The holiday-shortened initial week of trading for 2008 saw the junior mining-dominated S&P-TSX Venture Composite Index slip 19.68 points, closing the Jan. 2-7 session at 2,819.98. Daily trading volumes for the week averaged 70.2 million shares.

The weekly market pulse eased slightly from a strong recent bearish trend, with 18 exploration companies managing new yearly highs while 41 slipped to 52-week lows.

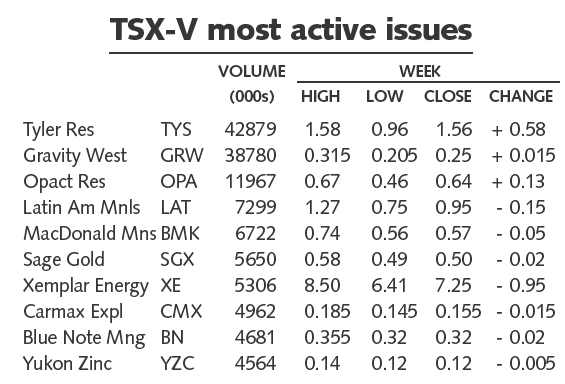

Sparked by a takeover bid by the Chinese smelting giant Jinchuan,Tyler Resourcesjumped 59% to close the week at $1.56 per share on nearly 43 million shares traded. Jinchuan has offered $1.60 per share in cash for the junior, topping an earlier hostile bid by Mercator Minerals of 0.113 of a share for each Tyler share — about $1 per share. The prize is Tyler’s Bahuerachi polymetallic deposit in northern Mexico.

On trading volume of 38.8 million shares,Gravity West Miningnotched up 1.5 to close at 25 per share. With assays still pending from its Voltaire Lake project in northwestern Ontario’s Sibley basin region — where recent drilling cut massive sulphides –the company posted photos of the core on its website.

Initial assays from its Paso Yobai project in Paraguay triggered a 15 drop in shares ofLatin American Minerals,closing the week at 95 per share on trading volume of 7.3 million. The company reported results of up to 11 grams gold per tonne over 6 metres.

Shares ofMacDonald Mines Explorationdropped a nickel on the session to close at 57 apiece on 6.7 million shares traded. With a $10-million financing closed in November, the company plans to drill its VMS projects in the McFaulds Lake-area of the James Bay lowlands.

Sage Goldposted a trading volume of over 5.6 million shares of volume for the week, slipping two pennies to close at 50 per share. With a recent $5.5-million financing under its belt, the company plans 22,000 metres of drilling for its projects in the Beardmore-Geraldton greenstone belt region of Ontario.

After a recent rally on reported rumours of apossible takeover by mining giantRio Tinto,or others, shares ofXemplar Energypulled back 95 on the week — closing at $7.25 apiece on trading volume of over 5.3 million shares. Xemplar is exploring its Warmbad uranium project, in Namibia, and awaits assay results from recent drilling.

Strong molybdenum grades fromTenajon Resources’Moly Brook property, in southern Newfoundland, prompted a 44% gain in the company’s share price to 69 per share, up 21 on nearly 2.3 million shares traded. Drilling cut up to 67 metres of 0.14% molybdenum.

On volume of 4.7 million shares,Blue Note Miningslipped a couple of pennies on the week to close at 32 per share. Softening base metals prices have taken a toll on the leadzinc producer, which has operations in New Brunswick.

Be the first to comment on "TSX Venture Exchange (January 14, 2008)"