After a year-end rally put the TSX Composite Index up 9.8% over 2007, the index fell 1.5% or 214.19 points to 13,618.87 points over the trading period Jan 2-7.

The Capped Metals and Mining Index dropped nearly 3% to 736.48, though gold stocks were a different story.

The Global Gold Index reaped the benefits of the record-setting gold price. The index jumped nearly 10% to 340.43 points, while the gold price rose by US$22.75 to a 28-year high of US$859 per oz.

The gold miners dominated the valuechange list over the period, taking leaps and bounds to set new highs on the back of the surging gold price.

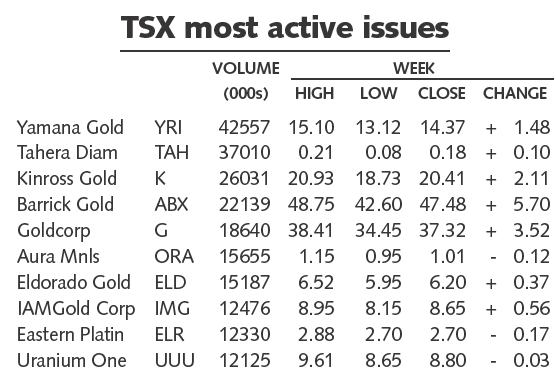

Barrick Goldtopped the list closing up $5.70 at $47.48 after reaching an all-time high of $48.75 with a trading volume of more than 22 million shares.

Agnico-Eagle Minesreached a new high of $58.98 per share, closing the period $4.27 higher at $58.69. Goldcorp rose by $3.82 to close at $37.32 after soaring to a record-setting high of $38.41. And heavyweightNewmont Miningclimbed $3.04 to $51.50, but did not beat its 52-week high of $56.11 per share.

NovaGold Resources,not quite yet a miner, started 2008 on a good foot, recovering some of its November losses. The stock rose 35%, or $2.85, to $10.95 per share. NovaGold finally got its official reprieve from a U.S. appeals court over a lawsuit related to the permitting of its Rock Creek project. Now, the company can move ahead at the mine, slated to begin production by early spring at 100,000 oz. gold per year.

Kinross Goldreached a high of $20.93, closing the period at $20.41, $2.11 higher, whileYamana Goldwas the most actively traded stock with more than 42 million shares traded, rising $1.48 to $14.37.

Tahera Diamondtopped the percentage change list by a landslide. The stock went up 125% — which wasn’t a major feat for a company that had plummeted to mere pennies in recent weeks. On Jan. 4, the company put out a release to say it had no answers for its rising stock price, which went as high as 21 per share. With hopes of raising $40 million, Tahera began the procedures for a financing at just 6.5 per share with warrants going for 13 per share over five years. The company needs money quickly so it can maintain the winter supply road and continue operational improvements at its Jericho diamond mine, in Nunavut. Tahera shares closed the week at 18.

Sudbury, Ont. base metals explorerWallbridge Miningwatched its share price fall the most on a percentage basis over the period, down 29% to 25.5. The company announced in late December that it had completed the first half of a $2-million financing at the purchase price of 40 per share.

Be the first to comment on "Toronto Stock Exchange (January 14, 2008)"