The need to discover new sizeable economic nickel deposits has never been more acute as the world transitions to a clean-energy-driven economy that relies heavily on nickel-based battery technologies and more robust nickel-infused steel products.

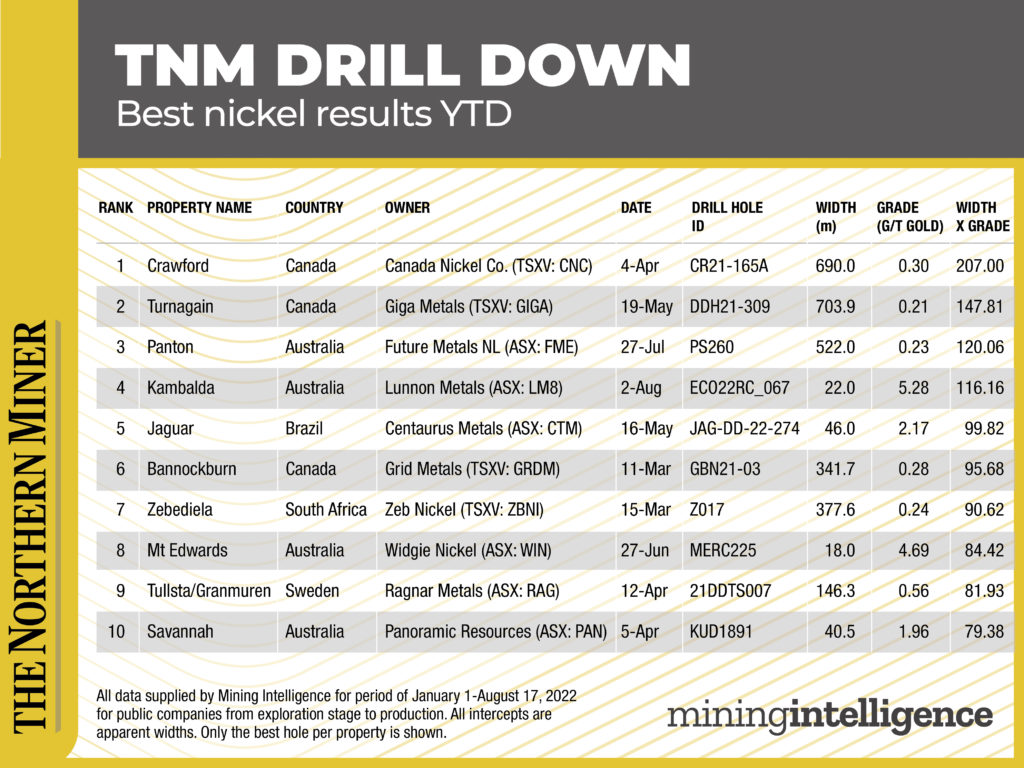

Set against this backdrop, The Northern Miner presents a top-ten ranking of the best nickel drill intercepts reported up to Aug. 17, 2022, with the top five results highlighted below. Assays are ranked by nickel grade x width, as identified by our sister company Mining Intelligence.

1 | CRAWFORD – CANADA NICKEL CO.

So far, the best nickel intercept this year comes from Canada Nickel Co. (TSXV: CNC; US-OTC: CNIKF) and its flagship Crawford nickel sulphide project in Ontario. The company reported the intercept on Apr. 4, with hole CR21-165A returning mineralization across its entire 690-metre length grading 0.3% nickel from 45 metres depth, including a 409.5-metre interval of 0.34% nickel (42-metre actual width) and 111-metre interval of 0.4% nickel (11.6-metre actual width), for a grade x width value of 207.

On July 6, Canada Nickel published an updated resource estimate that more than doubled the project’s measured and indicated resources. The company now has the world’s fifth-largest undeveloped nickel sulphide resource, measuring 1.4 billion tonnes grading 0.24% nickel and 6.59% iron for 3.5 million tonnes of contained nickel and 93.9 million tonnes of iron. Inferred resources add 670.1 million tonnes grading 0.23% nickel and 6.85% iron for 1.6 million tonnes of nickel and 45.9 million tonnes of iron.

Situated within the Timmins mining camp, the project is expected to produce an average of 34,000 tonnes of nickel annually over 25 years, according to a 2021 preliminary economic assessment. At an 8% discount rate, the project would generate a post-tax net present value of US$1.2 billion and an internal rate of return of 16%. The capital cost was pegged at US$1.2 billion.

2 | TURNAGAIN – GIGA METALS

The second-best drill intercept comes from Giga Metals’ (TSXV: GIGA; US-OTC: HNCKF) Turnagain nickel and cobalt project in north-central British Columbia. On May 19, the company released drill results from the 2021 season, which included hole DDH21-309, which intersected 703.9 metres (from 22.5 metres depth) grading 0.21% nickel for a grade x width value of 147.8.

On Aug. 15, Giga and global trading and investment firm Mitsubishi agreed to form a joint venture company, Hard Creek Nickel to develop the Turnagain project.

A preliminary economic assessment in 2020 for Turnagain envisaged an open-pit mine producing an average of 33,000 tonnes of nickel in concentrate and 1,962 tonnes of cobalt in concentrate every year for a total output of 1.2 million tonnes of nickel in concentrate and 72,592 tonnes of cobalt in concentrate over a 37-year mine life.

Initial capital costs were pegged at US$1.4 billion, with US$2 billion budgeted for sustaining capital over the life of the mine. Based on prices of US$7.50 per lb. nickel and $22.30 per lb. of cobalt, the study outlined an after-tax internal rate of return of 4.9%. Turnagain hosts 1.1 billion measured and indicated tonnes grading 0.22% nickel and 0.013% cobalt for 5.2 billion lb. contained nickel and 312 million lb. of cobalt, and 1.1 billion inferred tonnes grading 0.22% nickel and 0.01% cobalt for 5.5 billion lb. of nickel and 327 million lb. of cobalt.

3 | PANTON – FUTURE METALS NL

The third-best intercept comes from Future Metals NL (ASX: FME; LSE: FME) and its Panton project in Western Australia. Reverse-circulation hole PS260, released on July 27, returned 522 metres from 100 metres depth grading 0.23% nickel (grade x width of 120), or 0.94 gram palladium-equivalent per tonne. The results form part of priority-target drilling outside of the existing resource estimate boundary at Panton. According to the company, the result comes from the Lower zone, which represents the lowest portion of the stratigraphy, closest to the feeder conduit of the intrusion, where sulphides containing base metals, gold and PGM are most likely to accumulate during emplacement.

Panton’s structure is considered such that a large portion of this Lower zone is exposed from the surface, enabling the potential discovery of sulphide-rich zones at relatively shallow depths along the basal contact and the syncline fold (Keel Zone).

The company views the Lower zone as highly prospective for significant accumulations of sulphide-rich mineralization, supported by high-grade base metals, including nickel, copper, cobalt and gold intercepts uncovered in historical drilling, associated with local sulphide-rich lenses.

4 | KAMBALDA – LUNNON METALS

Lunnon Metals (ASX: LM8) produced the fourth-best nickel drill intercept this year, reporting 22 metres from 138 metres depth grading 5.28% nickel in hole ECO22RC_067. The hole was drilled at the Baker Shoot of the company’s Kambalda nickel project in Western Australia. The intercept has a grade x width value of 116.1.

The company interprets the width of this intercept as significant. The intersection may represent the effect of the interpreted eastern shear on the base of flow (BOF) nickel surface, with this feature potentially causing a thickening of nickel mineralization, as has been reported previously at the intersection of the mineralized western shear with the BOF. Both shears are interpreted to relate to the pinching and swelling that has been previously observed on the BOF surfaces.

Lunnon progressed the Baker Shoot to a JORC-compliant resource estimate totalling 15,800 tonnes of nickel grading 2.8% in 2020, within nine months of discovery. The current drilling program is in-filling and extending the June resource estimate.

5 | JAGUAR – CENTAURUS METALS

In fifth place is Centaurus Metals (ASX: CTM), which on May 16 reported that drill hole JAG-DD-22-274 in its Jaguar nickel project in Brazil returned 46 metres from 128 metres depth of 2.17% nickel for a grade x width value of 101.2.

According to the company, the specific hole was part of a series of infill holes designed to test the Jaguar Central, South and Northeast deposits.

The drilling program is expected to upgrade more of the Jaguar resource estimate into the measured and indicated categories in advance of a reserve estimation as part of the feasibility study currently underway and due by year-end.

“Seeing high-grade, shallow intersections like 46 (metres) at 2.17% nickel within a constrained US$22,000 per tonne nickel price pit shell gives us a lot of confidence that the early stages of a future mining operation at Jaguar can support robust capital payback on the project,” said Centaurus managing director Darren Gordon in a press release at the time.

The company has 15 drill rigs on site, with two focusing on step-out drilling and the rest on infill drilling.

Be the first to comment on "TNM Drill Down: Top Ten best nickel drill results year to date "