wawa, Ont., returned the week’s second-best assay with hole 925-E-231. The hole, reported on June 13, cut 9.4 metres of 83.2 grams gold starting at 447.3 metres depth for a width x grade value of 782. The true width of the interval was 6 metres at 40.7 grams gold (width x grade of 244.2).

The interval and others reported, expanded the high-grade 300 East zone, which starts at 750 metres depth, down-plunge 200 metres to the 1,600-metre level. Wesdome says that while quartz veining is typically under 1.5 metres true width, the longer intercept came from an area where several structures are believed to intersect. The area, with wider zones of mineralization and more complex geology, is similar to the already mined 303 lens, which had an average muck grade of 46.1 grams gold and was located about 400 metres up-plunge.

Heliostar Metals’ (TSXV: HSTR) Ana Paula project in Guerrero state of Mexico, returned the third best gold result. Hole AP-23-293 cut 129.2 metres of 6 grams gold starting at 55.5 metres for a grade x width value of 775. The intercept included 46 metres of 13.4 grams gold, which contained a sub-section of 28.5 metres at 17.4 grams gold.

Drilling at the project, which Heliostar acquired from Argonaut Gold in March for US$30 million, is focused on redefining Ana Paula as a high-grade underground mine. The highlight intercept was from an area of the deposit referred to as the High-Grade Panel. Heliostar says the results represent a 139% increase over modelled resource grades at a 5-gram gold per tonne cutoff, demonstrating the deposit could grow with further drilling.

As an open-pit operation, the project would have an eight-year mine life, based on an updated prefeasibility study for Ana Paula that was completed in February. The study pegged initial capital costs at US$233.6 million, with a post-tax net present value of US$279 million at a 5% discount, and an internal rate of return of 31%. Heliostar says a resource update along with metallurgical testing and an underground mine design are all in the works for 2023.

Be the first to comment on "TNM Drill Down: Musgrave Minerals serves week’s top gold hit as suitor makes takeout offer"