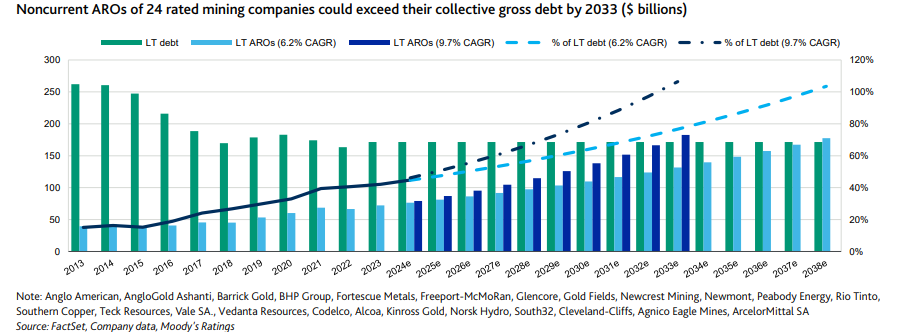

Mining companies’ rising asset retirement obligations (AROs) could exceed the industry’s debt by 2033, according to a new report by Moody’s Ratings.

Environmental reclamation and site restoration costs for 24 major mining companies reached US$72 billion in 2023, up from US$40 billion in 2013.

According to Moody’s, this figure represents about 42% of the mining industry’s outstanding long-term debt at the fiscal year-end of 2023.

The 24 companies studied spent between US$1.4 billion and US$1.8 billion annually on AROs during the 2013-2018 period. However, since 2018, their ARO payments have more than doubled to approximately US$3.7 billion in FY2023 — a five-year compound annual growth rate of 18.2%.

This increase comes as governments have tightened regulations on mining in recent years to promote more sustainable practices.

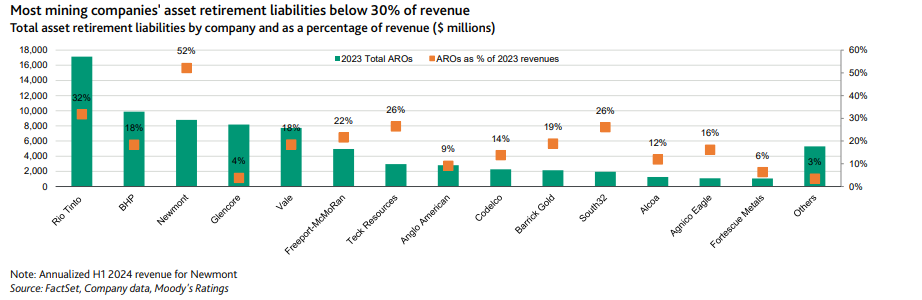

As of the end of 2023, Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) had the largest ARO provision, followed by BHP (LSE: BHP; NYSE: BHP; ASX: BHP), Newmont (NYSE: NEM; TSX: NGT), Glencore (LSE: GLEN), and Vale (NYSE: VALE).

To put this into perspective, Rio Tinto’s 2023 AROs represent 32% of its revenue. For BHP and Vale, the figure stands at 18%.

Be the first to comment on "Top miners’ reclamation obligations could surpass industry’s total debt by 2033"