The Santander mine project located 215 km from this coastal city has historic assets and strategic advantages that should help Trevali Resources (TV-T) achieve its goal of becoming Latin America’s newest silver-lead-zinc producer.

Benefits flowing from past production include road access, a nearby power plant, camp infrastructure and tailings that can be reprocessed for early cash flow. Other advantages are favourable metallurgy and a partnership with Swiss-based Glencore International for the development, construction and operation of the mine and the purchase of 100% of concentrates produced over the mine life.

Trevali president Mark Cruise says Glencore was familiar with the Santander project and its history of producing clean, readily saleable concentrates.

“They used to buy concentrates from the mine, starting in 1985, when (Glencore founder) Marc Rich was first active in Peru.”

Trevali, a relative newcomer to Peru, was attracted by Santander’s largely untapped exploration potential and world-class geological setting in the Central Peruvian polymetallic belt. This 700-km-long by 100-km-wide belt hosts many producing mines, including the large-scale Antamina and Cerro de Pasco open-pit operations and hundreds of small-scale historic producers and mineral occurrences.

In 2009, the Central Peruvian polymetallic belt ranked first in the world for silver production, second for zinc and fourth for lead, according to Peru’s mines ministry.

“And we’re smack in the middle of it,” Cruise says.

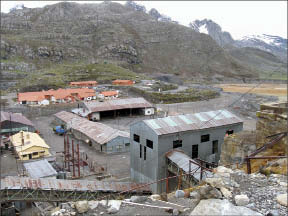

Santander in the district of Santa Cruz de Andamarca and province of Huaral is accessible by three roads; two are being upgraded and rehabilitated, including the route that will serve as a concentrate haul-road for mines in the area. The 44-sq.-km property covers a significant portion of a large, wide previously glaciated valley at elevations ranging from 4,000 to 5,000 metres above sea level.

Recorded historic exploration at Santander (starting in 1925) focused on silver-lead-zinc mineralization typical of intrusion-related, carbonate replacement deposits (CRDs). The Santander pipe was discovered by U.S.-based National Lead Co. in the 1940s.

The outcropping deposit was subsequently explored by American miner St. Joe Minerals, which developed it into a 500-tonne-per-day open-pit mine in 1958.

St. Joe likely saw potential for further discoveries as it invested heavily in infrastructure to support the mine, including a 1,000-person camp and associated amenities for workers and their families. The company also built a run-of-river power plant at Tingo, 17 km from the mine site at a lower elevation of about 2,500 metres.

In 1968, St. Joe made a transition to underground mining and subsequently boosted production to about 1,000 tonnes per day. In 1986, the company sold its interest in Santander to a Peruvian company, which continued to operate the mine until 1992. Low metal prices and political and economic turmoil forced the closure of the mine, which over its 35-year history has produced some 8 million tonnes at 6-10% zinc, 1-4% lead, 60 grams per tonne silver and 0.2% copper.

“Metal prices collapsed, there were labour problems, actions of terrorism (Shining Path) and exchange rate controls that made it impossible to operate,” says mine superintendent Javier Nunez Cuba. “The whole industry crashed at that time.”

Peru has since earned its status as one of the most stable and favourable jurisdictions for mining investment, however most of the early capital flowed to bulk-tonnage gold projects and porphyry copper-gold deposits similar to those in neighbouring Chile.

Santander sat dormant until 2007, when Trevali acquired the property rights of its Peruvian owner, then in the equivalent of Chapter 11 proceedings, for 50 years with an automatic 50-year extension. The consideration is a 3.5% net smelter return royalty. The monthly payments of $100,000 are being applied to settle the Peruvian company’s outstanding liabilities, which Trevali agreed to acquire in 2007 (with 92% of these liabilities owned to date).

Surprisingly, Trevali found that the Santander property was largely unexplored by modern methods. Senior project geologist Timothy Kingsley told visiting analysts and journalists that even the main Santander pipe has “significant exploration potential” as mining had ceased in massive mineralization at a 480-metre vertical depth.

“The historic drilling showed that mineralization goes at least 200 metres deeper.”

Trevali’s initial exploration program, which included detailed geological mapping and geophysical surveys, also tested the outcropping Magistral deposits – North, Central and South – and the nearby Puajanca prospect. Magistral Central and South were previously mined on a limited scale (estimated 100,000 tonnes) by a shallow adit in the case of Magistral Central and by a shallow open pit at Magistral South.

Geophysical surveys proved useful, as known mineralization is pyrrhotite-dominated and highly magnetic compared to the limestone host rocks. In addition to confirming exploration potential at known deposits, the surveys delineated several magnetic anomalies along strike.

Trevali’s first-pass drilling program targeting the Magistral deposits got off to a strong start, with an early hole hitting 28.4 metres grading 5.16% zinc, 3.66% lead, 0.12% copper and 90 grams silver. A parallel percussion drilling program was also initiated to delineate a zinc resource in the historic tailings.

Trevali also beefed up its technical team in 2008, led by newly appointed president Mark Cruise, who has extensive base metal experience and was part of the Anglo American (AAL-L, AAUKY-O) team that developed the Lisheen zinc-lead mine in Ireland in the 1990s. He later joined Cardero Resources (CDU-T, CDY-X), which like Trevali is part of the Cardero Resource Group, and managed several projects in South America, including Cardero’s Mt. Pampa de Pongo iron deposit in Peru.

By year-end 2008, Trevali had completed 104 diamond drill holes totaling 20,600 metres to define the three Magistral deposits. This led to the first independent National Instrument 43-101 compliant resource estimate, released in April 2009, of 5.3 million tonnes at 3.34% zinc, 1.27% lead and 38 grams silver in the indicated category, plus another 2.2 million tonnes of 2.92% zinc, 0.5% lead and 18 grams silver in the inferred category. These estimates used a 2% zinc-equivalent cutoff grade.

At the same time, Trevali tallied a resource for the Santander tailings impoundment of 1.65 million indicated tonnes at 2.74% zinc (at a 2.0% zinc cutoff grade), based on 55 percussion drill holes totaling 910 metres.

Cruise says negotiations with Glencore – now a privately held group of commodities and raw materials companies owned by management and employees (founder Rich divested his interest in 1993-94) – began after Trevali released these resource estimates.

“They were modest, but sufficient to get them interested,” he says.

Carlos Ballon, vice-president South America for the Cardero Resource Group, adds that another attraction for Glencore is Santander’s coarse-grained mineralogy, which provides for easy milling, good recoveries and clean concentrates. “The concentrates are well known on the market and highly desirable.”

The memorandum of understanding signed shortly thereafter called for Glencore to provide and operate a 2,000-tonne-per-day mill, larger than the 1,250-tonne-per-day operation initially envisioned by Trevali. Glencore also agreed to buy 100% of Santander’s production at benchmark terms. It took more than a year for the parties to finalize the legal agreement, which also allows Glencore to design, develop and operate the proposed mine, as well as the mill. Trevali will retain 100% ownership of the project and can acquire the processing plant and related infrastructure over four years following commercial concentrate production.

< p>Glencore also provided a US$2-million credit debenture facility to Trevali, including an advance of US$500,000 to fund a resource expansion program that was completed in the mid-2010.

An updated resource estimate for five deposits – Magistral North, Central and South, Puajanca South and the Santander pipe – followed in November of that year, based on 171 drill holes totaling 33,240 metres.

The resource expansion program boosted indicated tonnage by 53% to 5.85 million tonnes with an average grade of 3.86% zinc, 1.35% lead, 44 grams silver and 0.08% copper, for an estimated in-situ metal inventory of 498 million lbs. zinc, 174 million lbs. lead, 8.25 million oz. silver and 9.7 million lbs. copper.

Inferred resources rose 452% to 4.80 million tonnes at 5.08% zinc, 0.44% lead, 21 grams silver and 0.07% copper, for an estimated in situ inventory of 538 million lbs. zinc, 46 million lbs. lead, 3.19 million oz. silver and 7.8 million lbs. copper.

Both estimates used a 3% zinc-equivalent cutoff grade based on the three-year rolling average prices for silver, lead and zinc at the time, and applied a recovery of 85% to silver, 90% for lead, 85% for zinc and 60% for copper.

Metallurgical testing on composite samples from the Magistral deposits was also undertaken in the past year, yielding 90% lead and 75-85% silver recoveries (at 40% concentrate grade) and 75-80% zinc recovery (at 50% concentrate grade).

This was an important step as carbonate replacement deposits in the district display strong metal zoning, reflecting their position in the continuum between lower temperature and higher temperature types (relative to the intrusive heat source).

Santander’s deposits fit the classic gradational zonation model (vertical or horizontal) from proximal to distal as follows: copper with gold, to zinc, to lead-silver, then to iron-manganese in the uppermost or outermost portions of the systems. Alteration is variable along the temperature gradient, but is generally weak around the deposits at Santander, with a sharp boundary from mineralization to clean limestone.

The Santander pipe features zinc-rich zones at its upper levels, with copper values reaching 0.5% to 1% at the deeper levels before mining ceased. Magistral South has similar zinc-rich zones with some minor copper. The other deposits – Magistral North, Magistral Central, and Puajanca – fall more within the lead-silver-rich zones.

“This will be a blended operation,” Cruise says, adding that Glencore plans to move an existing mill from one of its first (now dormant) Peruvian mines to Santander.

Glencore is no stranger to the Central Peruvian polymetallic belt and currently owns the Iscaycruz mine situated along trend of Santander. This underground/open-pit mine is the company’s largest zinc-leader producer in Peru. (Operations were suspended during the 2009 global financial crisis, but have since resumed.)

The mine plan at Santander will also include open-pit and underground mining techniques (long hole and sub-level stoping). Ground conditions are good, with little support required. The structurally controlled bodies at Santander are shaped like inverted carrots, so dilution is to be expected. Historic dilution was 10% in the open pit and about 15% underground, but the company is confident this can be reduced.

Glencore plans to use contract miners at Santander, as is common in Peru. Along with the usual jumbos, scoop-trams, drills and other equipment, a pumping system will be required as all mines in the district are wet. The estimated capital costs to resume operations are estimated at $18-$20 million, including $1.5 million for the next phase of exploration and a $2-$4 million contingency. Development costs are low in Peru, typically one-third less than costs for similar work in North America. Trevali is also refurbishing facilities on site, with camp facilities for 200 persons

already completed. The company has even put the former school to use as a core shack.

Production at Santander is slated to begin in 2012. Trevali is optimistic that the existing tailings will contribute to early cash flow at low operating and capital costs, particularly after sending a technical team to study methods used at a tailings operation in Rustenburg, South Africa.

“We expect good recoveries from these coarse tailings, which just need a quick regrind before milling,” Cruise says.

With Glencore focused on reviving the Santander mine, Trevali is free to further explore the property, expand resources, advance the permitting process, upgrade and modernize the Tingo power plant and continue community consultations.

Ongoing exploration

At the time of the site visit, a follow-up work program was underway at Santander, to include at least 10,000 metres of exploration and definition drilling. Mineralization is open for expansion in all five deposits and numerous targets are yet to be tested.

The Santander property is underlain by a package of carbonate and clastic sediments that have been tightly folded into a series of anticlines and synclines occasionally disrupted by high-angle thrust faults. The Santander fault, a regional-scale deformation zone, is the most prominent of these faults; hence early exploration focused on defining its strike extent and the prospective Chulec limestone formation. The exploration model has since evolved. Mineralization is believed to be controlled by a complex (but now well understood) interplay between the northwest-trending regional Santander fault zone and east-northeast to east-west-trending secondary structures (interpreted feeders) and folded permeable limestone units.

Trevali sees excellent potential for new discoveries, including buried bodies, within two main mineralized fairways: the 14-km-long Magistral and 3-km-long Santander-Puajanca trends. “This gives us 17 kilometres of permissive strike,” Kingsley says.

Kingsley adds that less than 1 km of the total favourable strike has been explored to date (which partly reflects the proximity of the known deposits). The three Magistral deposits extend along a 750-metre northwesterly trend and remain open at depth (where it is speculated they may coalesce into a single body) and to the east. They are located roughly 2 km north of the Santander mill site. The Punjanca prospect (North and South) is located about 1 km north-northeast of the Magistral North deposit. The Santander pipe is at the mid-point of the property.

None of the three Magistral deposits has been tested below a 350-metre vertical depth, but Trevali plans to drill deep holes at each of these deposits (along with down-hole geophysics) as they are believed to have significant potential at depth. The company also plans to test near-surface targets adjacent to the Santander pipe.

Drilling is also planned to follow-up positive results from Puajanca North, where structurally controlled vein and stockwork silver mineralization has been mapped and sampled over an area of about 400 metres north-south and 330 metres east-west. Recent detailed systematic surface channel-sampling program revealed 1.5 km of aggregate veining averaging 1 metre wide at 182.7 grams silver, 14.3% lead and 2% zinc. The high-grade silver structures are interpreted to represent the uppermost levels of a significant polymetallic system similar to the Magistral deposits.

Another priority target is El Toro, situated 1.8 km northwest of Magistral North. The target covers 1.5 sq. km of prospective areas with coincident favourable structure and magnetic anomalies. Soil sampling reveals zinc-copper and silver-lead zonation.

Retreating glaciers have exposed bedrock and structures controlling mineralization, aiding the exploration process and enhancing the potential for new CRD discoveries. Deposits of this type have emerged as major global producers of zinc, lead and silver in recent years. They represent about 40% of Mexico’s 10 billion ounces of historic silver production and account for some of the country’s la

rgest base metal mines. And in less than a decade, they have helped Peru overtake Mexico as the world’s largest silver producer, as well as the world’s second-largest producer of zinc.

Tingo power

Trevali has established a wholly owned subsidiary to oversee the expansion and modernization of the Tingo hydroelectric power plant from a 1.6-megawatt to an 8.8-megawatt capacity, with potential to reach a 10-megawatt peak generation during the wet season.

“We would use half of the power generated and sell the other half,” Cruise says. “This means low-cost power for the mine and potential revenue from power sales.”

The Tingo plant has produced power continuously since it was built in 1958, which is a testament to its current operators, as equipment is antiquated. However the plant has advantages over many other run-of-river power plants operating or being constructed in Peru. The industry average power availability is 60% to 70% because of seasonal water flow in many catchment areas. Tingo has a year-round water supply from the Banos River and is estimated to have a 95% online availability.

With production slated for 2012, Trevali will have to tap power from the national grid until the new generation capacity at Tingo comes on line, 12 to 18 months from now. The company recently awarded Peru-based TECSUR the contract to build the 65-km transmission line from the Santander mine to the Peruvian national grid. Trevali also signed an agreement with SN Power of Peru to buy 2.4 megawatts of power over a 12-month period, which can be extended another six months if required.

Capital costs for the Tingo expansion and modernization program are estimated at $22.8 million. Trevali believes the new Tingo power plant could produce reliable power at an operational cost of US1¢-US1.5¢ compared to US10¢-US15¢ from power generation companies or US20¢-US30¢ for on-site diesel-generated power.

Social programs

Natalia Rodriguez Chang manages permitting matters and community relations for the Santander project, which is a “coming home” of sorts as she was born on the site where her parents worked as teachers.

She says Trevali has contributed to local communities by improving school infrastructure, donating education supplies, medical and other equipment, and providing assistance to sustainability studies.

“Trevali Peru has good relations with local communities,” she adds. “Mining is very important in this region as there is little else that can be done on the land.”

The permitting process is progressing on schedule, with approvals in hand for the water licence and the tailings retreatment environmental impact assessment. The mining environmental impact statement for the project was nearing completion at the time of the site visit, and will be submitted shortly to regulatory authorities, with final approval expected by July. The closure plan for the mine and the tailings retreatment are both being evaluated by the Ministry of Energy and Mines.

Trevali is positioning Santander to be “one of the few new supplies of zinc and lead-silver concentrates in South America, and globally, in the near future.” The company is also poised to acquire Kria Resources (KIA-V), whose key assets are the Halfmile and Stratmat zinc-lead-silver properties near Bathurst, N.B. The goal of the friendly transaction is to create a “new intermediate base metals producer.”

Cruise acknowledges that zinc traditionally has never been an “easy market” for juniors. Some of the largest deposits are located in either remote or politically high-risk areas. Others have low grades or complex, fine-grained mineralization, resulting in poor recoveries and metallurgical processing challenges, or deleterious elements in concentrates resulting in smelter penalties.

But he also notes that fundamentals have changed. Some of the world’s largest miners are now out of the zinc business while many mid-tiers are refocusing on copper and other metals or commodities. As a result, new zinc discoveries have dwindled and large mines are not being replaced. The company points to a growing zinc supply gap, based on forecast Chinese mine production and consumption, and cites forecasts showing a gap of 7 million tonnes of zinc mine production required by 2020, with 14 million tonnes required by 2025.

Based on discussions with metals trading groups, Trevali believes that it will have “one of only a few polymetallic mines coming on-stream” over the next few years.

– Based in Vancouver, the author is a freelance journalist specializing in mining, and is a former editor of The Northern Miner.

Be the first to comment on "Trevali revives Santander mine in Peru"